Is the ‘Crypto Bubble’ Bursting According to the Saylor-Buffett Ratio?

The enthusiasm sparked by Donald Trump's victory is rapidly diminishing: The S&P 500 has lost a third of its post-election increase and was down for the week, while the Nasdaq 100 Index experienced a four-day decline.

The narrative shifts significantly in the innovative realm of cryptocurrency. Despite Bitcoin's retreat from Wednesday's record peak, it has remained nearly 30% higher since the presidential election.

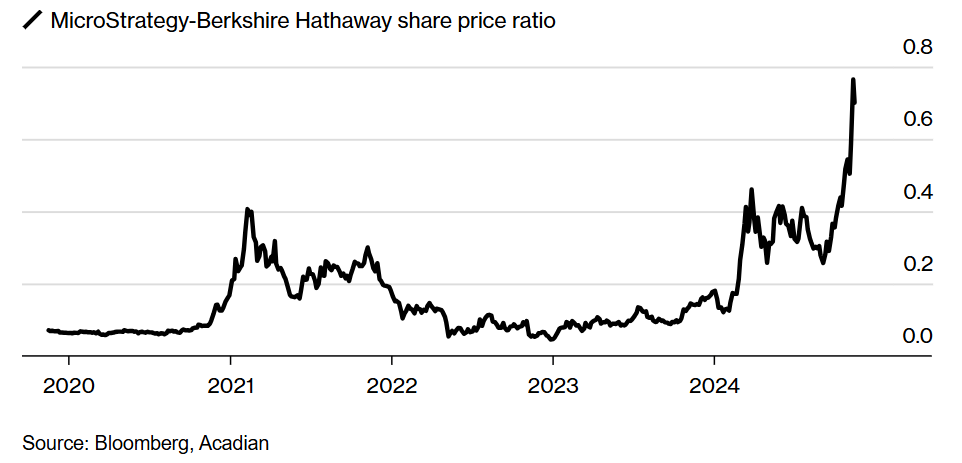

To assess the current state of animal spirits, consider a metric created by Owen Lamont, a portfolio manager at Acadian Asset Management.

The previous finance educator monitors the comparative performance of two stocks.

Warren Buffett's Berkshire Hathaway, a well-known entity that focuses on traditional companies, contrasts sharply with Michael Saylor's MicroStrategy, which has gained notoriety for its bold investments in Bitcoin.

Referred to as the Saylor-Buffett Ratio, this metric offers insight into the prevailing sentiments of fear and greed in the market.

Although Berkshire stock has appreciated by 31% this year, outperforming benchmark indexes like the S&P 500, it falls short when compared to MicroStrategy at this moment.

The latter has experienced an impressive increase of over 400%, driven by the ongoing surge in cryptocurrencies.

In Buffett vs. Saylor, the comparative performance contributes to the indication of an overheated market.

Due to MicroStrategy's improved returns, the Saylor-Buffett Ratio has surged to heights not observed since 2000. This conveys a concerning indication to Lamont.

MicroStrategy acquired 51,780 BTC over the last week for a total cost of $4.6 billion. Its stash now totals 331,200 BTC, worth just under $30 billion, with a purchase price of about $16.5 billion.

To fund the purchase, MicroStrategy utilized its at-the-market share issuance program, selling approximately 13.6 million shares for $4.6 billion. MicroStrategy has an additional $15.3 billion in stock available for sale under the same program, as stated in a regulatory filing released on Monday morning.

MicroStrategy has acquired 51,780 BTC for ~$4.6 billion at ~$88,627 per #bitcoin and has achieved BTC Yield of 20.4% QTD and 41.8% YTD. As of 11/17/2024, we hodl 331,200 $BTC acquired for ~$16.5 billion at ~$49,874 per bitcoin. $MSTR https://t.co/SRRtRrB2jO

— Michael Saylor⚡️ (@saylor) November 18, 2024

I think https://t.co/meaZhpFNq9 needs even more green dots. pic.twitter.com/Rs5hgrnbAm

— Michael Saylor⚡️ (@saylor) November 17, 2024

While the internet frenzy characterized the dotcom era, the current landscape also reveals that speculation remains robust for emerging investments such as Bitcoin and artificial intelligence.

"If we look at the big picture, I'm not sure that we've reached extreme conditions just yet," noted Owen Lamont.

On net issuance, he wrote, "We see a massive wave of corporate issuance and reduction in repurchases. We see this now in Berkshire and MicroStrategy, but not yet in the U.S. stock market as a whole."

He noted that, regarding the crypto and AI bubbles, "I don't know if we're in an AI bubble, but it sure feels like we're in a crypto bubble."

He wrote, "Right now, we have two largely separate narrative streams: AI and crypto. If these two streams cross, it would be bad."

Overall, Lamont concludes that "The recent increase in the Saylor-Buffett ratio is one of the many small pieces of evidence - including increased ADR mispricing, history's largest closed-end fund premium, and survey evidence on investor beliefs - that all seem to be pointing in the same direction: the market is getting frothy."

Elsewhere

Blockcast

This week's Blockcast features Independent Reserve CEO Lasanka Perera, who reflects on his journey of volatility, difficulties, uncertainty, and ultimately, success.

Perera, who's also an avid golf fan, discusses how and why Independent Reserve sponsored accomplished Singaporean golfer Shannon Tan, and how the exchange is helping young people invest in crypto.

Additionally, as a seasoned crypto investor who's seen countless bull and bear markets, Perera shares his immediate reactions to the market's recent pump post-US election.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!