Table of Contents

Despite a weak crypto market in August, a boost to cryptos and a rate cut in September is now on the cards.

The reason: the latest core PCE deflator print indicates inflation will reach the 2% goal early next year.

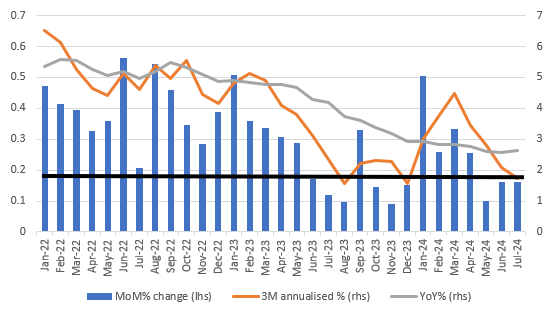

The US Federal Reserve's favoured inflation measure, the core PCE deflator, has come in at 0.2% month-on-month, as expected, but the year-on-year remains at 2.6% rather than rise to 2.7% as the consensus predicted.

To three decimal places it was 0.161% month-on-month, so a very "good" 0.2% that keeps us on the correct run-rate to get annual inflation to 2% by early next year.

A 0.17% each month for 12 months would get us to the 2% target and we have now had three consecutive prints that are below that with the 3M annualised rate now below 2%.

Additional revisions to April, May, and June were made upwards, and real consumer spending increased 0.4% month-over-month compared to the 0.3% estimate.

Real consumer spending is projected to reach 3.4% annually in the third quarter GDP report, even if August and September real spending prints are "just" 0.1% month-over-month.

So, to drop 50 bps on September 18th, the Fed would likely be hesitant due to that strength.

But the revenue side isn't strong. As in June, real household disposable income increased by just 0.1% month-over-month, leaving one to wonder where the funds are being used to fund this expenditure.

Households are obviously spending all their savings and taking out all of their debt. The savings rate is now a pitiful 2.9%. This was last seen on a regular basis in the years leading up to the Great Financial Crisis.

That means there is less of a safety net to keep consumers spending afloat in the event that the jobless rate keeps rising.

Personal Savings Rate in the US

The Fed may be hesitant to act forcefully due to the continued robustness of consumer spending. Still, a weak employment data on September 6th may change the tide for a 50 bps rate decrease.

Along with the market volatility in early August, markets revised its three 25 bps rate cut calls for this year to one in which the Fed could cut by 50 bps in September, return to 25 bps moves in November and December, and raise the policy rate to 3.5% by summer 2025.

Despite how aggressive the 50 bps call appears at the moment, the Fed's actions on September 18 will be decided by data in the upcoming week.

Following recent weakness and negative adjustments to payrolls, this week's employment report will undoubtedly capture everyone's attention.

"We don't seek or welcome further cooling in labour market conditions," Powell said, so if payrolls fall below 100,000 and the unemployment rate rises to 4.4% or 4.5%, 50 bps seems inevitable.

BRN confidently states that it will be a 25 bps increase if payrolls come in at approximately 150,000 and the unemployment rate remains at 4.3% or falls to 4.2%, as the current consensus predicts.

"If we do get a sub 100,000 on payrolls and the unemployment rate ticks up to 4.4% or even 4.5% then 50 bps cut looks likely given Powell's comment that 'we don't seek or welcome further cooling in labour market conditions,'" said the research desk's lead analyst Valentin Fournier.

"However, if payrolls come in around the 150,000 mark and the unemployment rate stays at 4.3% or dips to 4.2%, we can safely say it will be a 25 bps cut," Fournier added.

Those figures will give a clue as to whether we're entering this more precarious scenario.

And if we are, then there is a real risk central banks have left it too late to start cutting rates.

If they have, then we will have someone other than Taylor Swift to blame for inflation forecasts next summer.

"Overall, the macro scenario is pro-crypto and in the run beyond the short term, digital assets will get a shot in the arm once the Fed starts its easing cycle," Fournier said.

Yesterday, #Bitcoin climbed towards $61,000 before encountering strong bearish pressure, which brought it back to levels seen before the Jackson Hole speech. The initial excitement was short-lived, as the information had already been factored into the market.

— BRN (@thebrn_co) August 30, 2024

A thread 🧵(1/6)