Table of Contents

In October, the US economy added only 12,000 jobs, but the impact of hurricanes and strike action dampened that.

However, the hiring surge is waning, and the inflation backdrop appears less, so the Federal Reserve has room to bring policy closer to neutral.

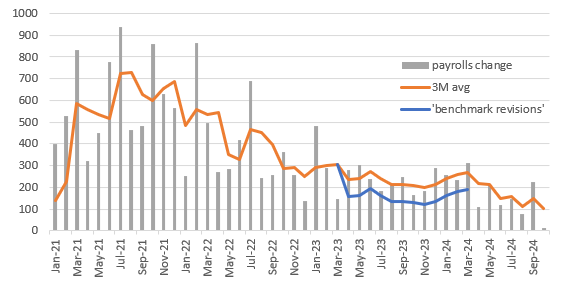

According to the employment report, payrolls increased by a meagre 12,000 in October, with a net negative revision of 120,000 from the prior two months.

Considering the possibility of weakening from substantial strike action throughout the month and a measurement impact caused by hurricane-related interruption, the consensus projection was 100,000.

As anticipated, the unemployment rate is 4.1%, while earnings increased 0.4% from the previous month.

We had some idea that strikes at Boeing would cut 44,000 jobs from the total, but we didn't know much about the hit from the hurricanes.

The Bureau of Labour Statistics said, "The initial establishment survey collection rate for October was well below average. However, collection rates were similar in storm-affected areas and unaffected areas....It is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect".

The data show that private payrolls declined 28k, with a 46k decline in manufacturing - a sector hit hard by the Boeing strike, which contributed 33k to the overall decline - leading the way.

Reduced by 4k were leisure and hospitality, while temporary assistance decreased by 49k.

There was a 57% increase in the private sector for healthcare and education, while government employment remained high at 40 thousand—possibly due to the influx of additional election workers.

Fed Has More Room to Cut Rates

The Fed has seen substantial downward adjustments, and the current figure is more in line with survey data from organisations like Homebase, the NFIB, and ISM.

It should be noted that the BLS acknowledged a one-third overestimation of employment from April 2023 to March 2024, and there is ongoing worry about a structural overestimation.

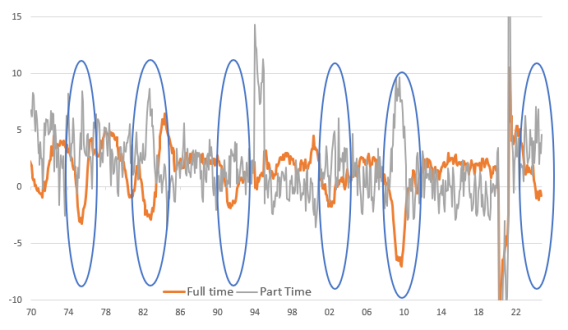

The increased employment is concentrating on more low-paying, part-time positions, which has raised some worries about their quality.

Friday's news solidified expectations for a 25 bps Fed rate cut this week, given the less dangerous inflation backdrop and the Fed's increased emphasis on jobs.

After that, in December, BRN anticipates another 25 bps rate cut.

US Goldilocks Story Gives the Fed Scope

The economy and job market are holding their own, and inflation is easing. This gives the Fed additional leeway to progressively lower interest rates, allowing the economy to maintain healthy growth.

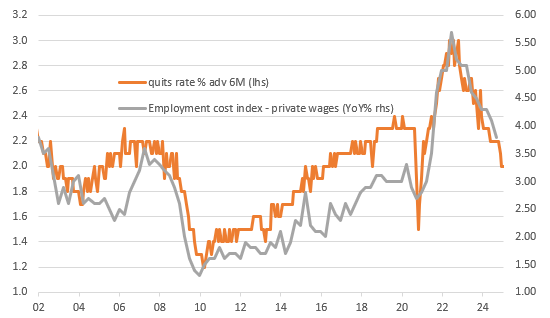

Labour costs are cooling, and there is little evidence of job firings. Consistent data from the United States shows that the economy is doing OK regarding activity and employment and that inflation is starting to cool down.

While continuing claims fell to 1862k from 1888k, they are still in an upward trend channel. Initial claims fell to 216k from 228k the previous week. And while hurricane-related factors are still influencing the numbers, the overall picture is that few people are losing their jobs, which is great news.

However, if you are among the unlucky few who lose their jobs, finding another one is getting harder, which is bad news. The employment cost index, meanwhile, grew by only 0.8% quarter-on-quarter (QoQ), which was far less than anticipated.

The Federal Reserve's key metric is the total cost of employment, including salary, bonus, and perks.

This is the most modest gain since the June quarter of 2021, but it provides more evidence that pipeline pricing pressures are easing and increases optimism that inflation can be sustained at 2%.

Inflation on Track for 2%

To round off the statistics, last week's quarterly GDP numbers gave an important message, so the personal income and spending report doesn't include big shocks.

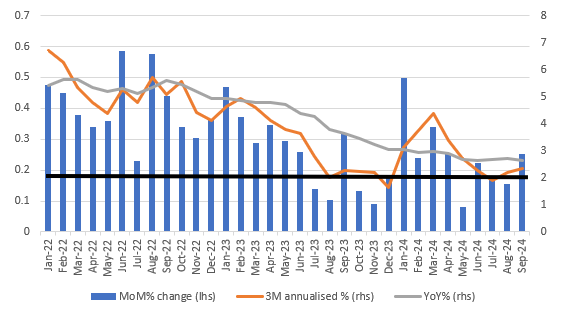

The 2.2% quarterly annualised core PCE deflator, the Fed's preferred inflation metric, was a minor surprise.

This meant that the result would be 0.34% mom-on-month (MoM), far higher than the market's prediction of 0.25%.

The core PCE deflator did, in fact, see upward adjustments for July and August, confirming BRN's suspicions. The MoM result was 0.254%.

Inflation of 2% year-over-year is not a prerequisite for additional Fed rate cuts. The only thing the Fed needs to know is that the rates are going in the right direction month after month. That is, to average 0.17% MoM, since 2% year-over-year inflation is produced by 12 measures of 0.17% MoM.

From 2021 to the middle of 2023, they were continuously too hot, but we saw readings over 0.17% MoM last month. In contrast, we had seen many readings below 0.17% MoM in the previous year.

These findings provide the Fed with greater leeway to maintain rate cuts around neutral, allowing the economy some room to keep expanding robustly.

Fed to Cut Irrespective of Election Outcome

Even as global markets see considerable volatility due to the expected close fight in the US election, the Fed will cut rates by 25 basis points on November 7.

The Fed is shifting its attention away from inflation and onto the waning employment market.

Consequently, BRN anticipates that the Fed will bring rates closer to neutral, regardless of the election outcome.

While the attention naturally is on Tuesday's election, market participants would do well to remember that Thursday's Fed policy announcement will also be a major market mover.

Even if a 25 basis point rate cut is widely anticipated and priced in, what really matters will be Fed Chair Jerome Powell's remarks about the present economic climate and how the next US president is likely to impact the forecast.

The financial markets may be experiencing very turbulent times right now, so the Fed will be careful with its words and actions.

In recent weeks, stock prices, the dollar, and Treasury rates have all risen, giving the impression that markets are becoming more certain of Donald Trump's triumph.

These tendencies could persist if Trump is elected.

On the other hand, if Kamala Harris is elected, the markets may react negatively to the idea of more taxes and a less favourable business climate. Still, they would welcome greater clarity about trade policy and foreign relations.

Policy Rates Remain Well Above "Neutral"

In pursuing a less harsh economic landing, the Fed has become less concerned about inflation and has shifted its attention to the labour market.

Even after the 50 basis point rate drop in September, the central bank still has room to decrease rates to a more neutral level, so the economy may keep expanding robustly while monetary policy remains tight.

Aside from implying that the magnitude of the move will be less than in September, the Fed has made no statements to discourage us from expecting a second straight rate decrease.

At the next December meeting, the US central bank will continue to base its decisions on the macro newsflow, as Joe Biden will still hold the presidency until January 20.

Here, BRN anticipates a 25 basis point drop by the central bank, bringing the overall amount of easing for the year to 100 basis points.

Election Has Important Implications for Fed Policy in 2025

A reduced tax environment, guaranteed by a Trump victory, will enhance sentiment and expenditure in the near term, looking at the big picture.

However, as his presidency progresses, the projected tariffs, immigration restrictions, and increased borrowing costs will become increasing obstacles.

Conversely, if Harris wins, it will be business as usual.

However, her capacity to implement her platform is still being determined, given that Congress will likely be divided.

The Treasury market may view a slightly higher tax rate with very small increases in expenditure as the best possible election outcome, but this would pressure the Fed to cut rates and boost economic growth.

BRN estimates that, under a permissive fiscal policy environment, the Fed would likely set policy rates closer to 3.5%, whereas the Fed's Summary of Economic Projections suggests that it believes in "neutral" rates of about 3%.

The central bank may decide that rates should remain slightly higher to counteract the fiscal stimulus and achieve the 2% inflation objective, given that the deficit is projected to approach 7% of GDP this year and next.

Based on this information, BRN predicts the Fed will raise interest rates to 3.5% by summertime during Trump's administration, but that under Harris's watch, rates will fall to 3% in the second half of 2025.

Elsewhere

Events

Singapore Fintech Festival (Singapore 6-8 November 2024)

As 2025 approaches, financial leaders face the challenge of navigating a landscape transformed by AI, data, and digital platforms that are rewriting the rules of global trade, commerce and financial services.

At the Singapore FinTech Festival 2024, hear from global leaders at Microsoft, Goldman Sachs, PayPal, and Tencent, and more, as they share the strategies shaping the future of finance.With 66,000+ participants from 150 countries and 10,000+ organisations, everyone who's anyone is here.

Click to see who’s attending and who you can network with at #SFF2024! Blockhead is proud to offer a 20% discount on tickets via this link.

GeckoCon (Bangkok, 11 November 2024)

GeckoCon returns, and this year we're diving into the revolutionary world of Web3 Gaming! Discover how the fusion of blockchain and traditional gaming is creating a whole new entertainment layer.Don't miss out—visit CoinGecko now to secure your spot in our first ever Hybrid Conference set to take place in Bangkok, Thailand. Or from the comforts of your home!

Get your tickets now with Blockhead's 40% code: BHGC24

[Limited to 30 redemptions, expires 31 October 2024]

[Redacted] (Bangkok, 9-11 November 2024)

The [REDACTED] conference is bringing together the brightest minds in technology for a transformative three-day event from November 9-11, 2024, at the Avani Riverside hotel. This gathering will take place just ahead of Devcon and promises to be a pivotal moment for the convergence of artificial intelligence and Web3.

Interested readers can apply for free tickets here, and sign up for the hackathon here.

Devcon (Bangkok, 12-15 November 2024)

Following Devcon Bogota in 2022, the Ethereum Foundation is set to host Devcon SEA, the 7th edition of its premier developer and community conference.

This landmark event is expected to bring together a diverse group of individuals, including developers, researchers, academics, and community members, to explore the future of Ethereum and its potential to reshape society.

Tickets are available here, with discounts for local builders, students and teachers, and youth.

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

Restaking & Infra Day (Bangkok, 12 Nov)

Restaking & Infra Day is a full day of keynotes, workshops and panel discussions about recent advancements in the restaking field:

- Liquid restaking and staking;

- Oracles and other AVSs;

- ZK Coprocessors and Layer 2 solutions;

- Restaking on BTC, Cosmos and other chains;

- Security and risks of restaking.

What to expect:

- 15+ speakers

- 250+ attendees

- Excellent networking opportunities

Blockhead readers can get 20 free tickets with the coupon code BLOCKHEADLOVE. You can use them after choosing the "guaranteed seat" option, in the "Add a coupon" field.

Be the first one to grab a free ticket:https://t.ly/ZP-pE

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!