Table of Contents

The much-awaited and crucial Fed pivot signal is here - Fed Chair Jerome Powell has told the Jackson Hole conference that the "time has come" to adjust policy.

The US Federal Reserve has been fighting inflation with a single-minded focus for the last two years, taking rates to two-decade highs.

Powell's Friday speech at the Jackson Hole Symposium suggested a tipping point, calling time on rate hikes.

Powell said 'the time has come' for a pivot to monetary policy easing, a clear signal that the rate cut cycle will start in September.

Cryptos and other risk asset traders cheered after Powell 'locked in' a September rate cut.

Global stocks hit a record high, and cryptos gained, with Bitcoin rising to trade over $64,000.

Finally, the trigger for digital assets is here, with the assessment shifting to the Fed's path and how much cryptos can gain from it.

The Fed chief did not provide any details on the magnitude or trajectory of the policy path.

But traders are counting down to the first rate cut in September and are reacting to that possibility.

The debate has clearly shifted to the size of a rate cut and the easing cycle.

Middle East Woes

Powell did mention that inflation has been making headway and that policymakers will be closely monitoring the state of the labour market.

Investors saw his comments as a signal to take risks, which caused US Treasury rates and the currency to fall as stocks and cryptos rose.

Nonetheless, it was before the Middle East crisis, which witnessed Israeli attacks on Hezbollah sites in southern Lebanon.

The Iranian-backed terrorist organisation said these attacks were in retaliation for the assassination of its military leader last month.

Will the tensions escalate, cause worry, and offset risk-on sentiment from the Fed's pivot?

Risk Assets FTW

The chaos will likely complicate traders' plans, especially regarding the demand for safe-haven assets like the dollar and Treasuries.

However, one thing is certain—bets on risk assets are here to stay, given the Fed's historic pivot.

Treasuries are now poised to register gains for a fourth consecutive month, marking their longest run of positive returns in three years.

The S&P 500 index has risen 18% so far in 2024. Since the end of June, the dollar index has lost more than 4% of its value.

In cryptos, Bitcoin has gained 10% in the last seven days and is up nearly 150% over the past year.

Powell said, "The direction of travel is clear."

However, he added that "the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

In light of Powell's remarks, the upcoming US labour report — due on September 6 — will be of paramount importance.

The latest employment figures were less than anticipated, and if the subsequent set is similarly disappointing, the rate path will become clearer.

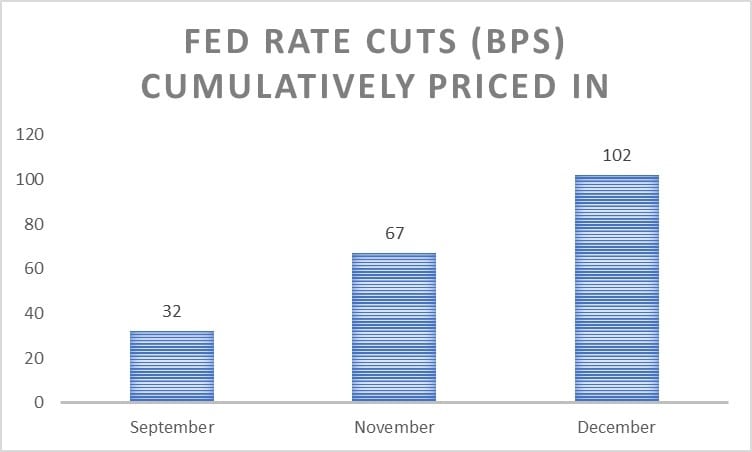

Rates on swaps contracts linked to central bank policy meetings indicate a cumulative decrease of around 1% for 2024.

That means markets are pricing in a high probability of a massive cut since there are just three more Fed meetings this year.

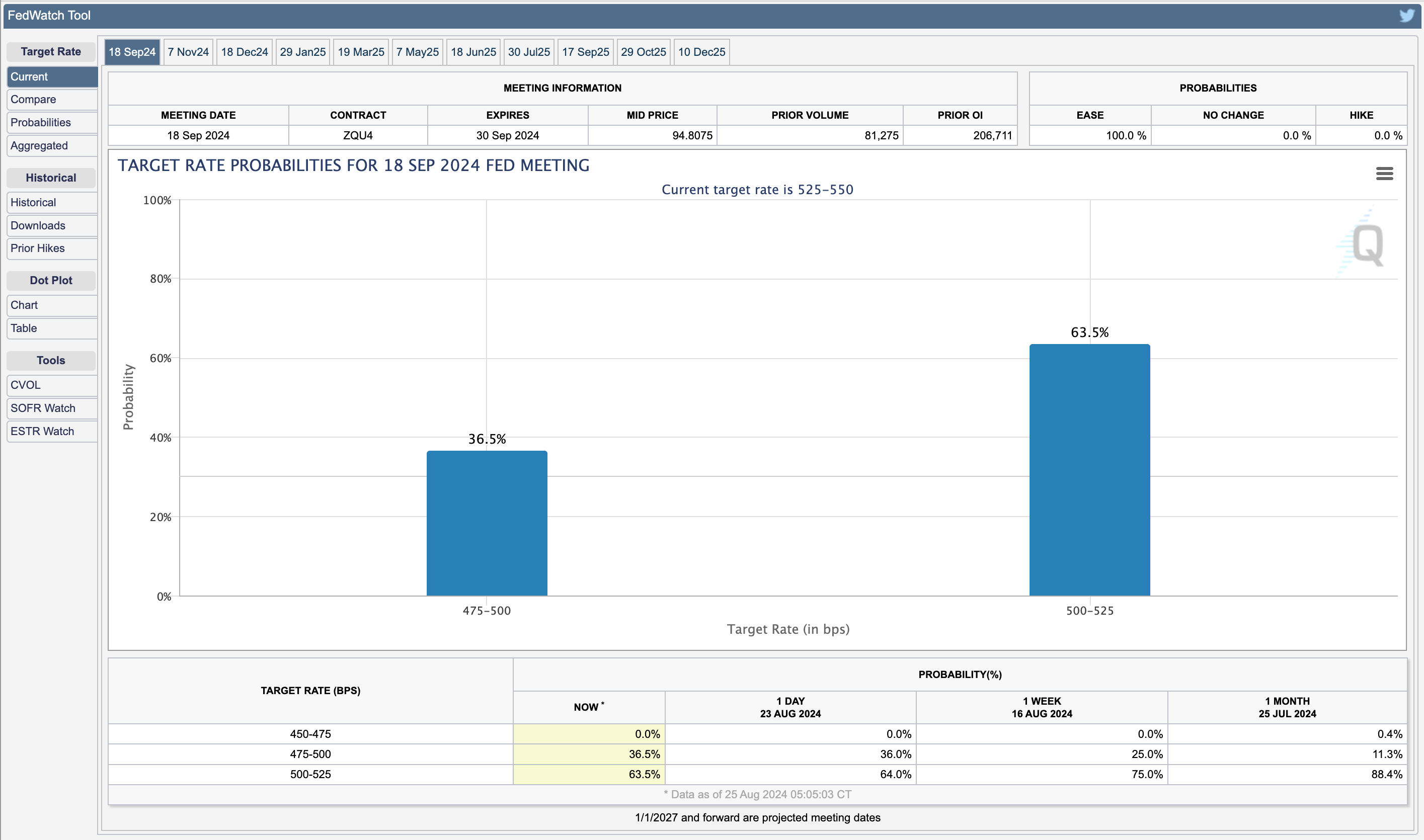

The CME FedWatch tool shows that a 25 basis point (bps) cut is priced in with a nearly 64% likelihood, while a 50 bps cut is priced in with about a 36% probability.

Wednesday's FOMC minutes also revealed the unanimous support for a rate cut in September.

In all, traders bet on about one percentage point of Fed easing in 2024. Fed rate cuts have been cumulatively priced in by swaps traders.

BRN Says

BRN predicts the Fed to ease policy moderately and cut rates by 25 basis points in each of the meetings this year, starting in September.

The shift in the Fed's stance focuses on one part of the central bank's dual mandate - the labour market.

However, inflation, which is easing, will weigh on the Fed's rate path.

The US central bank will be weary of its fight against inflation and will tread cautiously.

A mountain of data will be available to analyse, providing ample time to prepare for next month's reading on August job creation.

The Fed's favoured inflation gauge, the personal consumption expenditures price index, is scheduled to be released on August 30.

This data is a key agenda item. The headline and core PCE estimates are expected to be marginally higher than June's levels for the annual report.

Rate cuts are expected to hurt the dollar's value, regardless of their exact path.

This might make the dollar attractive for carry trades, where investors borrow dollars to invest in assets and currencies with greater yields.

However, if the conflict in the Middle East were to worsen, the viability of such transactions would be called into question due to their reliance on minimal volatility, especially in the financing currency.

Before the Bank of Japan hiked interest rates for the second time this year on July 31, global investors flooded carry trades using borrowed yen to purchase assets in higher-yielding currencies.

As a result, the trade fell through and the yen jumped, which led to a deep selloff in markets all across the world.

Now, with policy divergence between the US and Japan, the dollar could become the center of this trade.

For the cryptos market, the real question is - will the trigger push Bitcoin back over its life high?

BRN expects digital assets to gain significantly from the Fed's pivot and outperform most major assets in the final quarter of this year.

The #Fed has announced that the time has come for interest rate cuts. The pace and timing of these rate cuts will be announced on the 18th of September and will depend on incoming data.

— BRN (@thebrn_co) August 26, 2024

A thread 🧵(1/6)

Elsewhere

Events

Daemon Day (Singapore, 17 September 2024)

Join Blockdaemon on 17th September 2024 at Pan Pacific, Singapore for a day of groundbreaking discussions and networking opportunities with key players in the space. Event partners include AWS and Zodia Custody, while the event supporters include Liquid Collective, M2, MU Digital, Titanium Ventures, and Xangle.

For more info, click here.

Token2049 (Singapore, 18-19 September 2024)

Don't miss out on early bird ticket prices, until July 31! Use Blockhead's exclusive discount code BLOCKHEAD10 for a further 10% off.

All That Matters (Singapore, 16-18 September 2024)

The 19th All That Matters is the gateway to the APAC Music, Sports, Gaming, Marketing, Web3, Arts and Entertainment industries.

Conference by day and live music festival by night, ATM is Asia’s premiere ‘Business 2 Business 2 Fan’ event experience bringing together world class speakers with more than 2,000 senior executives.

Get your tickets now with Blockhead's 15% off code: ATM24BLOCKHEAD15

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!