Table of Contents

The United States may soon reclaim its position as the global leader in the crypto space. That's what Donald Trump vowed earlier this year, and that's what industry leaders are hoping materializes.

The 47th president of the United States, who will be inaugurated on January 20, won both the Electoral College and popular vote by a landslide on Wednesday, and with his pro-crypto rhetoric and pledges to overhaul the U.S. regulatory landscape, many in the industry now expect a friendlier environment for digital assets.

Trump’s embrace of crypto is seen as a direct contrast to the policies of his Democratic rival, Vice President Kamala Harris, who during her campaign displayed a more cautious stance on cryptocurrencies.

But with Harris-hype becoming irrelevant and forgotten faster than Tiger King, all eyes are now on Trump and the next stage for crypto.

To glean some insight, Blockhead spoke to a number of industry leaders and scoured through social media, so you don't have to.

With the Republican Party's win, expectations are high for more constructive crypto regulations in the U.S., which could lead other countries to follow suit. We have already had conversations overnight with banks and institutions wanting to re-enter the crypto space, and see signs of capital markets opening up."

Ultimately, what won’t change is the growing U.S. debt, high fiscal spending, and increased liquidity in the system, which will support Bitcoin and crypto prices – Lasanka Perera, CEO, Independent Reserve Singapore

Incoming President Trump has the power to save crypto in the U.S., where urgent change is needed. First amongst the new administration’s priorities should be to define staking as an opportunity for U.S. investors. The question still lingers: is staking a commodity or a security? Asset managers need to know how to safely incorporate staking into their ETH ETFs to satisfy the total returns of Ether."

Currently, $6 billion sitting in ETH ETFs is not being staked, marking significant missed economic opportunities. This may also be the key reason that uptake of ETH ETFs has lagged behind that of BTC ETFs. ETH ETFs are not as competitive and are stifled by unclear and unsustainable regulation.

Once these core issues have been solved, changes are needed within the SEC to ensure that crypto is viewed as a vehicle of innovation, rather than something to be feared. – Jesper Johansen, CEO & Founder, NORTHSTAKE A/S

On X, Brad Garlinghouse, CEO, Ripple, posted:

"Some fodder for your first 100-day checklist to get things moving:

- Fire Gensler. Day 1, no delays.

- In his place, appoint Giancarlo, Brooks, or Gallagher – they’d be massive upgrades in rebuilding the rule of law (and reputation) at the SEC.

- Host a family dinner and get the Rs and Ds moving the digital asset market structure bill forward in the Senate.

- And last but not least, can we get some clarity…..similar to XRP and BTC, that ETH is not security, right?!"

Well…this aged well! Seems like they realized it too late to change course.

— Brad Garlinghouse (@bgarlinghouse) November 6, 2024

The misguided anti-crypto leaders and their allies/cronies (including @senwarren and @GaryGensler) played a key role in the ‘Red Reset’ https://t.co/3XqoECPYAE

Brian Armstrong, CEO, Coinbase, said: "Americans disproportionately care about crypto and want clear rules of the road for digital assets. We look forward to working with the new Congress to deliver it."

"DC received a clear message that being anti-crypto is a good way to end your career, as it doesn't represent the will of the voters, who are disaffected by the current financial system and want change."

Welcome to the new members of America's most pro-crypto Congress ever... 219+ pro-crypto candidates and counting have now been elected to the House & Senate.

— Brian Armstrong (@brian_armstrong) November 6, 2024

Tonight the crypto voter has spoken decisively - across party lines and in key races across the country. Americans… pic.twitter.com/t91wC3Wtzr

Meanwhile, Michael Saylor, executive chairman, Microstrategy, posted a picture of a Bitcoin flag atop the White House and called for the United States to establish a Bitcoin strategic reserve, which aims to reduce national debt by half by 2045 and position the US as a financial innovation leader.

This was an idea that President Trump had proposed, and which Senator Cynthia Lummis reaffirmed on Wednesday following his victory, with the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act (BITCOIN act) proposing that the US Treasury to acquire 1 million BTC over five years.

We have a #Bitcoin President. pic.twitter.com/HUACTe1XPI

— Michael Saylor⚡️ (@saylor) November 6, 2024

The Road Ahead for Crypto Regulation

In the wake of Trump’s victory, the focus now shifts to what this new pro-crypto administration will do to reshape U.S. policy on digital assets. Industry players are optimistic that a Trump presidency could lead to more favorable regulatory frameworks, and a clearer path forward for institutional investors and crypto companies alike.

With the SEC's stance on crypto in recent years having been one of cautious regulation, many anticipate a shift towards more innovation-friendly policies.

“As the election results show, the public is calling for change in many sectors, and cryptocurrency is no exception,” Coinbase chief legal officer Paul Grewal said. “It’s time for regulators to engage with the industry, rather than stifling it.”

But more importantly, BRN analyst views Trump's win as a bullish signal that is boosting confidence in the crypto market, especially for Bitcoin:

Following Trump's victory, Bitcoin reached a new all-time high of $76,400, driven by investor optimism surrounding the upcoming administration’s policies. Factors such as potential quantitative easing and supportive regulatory changes are fueling expectations of continued growth for Bitcoin, BRN analyst, Valentin Fournier said.

"Trump’s election presents a strong bullish case, with expectations that incoming rate cuts and global stimulus will further lift the economy and support Bitcoin’s performance," the analyst added.

Donald Trump’s election win over Kamala Harris, coupled with Senate control by Republicans, have boosted confidence in the crypto market, especially for #Bitcoin.

— BRN (@thebrn_co) November 7, 2024

Last night, Fournier discussed "Trading the Presidential Election Results," in a Twitter/X Spaces session with Lin Chen, Institutional Sales (APAC), Deribit; Marty, Retail Trader & KOL, Premia; and Augustine Fan, founding partner, SOFA.org. Listen to the recording here.

Elsewhere

Bridging the Gap: How AI & Blockchain Are Shaping the Digital Assets Landscape

As two of the most significant technological advancements of our time, AI and blockchain have historically developed independently but are now increasingly integrated to address each other's limitations. This convergence represents a significant shift in how digital ecosystems can be structured and governed.

This report, jointly produced by Blockhead and BRN, covers the diversity of solutions, the technical challenges they try to overcome, and the still early stage of their development.

Events

GeckoCon (Bangkok, 11 November 2024)

GeckoCon returns, and this year we're diving into the revolutionary world of Web3 Gaming! Discover how the fusion of blockchain and traditional gaming is creating a whole new entertainment layer.Don't miss out—visit CoinGecko now to secure your spot in our first ever Hybrid Conference set to take place in Bangkok, Thailand. Or from the comforts of your home!

Get your tickets now with Blockhead's 40% code: BHGC24

[Limited to 30 redemptions, expires 31 October 2024]

[Redacted] (Bangkok, 9-11 November 2024)

The [REDACTED] conference is bringing together the brightest minds in technology for a transformative three-day event from November 9-11, 2024, at the Avani Riverside hotel. This gathering will take place just ahead of Devcon and promises to be a pivotal moment for the convergence of artificial intelligence and Web3.

Interested readers can apply for free tickets here, and sign up for the hackathon here.

Devcon (Bangkok, 12-15 November 2024)

Following Devcon Bogota in 2022, the Ethereum Foundation is set to host Devcon SEA, the 7th edition of its premier developer and community conference.

This landmark event is expected to bring together a diverse group of individuals, including developers, researchers, academics, and community members, to explore the future of Ethereum and its potential to reshape society.

Tickets are available here, with discounts for local builders, students and teachers, and youth.

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

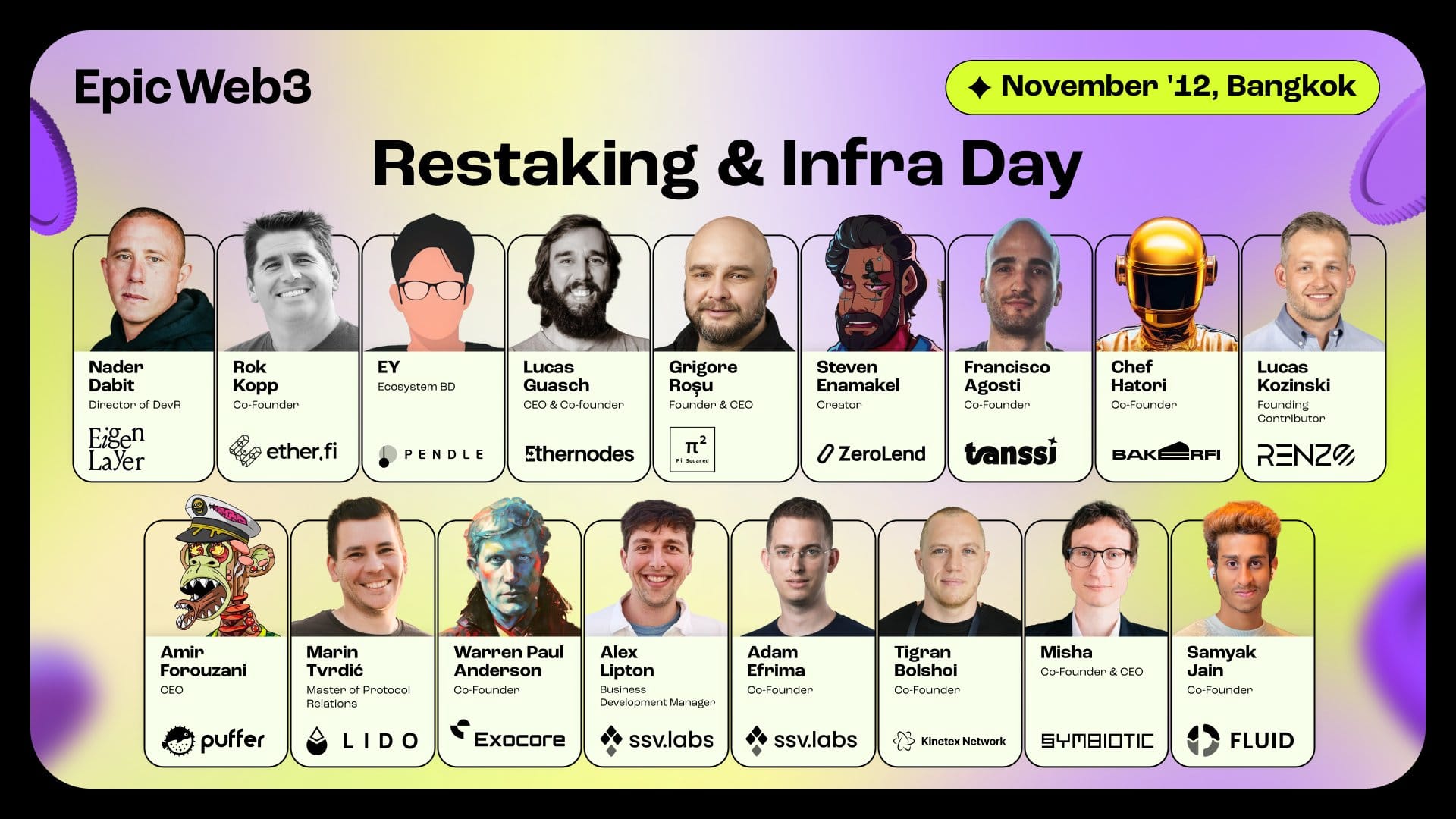

Restaking & Infra Day (Bangkok, 12 Nov)

Restaking & Infra Day is a full day of keynotes, workshops and panel discussions about recent advancements in the restaking field:

- Liquid restaking and staking;

- Oracles and other AVSs;

- ZK Coprocessors and Layer 2 solutions;

- Restaking on BTC, Cosmos and other chains;

- Security and risks of restaking.

What to expect:

- 15+ speakers

- 250+ attendees

- Excellent networking opportunities

Blockhead readers can get 20 free tickets with the coupon code BLOCKHEADLOVE. You can use them after choosing the "guaranteed seat" option, in the "Add a coupon" field.

Be the first one to grab a free ticket:https://t.ly/ZP-pE

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!