Table of Contents

Decentralized perpetual exchange, Hyperliquid, has reached an all-time high in its trading volume.

Launched in Q1 2023, the exchange with 188,000 users reached an unprecedented trading volume of $4.3 billion during the recent crypto bloodbath according to their X profile.

Their network traffic also reached an all-time high with no downtime, unlike traditional counterparts like Schwab and Fidelity which went down due to technical issues.

Hyperliquid reached a new all-time high in 24h perps volume at 4.3B. This was coupled with an ATH in network traffic with no downtime. pic.twitter.com/R5SbmHiy7F

— Hyperliquid (@HyperliquidX) August 6, 2024

However, increases in trading volume do not result in more profits for the Hyperliquid team. On Hyperliquid, fees are entirely directed to the community (HLP and the insurance fund) according to their docs, with the founder reemphasizing the point in May.

Reminder: the Hyperliquid dev team does not profit from increased activity as it does not collect trading fees. On the contrary, it is entirely self-funded with exponentially increasing burn. There is not a single private investor.

— jeff.hl (@chameleon_jeff) May 29, 2024

>$25M of revenue has gone back to the…

Built on Hyperliquid L1 chain, Hyperliquid Perpetuals DEX can support 100,000 orders per second with every order, trade, and liquidation happening on-chain, operating a permissionless financial application.

Founded by team members with proprietary market-making backgrounds, the team sought to design a trading platform with a good user experience, providing traders with a seamless experience.

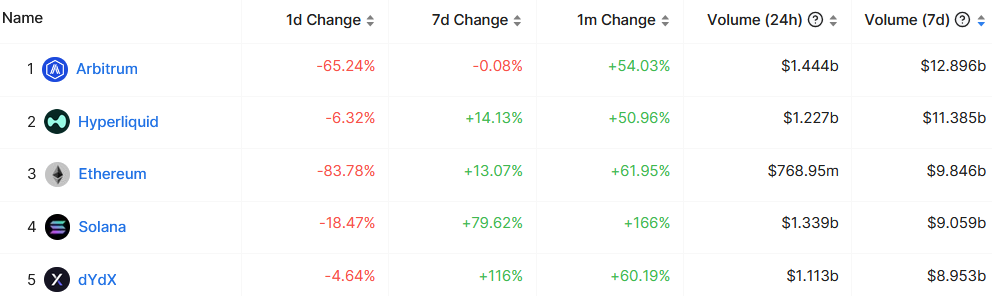

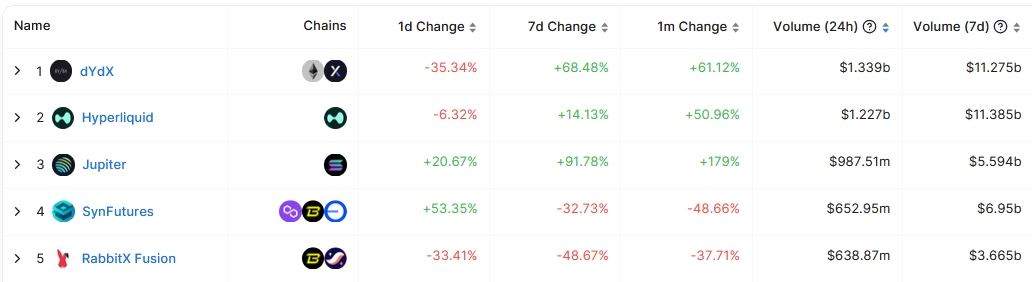

As a standalone chain, Hyperliquid ranks behind Arbitrium in 7-day Volume. Compared on an individual project level, Hyperliquid ranks just behind dydx in terms of volume which is impressive considering that they did not raise any outside capital. According to their docs, Hyperliquid Labs is self-funded and has not taken any external capital, which allows them to focus on building a product without external pressure.

https://defillama.com/derivatives/chains,https://defillama.com/derivatives

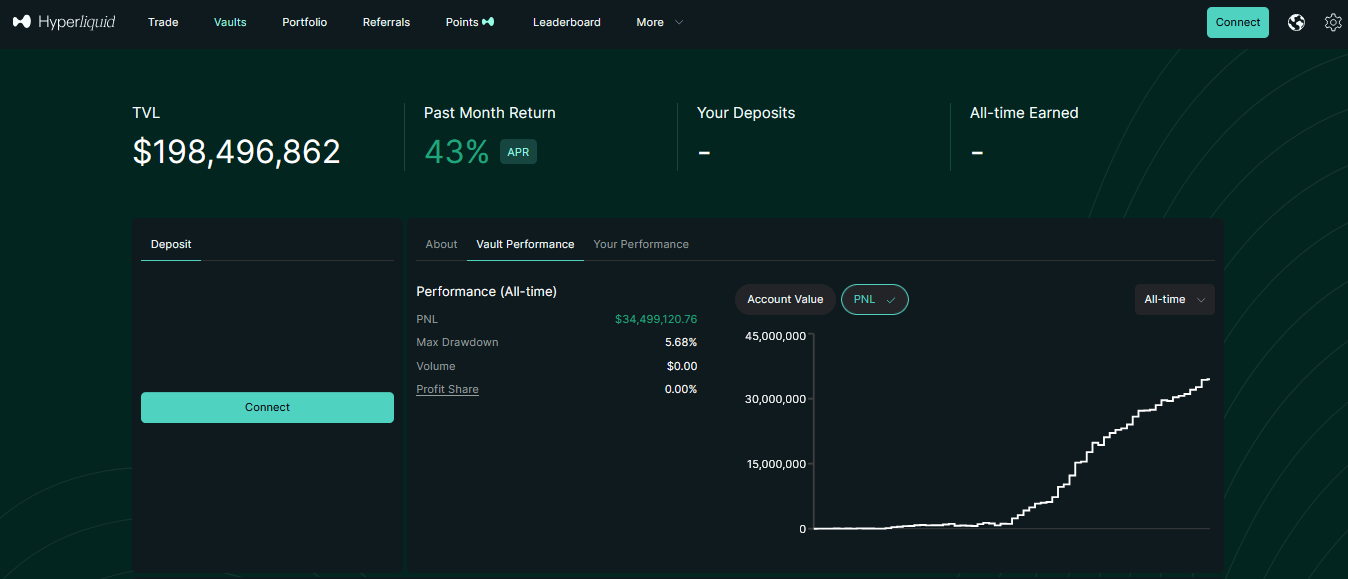

There is also the Hyperliquidity Provider (HLP) vault, which is a protocol vault that acts as a market maker and executions liquidations, receiving a portion of trading fees where users can deposit USDC and share in the profit and loss.

HLP doesn’t charge any fees and profits and losses are shared proportionally based on each depositor’s share of the vault. Since its inception, the vault has done phenomenally well, generating a profit and loss of $ 34 million with 5% drawdown.

Although it is still early days for Hyperliquid, it will be exciting to see how the project develops especially given the speed the team is executing.