Tether’s Hadron Platform Sets Sights on Democratizing Asset Tokenization

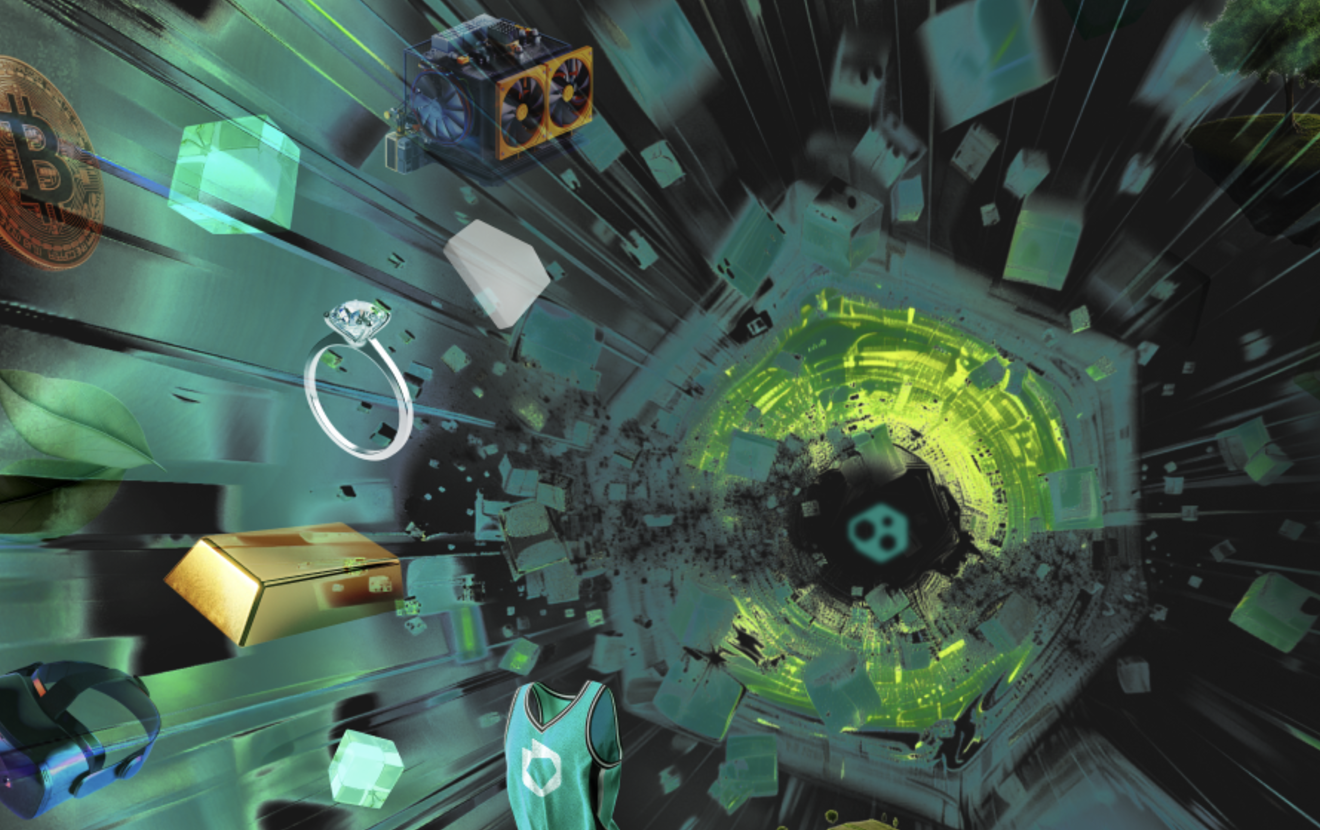

Tether has launched Hadron, a new asset tokenization platform, designed to allow the tokenization of a vast range of assets from stocks and bonds to commodities, stablecoins, and even loyalty points, the stablecoin giant announced Thursday.

With Hadron, Tether is positioning itself as a key player in the rapidly growing market for real-world asset tokenization, an area now valued at over $6.5 billion, according to DefiLlama data.

However, where other platforms focus primarily on institutional solutions, Tether is betting on Hadron’s user-friendly approach to capture an audience beyond just large financial institutions. The platform combines blockchain-driven transparency and security with an accessible, all-in-one interface, targeting everyone from retail investors and startups to governments and fund managers.

The platform’s tokenized assets will provide fractional ownership options, potentially opening up new asset classes to a broader spectrum of investors. For instance, a private company could tokenize shares, making them available for smaller investors who previously couldn’t participate in private equity markets. Similarly, developing countries could tokenize debt instruments to make them more attractive to global investors, potentially unlocking alternative financing methods for governments and municipalities, Tether explained.

Tether’s focus on compliance, a critical area for regulators, aims to ease the friction for asset tokenization in highly regulated markets. This emphasis may be part of a broader strategy to align the platform’s operations with financial authorities in jurisdictions like the EU, U.S., and parts of Asia, where blockchain innovation is accelerating, but regulatory compliance remains a high barrier to entry.

“We believe Hadron by Tether will significantly improve the financial industry. By leveraging all Tether’s technology – which today has already secured 125 billion dollars – we’re making asset tokenization easier, secure and scalable. Our goal is to create new opportunities for businesses and governments, while also making the digital asset space more accessible and transparent,” said Paolo Ardoino, CEO of Tether.

“While traditional finance institutions have always pushed for closed ecosystems that are opaque to citizens, Hadron by Tether reinforces our commitment to build a more inclusive future,” Ardoino added.

Hadron will support multiple blockchain systems, including Ethereum, Binance Smart Chain, and Bitcoin Layer 2 solutions like Liquid by Blockstream. Tether said the integration with Layer 2 solutions enables Hadron to scale transactions while keeping costs low—an attractive feature for smaller users in regions where transaction fees can present a significant barrier to adoption.

While Hadron is not the first platform to explore tokenizing real-world assets, its combination of compliance-first features and multi-chain adaptability could make it a blueprint for future platforms aiming to bridge traditional and digital finance. With tokenization being one of the more anticipated developments within DeFi, Hadron’s impact on asset liquidity, market accessibility, and regulatory integration will be closely watched by industry leaders and regulators alike.

In the past week, Tether minted $5 billion worth of its USDT stablecoin, coinciding with a sharp rally in Bitcoin, which reached a high of over $93,000. This fresh supply of USDT, a critical driver of liquidity within the cryptocurrency markets, has pushed Tether’s market capitalization to a record $125 billion.

The company also also launched WDK, an open-source wallet development kit intended to advance non-custodial wallet capabilities. This initiative is expected to drive broader adoption in decentralized finance (DeFi) by simplifying non-custodial wallet integration for developers and businesses.