Table of Contents

BlackRock and the Nasdaq are seeking to list options on the asset manager's Ethereum ETF according to a filing on Tuesday.

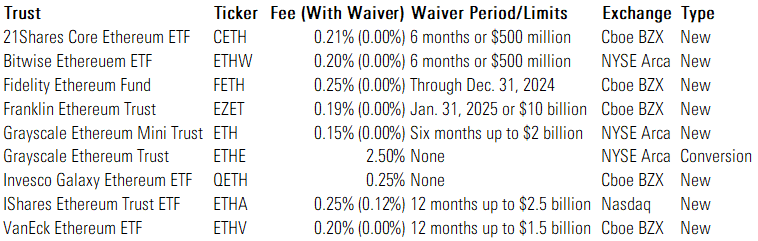

The rule change will only apply to BlackRock’s iShares Ethereum Trust (ETHA), which is the only ETH ETF listed on the Nasdaq. NYSE Acra and Cboe are being used to list the other ETH ETF products from the likes of Franklin Templeton, Bitwise, VanEck, Grayscale and more.

The US Securities and Exchange Commission (SEC) approved Ethereum ETFs to go live on exchanges in July but has not even authorized options trading on Bitcoin ETFs, which were listed in January.

ETH ETFs have attracted $1.5 billion in net inflows since their launch while BTC ETFs have a total market cap of $71 billion.

"The exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot ether," the filing said.

The SEC told six options exchanges in July that had requested to list options on BTC ETFs that it needed more time to reach a decision.

Options are financial derivatives used for hedging and speculating, giving the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame.

Amid the recent market crash, Bitcoin ETFs have seen their trading volumes surge, reaching $5 billion in daily trading volume, the highest level since April. However, Eric Balchunas, senior ETF analyst at Bloomberg, explained that high trading volume in a market downturn is a "pretty reliable measure of fear."

"If you bitcoin bull you actually DONT want to see crazy volume today as ETF volume on bad days is a pretty reliable measure of fear [sic]," he said. "Deep liquidity on bad days is part of what traders and institutions love about ETFs, so you also want to see volume too, good for the long term."