Table of Contents

Within a span of just over a week, someone tried to take out former President Donald Trump, a new Republican vice president was announced, President Joe Biden caught COVID, and now, current VP Kamala Harris might soon be the leader of the free world.

In the latest episode of US Politics 2024, Biden has removed himself from the presidential race - a move we were expecting but also not expecting.

But throughout this tumultuous and nail-biting season of US politics, the crypto markets have behaved relatively calmly. On Monday, as markets responded to the prospect of a matchup between pro-crypto Trump and VP Harris, the largest digital asset rebounded from initial losses to hover around $68,000.

The weekend trade is being considered differently after Bitcoin's price rose above $67,000 on Friday for the first time in almost a month.

This reignited hopes that digital assets may benefit from a second Trump presidency and prompted speculation that the largest cryptocurrency may soon make another run at new highs.

Bitcoin hit a life high of almost $74,000 in March but has since veered lower and traded largely in the $60k to $70k range.

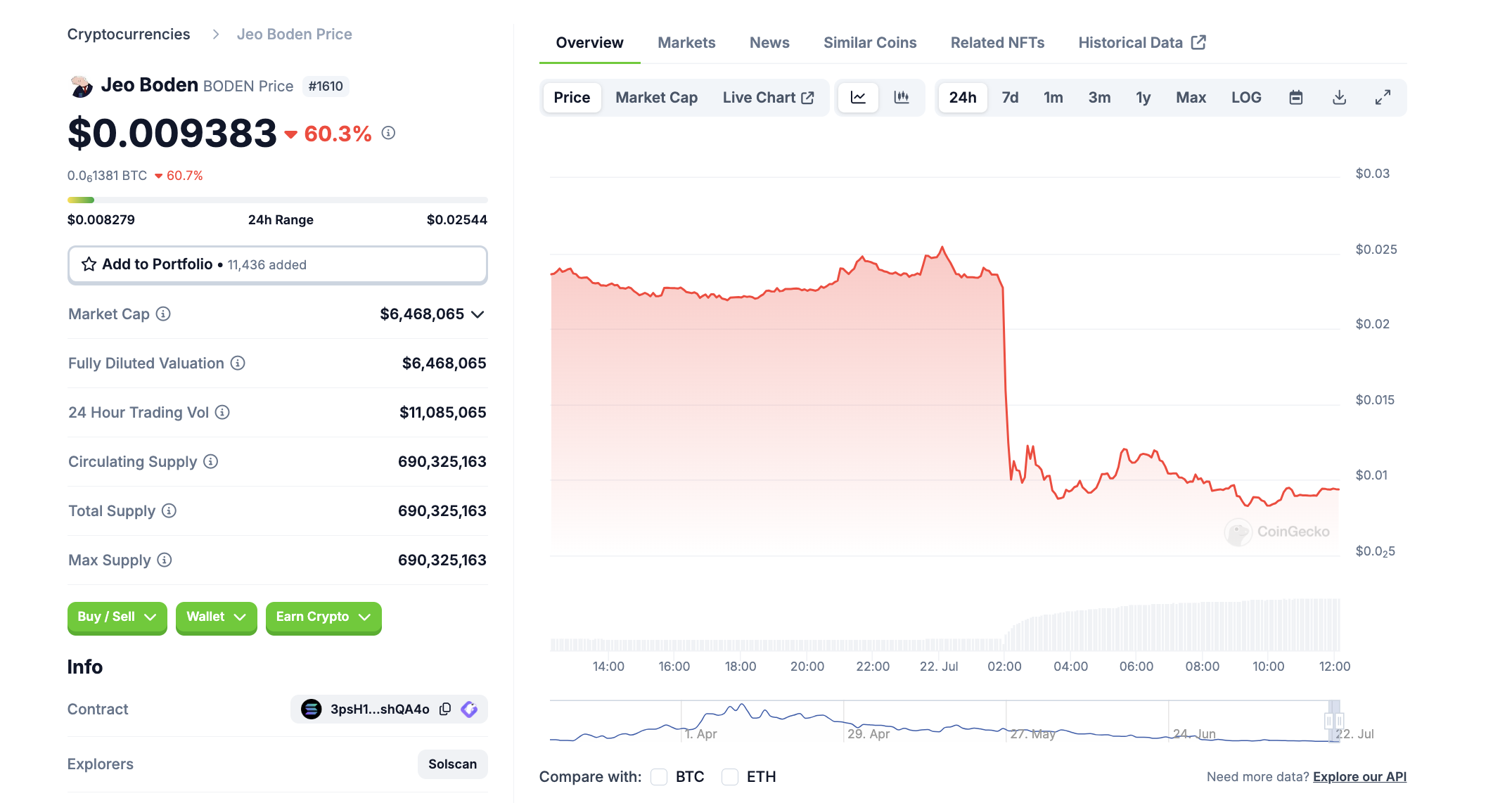

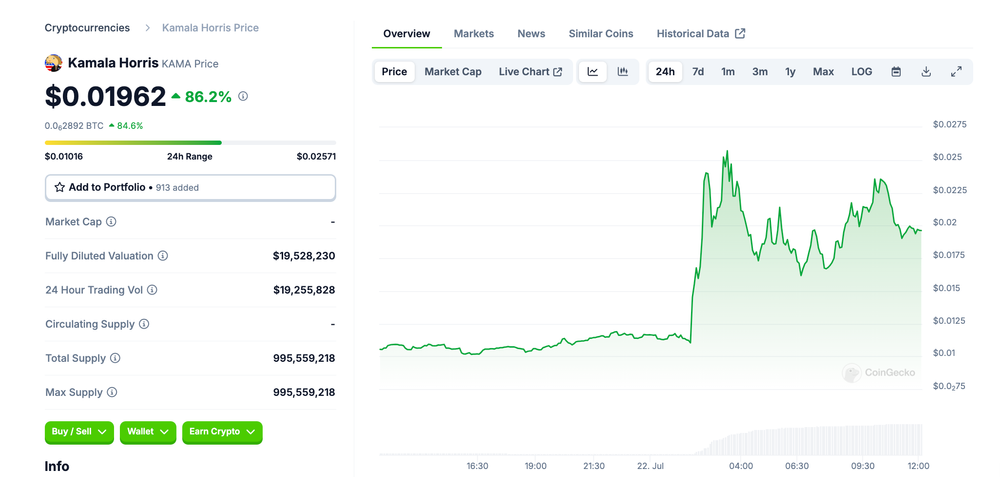

Of course, memecoins behaved as expected, with Jeo Boden (BODEN) crashing more than 60.3% and Kamala Horris (KAMA) surging 86.2% over the last 24 hours.

While Trump has made clear his interest in cryptos and has even called himself a "crypto president," very little is known about Harris's attitude but we should be getting more clarity in the coming weeks.

It's Not Just Presidential Influences

Politically and economically, the job of the US president is certainly an influential one. However, there are other factors at play that influence markets.

On Friday, the majority of the S&P 500's component stocks fell, leading to the index's worst week since April. However, cryptos rallied even as other risk assets plunged.

This has eroded the recent correlation between cryptos and other related-risk assets even before the weekend's political drama in the US.

Institutional investors are showing signs of growing bullishness as the interest in December 2024 calls with a $100,000 strike price rises again.

The rate cut macro'nomics' is also boosting cryptos' appeal.

The latest comments from Federal Reserve policymakers suggest an easing pivot as early as September, driving bets in favour of cryptos.

The listing of more new coins on major digital-asset exchanges in the first half of this year compared to 2023 is another indication that crypto is back in popularity.

More Crypto Attracts More Crypto

According to a study of select exchanges by CCData, currency listings on higher-volume exchanges like Binance and Bybit increased by 11.6% to 2,066 in the first half of the year.

The study discovered that listings had increased by roughly 32% to 488 on several exchanges, including CoinJar and BTC Markets.

Centralized exchanges, like Binance and Coinbase Global, keep track of customer assets.

Uniswap and other decentralized exchanges let users keep ownership of their assets, and the statistic doesn't account for the flood of meme coins based on internet memes or trends.

This year's boom in crypto values, spearheaded by market leader Bitcoin's more than 50% gain, has driven the growth of listings on centralized exchanges.

The US, along with Hong Kong, Australia, and the UK, approved Bitcoin and Ether ETFs this year, adding to the expectations for more regulatory freedom.

BTC to $70K

With Ethereum ETFs set to go live tomorrow, excitement in the crypto industry is palpable. Despite its brief dip after Biden's announcement, Bitcoin seems to be on the trajectory to hit $70K.

As BRN analyst, Valentin Fournier, explains, "With significant macroeconomic indicators such as the US GDP and PCE set to be released this week, we anticipate high market volatility in the coming days. These figures are likely to confirm imminent rate cuts, potentially fueling the current rally."

Over the weekend, #Biden dropped out of the presidential race, introducing uncertainty as the Democratic nominee has not yet been chosen. Kamala Harris, who was endorsed by Biden, has not taken a stance on #cryptocurrency.

— BRN (@thebrn_co) July 22, 2024

Open thread 🧵 (1/6)

"Bitcoin's price continues to follow the sharp upward trend we highlighted last week. If this trend persists, Bitcoin could cross $70,000 tomorrow with the launch of Ethereum ETFs. Although a parabolic acceleration for Bitcoin seems unlikely at this time, positive ETF inflows could sustain the rally longer than previously expected."

"We anticipate Ethereum to drop to levels between $2,800 and $3,100 before bouncing back towards $4,000 by September," he said.

Elsewhere

Events

Coinfest Asia (Bali, 22-23 August)

Get ready to connect with 6,000+ people from 2,000+ companies at the largest Web3 festival in Asia. Get your tickets now with Blockhead's 10% discount code: CA24BLOCKHEAD

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!