Riot Platforms Settles With Bitfarms Amid Takeover Battle

Riot Platforms and Bitfarms have agreed on a settlement after months of takeover controversy.

Earlier this year, Riot Platforms planned to buy all of Bitfarms' outstanding shares at $2.30 each, marking a 24% premium on the one-month weighted average per share. In total, the deal was valued at $950 million.

The move came after Bitfarms fired CEO Geoffrey Morphy earlier this month following his lawsuit against the firm in which he claimed $27 million in damages for breach of contract.

The board of directors at Bitfarm ultimately rejected the deal but Riot then purchased a 9.25% stake in Bitfarms, making it the largest shareholder. Riot has since been steadily increasing its ownership of Bitfarms through share acquisitions and now controls approximately 20% of the company.

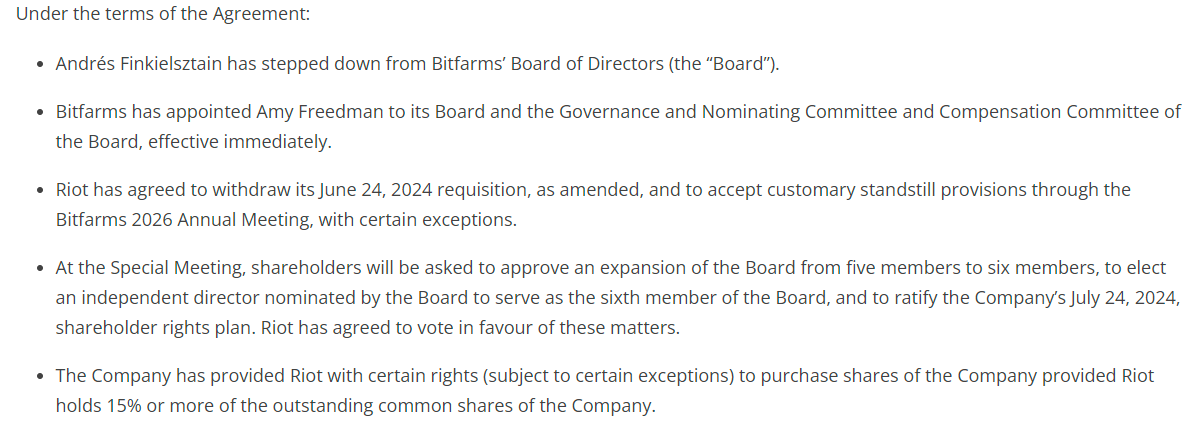

In June, Riot sought to replace several Bitfarms board members with individuals more inclined to favour an acquisition. As per the settlement banker and corporate advisor, Amy Freedman has been appointed to the Board of Governnace.

Bitfarms co-founder Andrés Finkielsztain has stepped down from the board too but the settlement does not signal a full takeover yet. It nonetheless allows Riot to buy more shares as long as it keeps a stake above 15%.

“This agreement represents a significant step to advance shareholder value creation at our respective companies, and we are pleased to have reached this constructive resolution with Bitfarms,” Riot CEO Jason Les said in a statement. “As Bitfarms’ largest shareholder, we look forward to supporting a reconstituted Bitfarms board and continued engagement with management.”

Brian Howlett, Independent Chairman of the Board, said, “We are pleased to reach this agreement with Riot, which we believe is in the best interests of all Bitfarms shareholders.”

Bitfarms continues to work against a hostile takeover. Last month, Bitfarms acquired Stronghold Digital Mining, a move aimed at increasing its valuation and making a takeover more difficult.

Bitcoin mining companies havefaced headwinds recently. In August, Riot and Marathon Digital have reported disappointing results in their latest earnings reports, underscoring the challenging operating environment for the industry.

Both companies grappled with declining revenues and widening losses as they navigate the complexities of the post-halving landscape.