US Ethereum ETFs (Finally) Approved to Launch Today

The day has finally come - Ethereum ETFs have been officially approved to start trading in the United States.

As of yesterday afternoon, the US Securities and Exchange Commission (SEC) has allowed registration forms from 21Shares, Bitwise, BlackRock, Fidelity, Franklin Templeton, VanEck and Invesco Galaxy, as well as Grayscale Ethereum Trust and the Grayscale Ethereum Mini Trust.

"The launch of the 21Shares Core Ethereum ETF (CETH) marks a significant milestone for 21Shares and for U.S. investors. Today's approval represents further proof that crypto as an asset class is here to stay," said Ophelia Snyder, co-founder and president of 21Shares, in an emailed statement.

Technically the Ethereum ETFs were approved by the SEC back in May but the firms still needed their registration statements to become effective before launching on exchanges.

The market has since been waiting anxiously for the actual launch, patiently waiting through rounds of delays. Initially expected to launch on 2 July, the fate of the Ethereum ETF launch was pushed back after the regulator returned the S-1 forms to prospective ETH ETF issuers.

Cynthia Lo Bessette, head of digital asset management at Fidelity, said the firm's ETH ETF will give investors exposure to Ethereum through "thoughtful index and product design supported by a dedicated operations and trading team and industry-leading security."

"This is exemplary of Fidelity's rich history and commitment to meeting the evolving needs of our customers," Lo Bessette added.

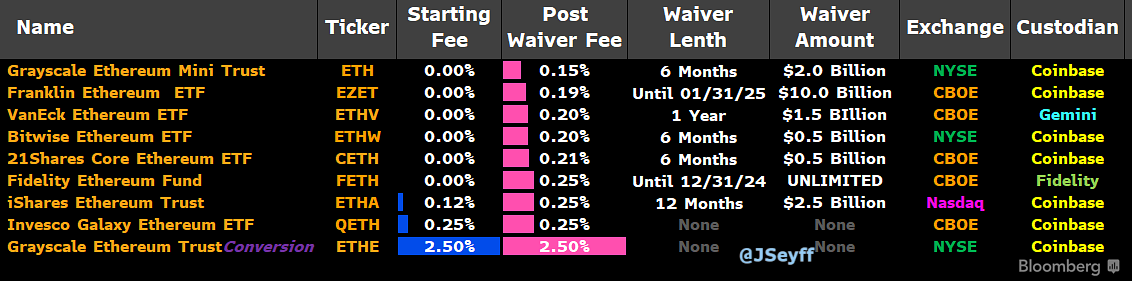

The launch of Ethereum ETFs comes six months after the launch of Bitcoin ETFs, which have attracted over $16 billion of inflows. Proposed fees for the ETH ETFs as as show in the table below, shared by Bloomberg analyst James Seyffart on X/Twitter. Grayscale has changed their fee waiver details to 0% for the first six months.