Table of Contents

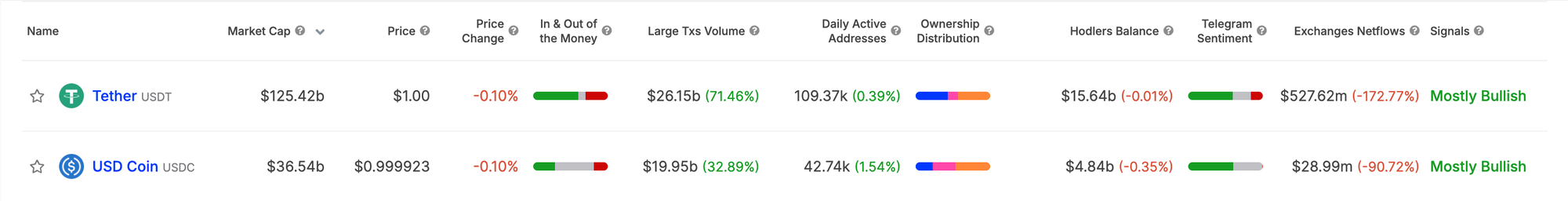

Tether, the dominant stablecoin issuer, minted $5 billion worth of its USDT stablecoin over the past five days, coinciding with a sharp rally in Bitcoin, which reached a high of nearly $90,000. This fresh supply of USDT, a critical driver of liquidity within the cryptocurrency markets, has pushed Tether’s market capitalization to a record $125 billion.

The increase aligns with a broader surge in crypto trading activity as sentiment swells following Donald Trump’s re-election and speculation of a more crypto-friendly stance from the White House.

The recent USDT issuances began with a $1 billion tranche on November 6, followed by $2 billion each on November 9 and 10, supporting a wave of trading volume that saw Bitcoin’s market capitalization soar to $1.67 trillion.

With Bitcoin now dominating 59.81% of the total cryptocurrency market — which stands at $2.88 trillion — Tether’s contribution to liquidity is seen as instrumental in sustaining current market levels.

Role in Supporting Crypto Prices

Stablecoins like USDT are central to liquidity flows in cryptocurrency trading, particularly on decentralized and centralized exchanges. Data from Coinmarketcap reveals that USDT remains one of the most actively traded assets, with a 24-hour trading volume nearing $246 billion, highlighting its role in enabling swift and sizable trades. Stablecoin issuance has long been tied to price support in digital assets, and the recent $5 billion injection appears to be fueling buying momentum, especially in Bitcoin.

“Tether’s substantial issuance of USDT often signals a high liquidity phase, giving traders the flexibility to enter and exit positions across multiple crypto pairs,” said BRN analyst Valentin Fournier.

“This pattern frequently correlates with price appreciation in leading assets like Bitcoin and Ethereum, particularly during periods of heightened investor optimism,” Fournier added.

Trump’s Re-Election Boosts Market Optimism

Trump’s re-election has injected fresh optimism into the crypto markets, with analysts speculating on the potential for policies that could benefit the digital asset space. Bitcoin’s market cap of $1.722 trillion places it just above Silver’s $1.72 trillion valuation, according to CompaniesMarketCap, underscoring its increasing significance in global asset rankings.

Beyond Bitcoin, the broader cryptocurrency market is riding high on renewed confidence. Major altcoins like Solana and Binance Coin (BNB) have seen elevated interest as investors grow bullish on the possibility of a supportive regulatory environment.

“The outlook for crypto assets is positive, with the expectation that regulatory clarity will stimulate more investor interest,” BRN analyst Valentin Fournier said.

Non-Custodial Wallet Development

In addition to the recent issuance, Tether also launched WDK, an open-source wallet development kit intended to advance non-custodial wallet capabilities. This initiative is expected to drive broader adoption in decentralized finance (DeFi) by simplifying non-custodial wallet integration for developers and businesses. The kit comes amid increasing demand for self-custody options as investors prioritize security and regulatory compliance.

WDK by Tether: why?

— Paolo Ardoino 🤖🍐 (@paoloardoino) November 11, 2024

The future is unpredictable: chaos, instability, or prosperity – no one knows. But with WDK by Tether we can build programmable, open, and resilient monetary systems that connect people, machines, robots, families, communities, AI agents, societies, and even… https://t.co/fTX6qAQSNX

With Tether’s new tools, developers can now integrate USDT into non-custodial wallets more effectively, a move seen as critical in meeting DeFi’s call for privacy and transparency.

"The future is unpredictable: chaos, instability, or prosperity – no one knows. But with WDK by Tether we can build programmable, open, and resilient monetary systems that connect people, machines, robots, families, communities, AI agents, societies, and even planets, to remain in control of our own financial destiny," Tether CEO Paolo Ardoino said in a post on X.

Record Profits

Earlier this month, Tether reported record-breaking profits for the third quarter of 2024, even as the company faces increased regulatory scrutiny from U.S. authorities.

The company’s net profit for the quarter reached $2.5 billion, contributing to a 2024 nine-month consolidated profit of $7.7 billion, according to its Q3 2024 attestation report, published Thursday.

The company is one of the most profitable firms in crypto and in financial services firms globally, with fewer than 150 employees.