Table of Contents

Crypto asset management firm, Grayscale, has launched the Grayscale XRP Trust to offer investors exposure to XRP.

The trust is open to eligible individuals and institutional accredited investors. It operates similarly to Grayscale's other single-asset trusts but focuses exclusively on XRP - the crypto used by the XRP ledger - as its underlying asset.

Rayhaneh Sharif-Askary, Grayscale’s Head of Product & Research, emphasized the value of the XRP Ledger’s real-world applications.

“We believe Grayscale XRP Trust gives investors exposure to a protocol with an important real-world use case,” he said in a statement. "By facilitating cross-border payments that take just seconds to complete, XRP has the potential to transform the legacy financial infrastructure."

News of the XRP tie-up sent XRP's price up around 8% to as high as $0.58.

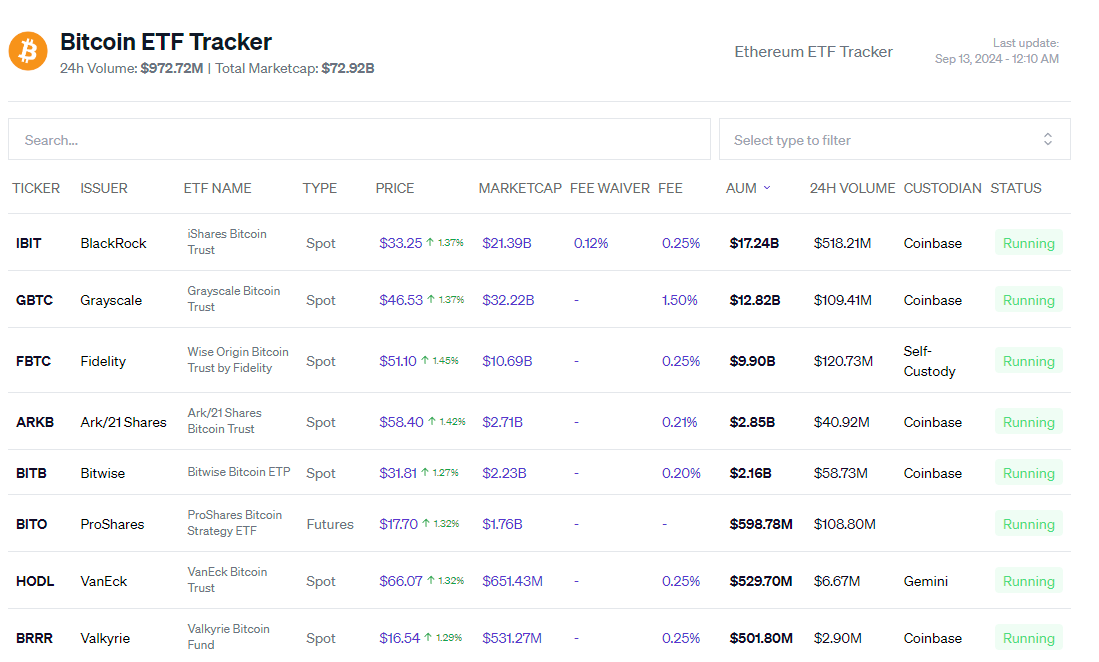

Recently, Goldman Sachs revealed holdings of Grayscale's Bitcoin Trust (GBTC) valued at $35 million.

GBTC is now the second-largest Bitcoin ETF with AUM of $12.82 billion. BlackRock's IBIT takes the top spot with $17.24 billion AUM.

Last month, the NYSE pulled its application that would see a rule change to allow it to list and trade options on the Bitwise Bitcoin ETF (BITB) and GBTC.

Grayscale and Bitwise then sought approval for options for their spot Ethereum ETFs on the NYSE. The exchange said options would "benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions."