Table of Contents

Due to concerns about their jobs, US consumers may be less optimistic about the economy's state, but they are content to keep spending for the time being.

Although many households are experiencing increasing financial strain, the strong expenditures of the wealthiest individuals more than compensate for this trend.

This implies that the Fed will be cautious when making 25 bps cuts.

While the "control group" increased 0.7% month-on-month (MoM) against the 0.3% market forecast, US retail sales were up 0.4% MoM in September, falling short of the 0.3% MoM consensus.

The latter metric has a track record of better following general consumer spending patterns and does not include certain volatile categories like cars, petrol, food service and building supplies.

Since this is a nominal dollar increase, "real" expenditure growth—which influences GDP—must be produced after accounting for inflation (0.2% MoM).

At around 0.5% MoM, it is rather stable and presents a more compelling picture than that suggested by surveys of decreasing consumer confidence.

Naturally, recent storms have the potential to skew trends, with individuals purchasing a lot of supplies, such as food, flashlights, batteries, before a storm strikes out of concern that they won't be able to acquire them before the cleanup effort begins.

Indeed, with a 4% MoM increase, "miscellaneous" retailers were the strongest category. In addition to this component, there was strength in food services (+1%), health & personal care (+1.1%), and apparel (+1.5% MoM).

Electronics (-3.3%) and furniture (-1.4%) were the main areas of weakness, while decreased fuel costs resulted in fewer sales at petrol stations (-1.6%). Overall, however, it suggests that the household sector continues to be resilient.

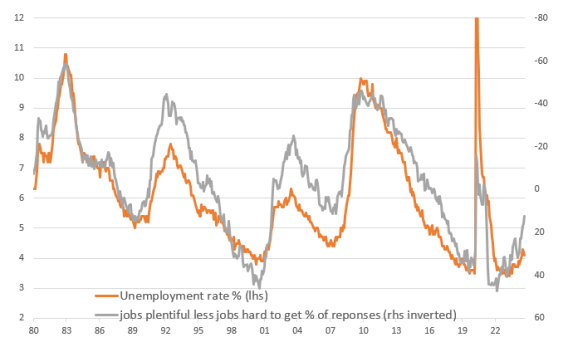

Deteriorating perceptions of the jobs market tend to lead to moves in the unemployment rate.

How long can high-income families make up for low-income households' inadequate spending?

BRN is aware that the wealthiest 20% of households spend more than the combined incomes of the lowest 60% of households.

The wealth of the top 20% has increased, inflation has not been a barrier, and they profit from high interest rates. They receive 5% plus on money markets rather than paying 3.5% on a mortgage, assuming they have one.

This gang is likely to keep spending a lot. However, the situation for the lowest 60% of earners is considerably different.

While wealth gains have been far more modest, rising auto loan and credit card borrowing fees have been unpleasant, and many more renters are suffering from recent significant rises in housing expenses.

The percentage of credit card users who only make the minimum monthly payments has risen, and loan delinquencies are increasing.

The question surrounding consumer spending is how long those higher-income families can counteract a slowdown in lower-income households' spending growth. It might only last a short time if the hiring statistics indicate that the jobs market cools as quickly as it might and unemployment concerns increase.

Take note of the preceding figure, which indicates a noticeable fluctuation in the impression of work security, which typically manifests before real increases in the unemployment rate.

Labour Market is Cooling

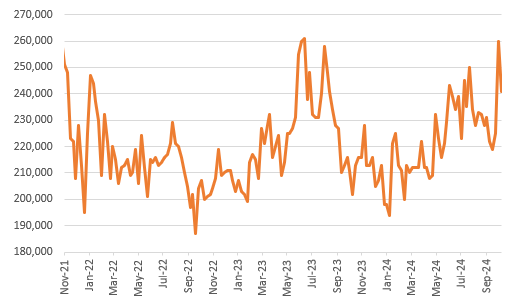

Separately, last week's initial unemployment claims were 241k, down from an upwardly revised 260k the week before and below the 259k consensus. However, continuing claims were somewhat higher than anticipated, going from 1,858k to 1,867k, which was higher than the consensus of 1,865k.

Hurricanes are also affecting the data here, much like they do with retail sales figures, but the overall trend is rising. Hurricanes negatively impacted industrial activity during September. August's growth was 0.3% lower than the initial 0.8% pace, while output fell 0.3% MoM against the -0.2% forecast.

Manufacturing was especially weak, down 0.4% MoM. This is likely due to hurricane disruptions affecting output and the Boeing strike action's knock-on effect on suppliers.

Next month, we ought to see some form of recovery.