Table of Contents

If LUNA taught us anything it's that stablecoins aren't always safe. But two years on from the catastrophic collapse of Terra, surely the likes of stablecoin giant Tether won't do a Do Kwon on the industry. Or can it?

According to the Wall Street Journal, the US federal government is investigating Tether for allegedly violating sanctions and anti-money laundering laws. Specifically, prosecutors in Manhattan are probing whether Tether has been used to support illegal activities like drug trafficking, terrorism, or hacking.

Furthermore, the Treasury Department is also investigating sanctions against Tether due to its popularity among US-sanctioned entities like Hamas and Russian arms dealers.

The probe comes on the heels of the company's record-breaking profits, with a staggering $5.2 billion in earnings for the first half of 2024 alone.

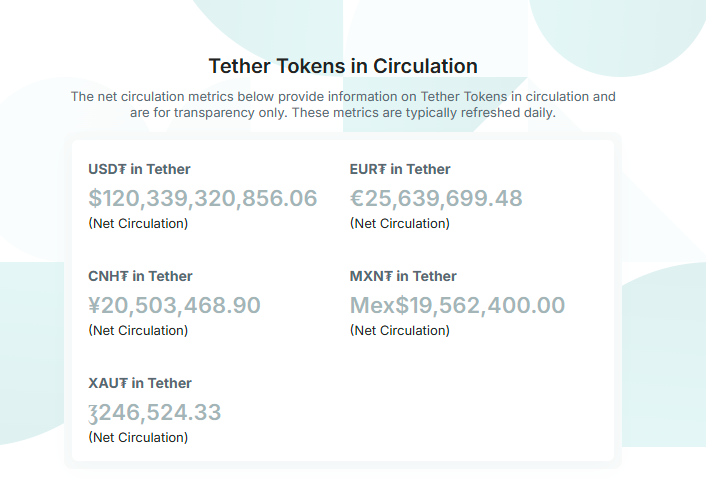

According to recent reports, there has been a recent record surge in the number of stablecoin transactions. Stablecoin liquidity surged to an all-time high of $169 billion at the end of last month, reflecting a 31% growth since the beginning of the year.

Tether's USDT maintained its leading position, with its market cap expanding by $28 billion to nearly $120 billion, representing 71% of the market. As the world’s most traded cryptocurrency, Tether sees about $190 billion traded daily.

However, these transactions are linked to several U.S. national security concerns, including “the North Korean nuclear weapons program, Mexican drug cartels, Russian arms companies, Middle Eastern terrorist groups, and Chinese manufacturers of chemicals used to make fentanyl,” according to The Wall Street Journal.

These allegations are nothing new either. Cyber Capital founder Justin Bons recently lashed out at Tether, describing it as "one of the biggest existential threats to crypto as a whole" and a "118 billion dollar scam; bigger than FTX & Bernie Madoff combined." Tether's market cap has since risen to $120 billion.

1/17) Tether is a 118 billion dollar scam; bigger than FTX & Bernie Madoff combined!

— Justin Bons (@Justin_Bons) September 14, 2024

No proof of reserves & an audit has never been done; USDT is printing counterfeit money (fraud)

Caught falsifying documents, obscuring identities & lying about reserves

Stop using USDT now! 🧵

Bons accuses the USDT issuer of printing counterfeit money, falsifying documents, obscuring identities, and lying about reserves. "No proof of reserves and an audit have ever been done," he said.

“This means we have to take their word for the vast majority of reserves, as they cannot be independently verified. The first firm to attempt an audit even got fired for being too thorough in 2018!”

Although Bons' remarks were made over a month ago, they seem timingly relevant as Tether recently revealed its reserve breakdown. Speaking at Lugano’s PlanB event in Switzerland, Tether CEO Paolo Ardoino revealed that Tether holds $100 billion in US treasuries and more than 82,000 Bitcoin valued at $5.5 billion.

"All Tether tokens are pegged at 1-to-1 with a matching fiat currency and are backed 100% by Tether’s Reserves," Tether's website states.

Ardoino blamed the Wall Street Journal article for causing FUD around the token. On X, he refuted the article's claims, stating "As we told to WSJ there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop."

As we told to WSJ there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop.

— Paolo Ardoino 🤖🍐 (@paoloardoino) October 25, 2024

"We deal regularly and directly with law enforcement officials to help prevent rogue nations, terrorists, and criminals from misusing USDT. We would know if we are being investigated as the article falsely claimed. Based on that, we can confirm that the allegations in the article are unequivocally false."

In the article itself, the Wall Street Journal quoted Tether as dismissing the allegations. “To suggest that Tether is somehow involved in aiding criminal actors or sidestepping sanctions is outrageous,” the Wall Street Journal quoted Tether as saying, “We work actively with U.S. and international law enforcement to combat illicit activity.”

The Justice Department's scrutiny of Tether nonetheless began years ago, initially focusing on alleged bank fraud by Tether backers. Tether bolstered oversight of how its cryptocurrency is used, claiming the transparency of blockchain makes it difficult for criminal activity to go undetected. Tether even paid $61 million in a prior settlement over accusations of misrepresenting the assets backing its currency.

Recently, Tether revealed plans to explore lending opportunities in the commodities trading sector. The move is seen as a direct response to the challenges faced by smaller commodity trading firms, who often struggle to secure the necessary credit lines from traditional lenders. Tether's involvement could offer a lifeline, providing a less regulated and potentially more flexible funding option.

With billions in reserves, Tether is looking for new ways to deploy its capital. The commodities market, with its vast array of assets and complex trading dynamics, presents a compelling opportunity.

Elsewhere

Blockcast

This week's Blockcast features Augustine Fan, founding partner of SOFA.org. SOFA is a decentralized, non-profit, and open-source DAO dedicated to developing a trustless, DeFi ecosystem capable of atomically settling financial assets on the blockchain.

Fan chats with host Takatoshi Shibayama focuses on role of structured products in crypto, they types available to investors, how they work, and how investors can use them to capitalize on volatility.

Events

Singapore Fintech Festival (Singapore 6-8 November 2024)

As 2025 approaches, financial leaders face the challenge of navigating a landscape transformed by AI, data, and digital platforms that are rewriting the rules of global trade, commerce and financial services.

At the Singapore FinTech Festival 2024, hear from global leaders at Microsoft, Goldman Sachs, PayPal, and Tencent, and more, as they share the strategies shaping the future of finance.With 66,000+ participants from 150 countries and 10,000+ organisations, everyone who's anyone is here.

Click to see who’s attending and who you can network with at #SFF2024! Blockhead is proud to offer a 20% discount on tickets via this link.

GeckoCon (Bangkok, 11 November 2024)

GeckoCon returns, and this year we're diving into the revolutionary world of Web3 Gaming! Discover how the fusion of blockchain and traditional gaming is creating a whole new entertainment layer.Don't miss out—visit CoinGecko now to secure your spot in our first ever Hybrid Conference set to take place in Bangkok, Thailand. Or from the comforts of your home!

Get your tickets now with Blockhead's 40% code: BHGC24

[Limited to 30 redemptions, expires 31 October 2024]

[Redacted] (Bangkok, 9-11 November 2024)

The [REDACTED] conference is bringing together the brightest minds in technology for a transformative three-day event from November 9-11, 2024, at the Avani Riverside hotel. This gathering will take place just ahead of Devcon and promises to be a pivotal moment for the convergence of artificial intelligence and Web3.

Interested readers can apply for free tickets here, and sign up for the hackathon here.

Devcon (Bangkok, 12-15 November 2024)

Following Devcon Bogota in 2022, the Ethereum Foundation is set to host Devcon SEA, the 7th edition of its premier developer and community conference.

This landmark event is expected to bring together a diverse group of individuals, including developers, researchers, academics, and community members, to explore the future of Ethereum and its potential to reshape society.

Tickets are available here, with discounts for local builders, students and teachers, and youth.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!