Japanese crypto and blockchain firms are petitioning the government to reform the tax on cryptocurrencies.

According to an official Japan Blockchain Association (JBA) statement, the companies claim that high tax rates on crypto profits are "hindering" the ability to save and invest.

JBA is thus calling on the government to use the same tax rate on crypto that currently applies to traditional assets such as stocks. Additionally, the body believes the current rules on crypto transactions are too complicated.

Under Japan's crypto tax law, citizens must file profits from digital assets in the 'other income" section on their tax forms, rather than enforcing a flat-rate capital gains tax.

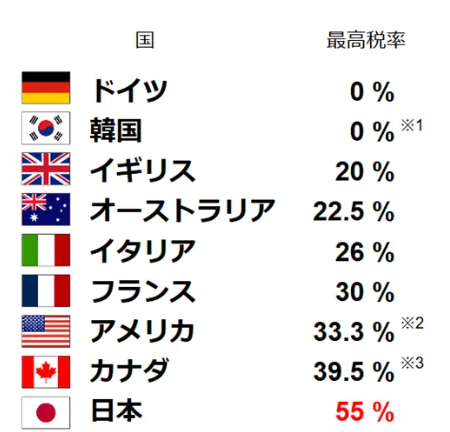

Individuals can result in paying up to 55% of tax on their crypto earnings. Japan's taxation system is a “reason why many investors avoid investing in cryptoassets,” JBA stated.

Instead, the JBA is calling for a flat rate of 20% tax on crypto profits and for the government to abolish tax on crypto-to-crypto transactions. Other demands include scrapping the inclusion of crypto in "other income" sections of tax declarations and permitting traders to carry forward losses for three years, enabling deductions from future crypto-related income.

The companies are requesting that the government make the changes ahead of FY 2025.

Among the companies are Japan's top blockchain firms and crypto companies including bitFlyer.

日本ブロックチェーン協会は、暗号資産に関する税制改正要望(2025年度)を政府へ提出しました。

— 日本ブロックチェーン協会/JBA(Japan Blockchain Association) (@J_Blockchain) July 19, 2024

web3が我が国の次世代を担う基幹産業として成長し世界をリードできるよう、喫緊の課題である暗号資産の税制改正を強く要望いたします。#JBAhttps://t.co/m7NY0hq6uT pic.twitter.com/KBoNRzeHDh

"We strongly request that tax reform of crypto assets, which is an urgent issue, be implemented so that web3 can grow into a core industry that will lead the next generation of Japan and lead the world," JBA said on X.

Yuzo Kano, head of JBA and the CEO of bitFlyer, also tweeted, "I believe that web3 will make a significant contribution to the medium- to long-term growth of the Japanese economy and enable Japan to gain international industrial competitiveness."

"Now that the whole world is paying attention and major movements are taking place in various countries, we cannot afford to fall behind. Tax reform of crypto assets is an urgent issue. Let's raise our voices together to make it happen.""

日本ブロックチェーン協会は、2025年度の暗号資産に関する税制改正要望書を政府に提出しました。

— 加納裕三@bitFlyer (@YuzoKano) July 19, 2024

私は、web3が日本経済の中長期的な成長に大きく貢献し、日本が国際的な産業競争力を獲得できると信じています。

世界中が注目し各国で大きな動きが出ている今、ここで遅れを取るわけにはいきません❗️… https://t.co/Fc1TpsMdjD

Last year, the JBA and other groups successfully pushed Tokyo to reform crypto tax laws for companies, which resulted in companies no longer having to pay taxes on their unrealized crypto holdings.

According to a recent report by Nomura, more than half of investment managers in Japan are keen to diversify their portfolios with crypto.