Table of Contents

Worldcoin (WLD) is up 55% in the past 5 days. In comparison, BTC and ETH is up only 8.97% and 7.67% respectively. Trading volume also picked up significantly compared to average trading days.

Tools for Humanity (TFH), a key contributor to Worldcoin, has announced a delay extension of the unlock schedule for 80% of WLD tokens allocated to its investors and team members. Originally planned to begin unlocking on July 24, 2024, and conclude by July 2026, the new schedule extends this period to unlock tokens daily over four years, ending by July 2028.

Not That Unpredictable FDV

Worldcoin has once again drawn attention due to its striking Fully Diluted Valuation (FDV), which many find absurd. This controversy has intensified with allegations of insider trading coinciding with the extension of token unlock.

Worldcoin's announcement brought the market good news, but for some in the crypto industry, it's news that was already expected.

X user @DefiSquared saw the announcement coming. On May 2024, Defisquared posted a thread stating: "Worldcoin realistically might become the greatest transfer of wealth of this entire cycle. Unfortunately, this wealth transfer isn't in the form of universal basic income as their mission suggests, but instead to the pockets of the team and insiders. If you see strategically timed announcements between now and insider unlocks in July- it's sadly not a new play in this industry, but serves to ensure exit liquidity for insiders at eye-watering valuations."

Worldcoin realistically might become the greatest transfer of wealth of this entire cycle. Unfortunately, this wealth transfer isn't in the form of universal basic income as their mission suggests, but instead to the pockets of the team and insiders. I’ve posted a bit on it… pic.twitter.com/Gr83mnt3Ms

— DeFi^2 (@DefiSquared) May 13, 2024

Along with high levels of FDV, emissions from orb operators, which are often promptly sold based on blockchain data, also add to the devaluation of WLD.

The Worldcoin Foundation has also disclosed plans to sell an additional $200 million worth of tokens to trading firms, equivalent to 19% of the total circulating supply. This sale will execute private placements "at prices closely aligned with prevailing market prices for WLD".

In December, the Foundation terminated a market maker contract to elevate prices, achieving this by keeping a low float and maintaining a high Fully Diluted Valuation (FDV). This strategy enables insiders to profit from locked allocations at inflated values through methods like perpetual contracts (perps) and over-the-counter (OTC) trades prior to scheduled unlocks.

In addition, many retail investors may be unaware that Sam Altman is currently not actively involved in Worldcoin, and that the project is entirely independent and unrelated to OpenAI.

Insider Trading?

Although it's a minor adjustment to relieve selling pressure, the recent announcement has significantly influenced retail investors. This has unwittingly driven up prices and provided more liquidity for insiders to exit in the coming week.

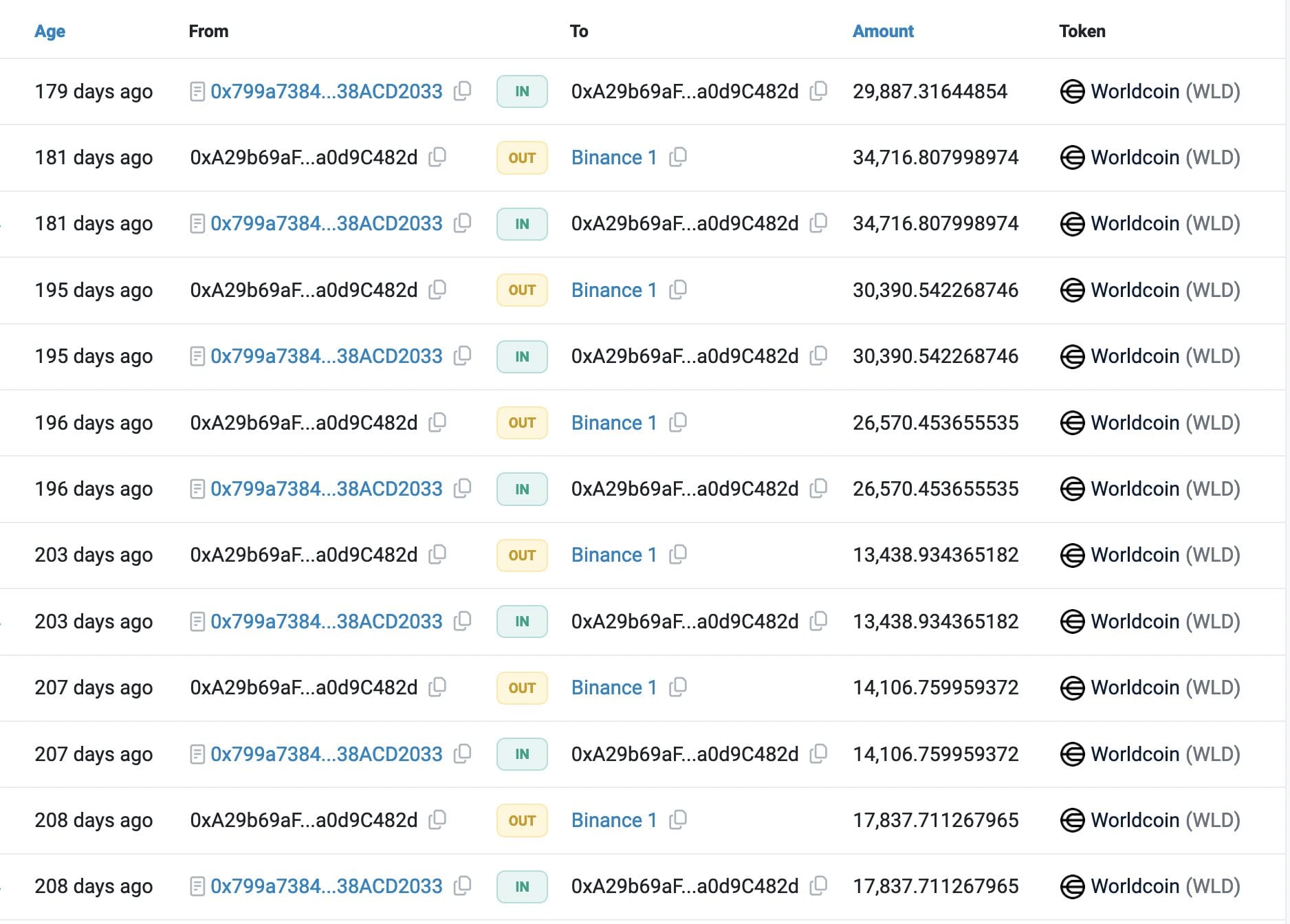

Moreover, there's a suspicion that individuals from the team engaged in insider trading. As DefiSquared explains, "It appears likely (but not proven) that someone from the team or VCs used insider information to frontrun buying the news before it was even publicly announced."

As more information reaches retail users, some critical questions need to be addressed to understand if this price surge has strong foundations.

— DeFi^2 (@DefiSquared) July 17, 2024