Table of Contents

Grayscale's Ethereum ETF fee has caused a stir in the market just days before the products are set to launch on exchanges in the US next week.

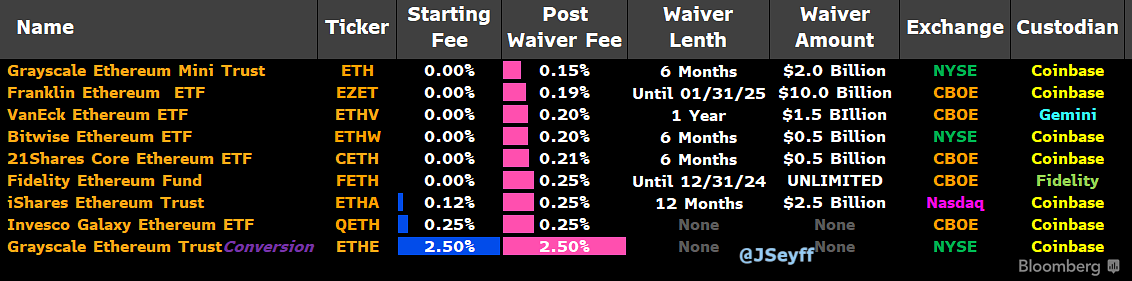

In a recent filing, Grayscale revealed that it plans to leave fees for its ETH ETF at 2.5% after converting its $10 billion Grayscale Ethereum Trust (ETHE). The figure is at least 10 times higher than those revealed by competitors.

Grayscale is also launching the Grayscale Ethereum Mini Trust (ETH), which will be seeded by 10% of ETHE’s assets after launch.

A 0.25% fee will be charged, with an initial fee of 0.12% for the first 12 months or until the fund reaches $2 billion.

BlackRock and Fidelity are only charging a 0.25% sponsor fee on funds. BlackRock will impose a fee of 0.12% for the first $2.5 billion or 12 months while Fidelity will waive the entire sponsor fee until year-end.

Meanwhile, Bitwise and 21Shares will charge a fee of 0.20% and 0.21% respectively, both of which will be waived for the first six months or until AUM hits $500 million.

VanEck is also charging a 0.21% fee with a 12-month waiver period or until $1.5 billion in assets is hit. Franklin Templeton is charging a 0.19% fee, waived until the first $10 billion in assets on 31 January 2025. Invesco Galaxy's 0.25% fee will not include a fee waiver, and Pro Shares has not yet disclosed its fee structure.

Grayscale, which holds the lead for having the biggest Bitcoin ETF fund, with AUM of $24.33 billion, has now come under fire from the market for its ETH ETF fees.

"Grayscale not lowering at all. This means they 10x higher than competition. Wow. Prob cause some outrage outflows. My guess is the mini me ETF will be dirt cheap tho, like maybe 15bps. Interesting dynamic at play," said Bloomberg ETF analyst Eric Balchunas.

Grayscale not lowering at all. This means they 10x higher than competition. Wow. Prob cause some outrage outflows. My guess is the mini me ETF will be dirt cheap tho, like maybe 15bps. Interesting dynamic at play. https://t.co/ou87O1wriw

— Eric Balchunas (@EricBalchunas) July 17, 2024

Scott Johnsson, a general partner at Van Buren Capital, questioned Grayscale's strategy, stating, "I'm not sure what Grayscale's strategy is here. Feels like they started with the right idea, then it got botched somewhere along the way. Investors selling ETHE are probably not going to be charitable with your mid-price mini option after you stick them with a 10x fee and force them to realize gains. Even the waiver is like wtf."

I'm not sure what Grayscale's strategy is here. Feels like they started with the right idea, then it got botched somewhere along the way. Investors selling ETHE are probably not going to be charitable with your mid-price mini option after you stick them with a 10x fee and force…

— Scott Johnsson (@SGJohnsson) July 17, 2024

Adam Morgan McCarthy, an analyst at crypto data firm Kaiko Research, highlighted that the fund is charging but does not even feature staking.

“There’s one massive idiosyncratic factor with Ethereum that will affect demand and that’s staking,” he said. “The value proposition for a crypto-native fund holding ETHE is hard to see when these funds can redeem shares and buy Ether to stake in return for yields — as opposed to paying high fees to stick around in Grayscale’s fund. Even paying 0.2% without the staking element seems like a nonstarter to me.”