Table of Contents

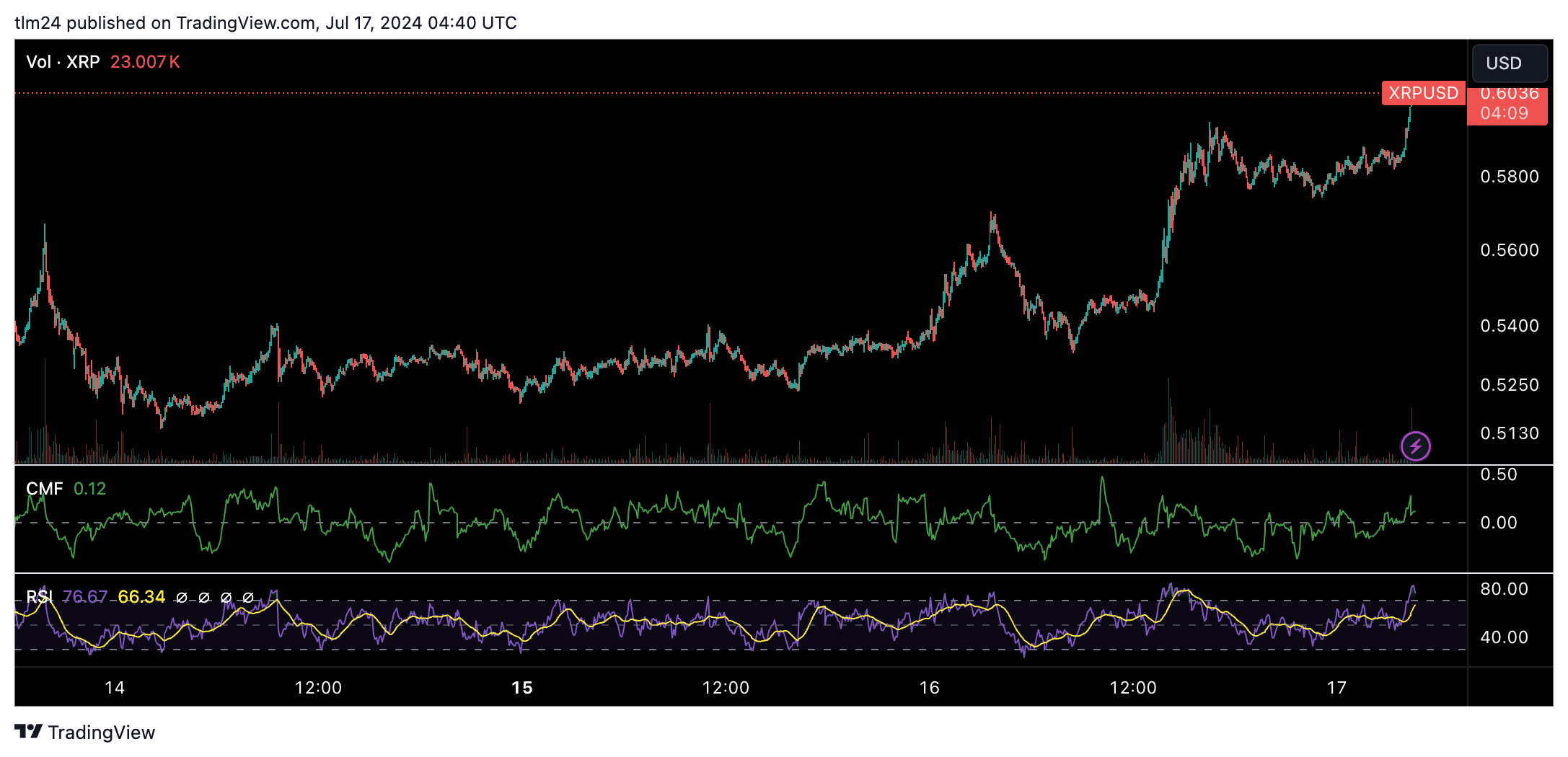

XRP, the token powering Ripple's international payments network, has defied the recent slump in the cryptocurrency market. Over the past week, XRP has surged over 30%, breaking past the $0.55 resistance zone and currently hovering around next resistance of $0.60.

This bullish momentum seems to be driven by a confluence of factors. From a technical standpoint, indicators are flashing positive signals. An upward trend line is forming on the hourly chart, and a potential close above the $0.60 resistance level could trigger further buying pressure.

Adding fuel to the fire are rumors of a potential XRP-based exchange-traded fund (ETF). The mere possibility of such an instrument has boosted investor sentiment. Further inflaming the speculation is the recent announcement by CME Group, a leading derivatives exchange, of new reference rates and real-time indices specifically for XRP.

Starting July 29, benefit from transparent pricing on two new cryptocurrencies as CME CF Internet Computer-Dollar and XRP-Dollar Reference Rates and Real-Time Indices are added to our expanding suite of benchmarks. https://t.co/1kn5BPZi4C pic.twitter.com/jqcJPInSt9

— CME Group (@CMEGroup) July 11, 2024

Beyond technicals and speculation, the XRP community remains a strong force. James Murphy, a prominent crypto advocate, has called upon the community, including the passionate "XRP army," to rally behind John Deaton, a pro-crypto candidate in the upcoming Massachusetts Senate race who aims to unseat Senator Elizabeth Warren. This highlights the community's commitment to influencing regulations in a crypto-friendly direction.

Ripple itself is taking a proactive approach on the regulatory front. Strategic contributions to pro-crypto political action committees (PACs) signal their intent to shape the regulatory landscape. Additionally, hopes are high for a potential settlement in the ongoing legal battle with the SEC. A favorable outcome for Ripple could significantly boost investor confidence in XRP.

Uncertainties linger

The SEC lawsuit remains a cloud hanging over XRP, and a negative outcome could dampen the current enthusiasm. Also, not everyone is convinced of XRP's future prospects. A March 2024 Forbes article titled "The Rise of Crypto's Billion-dollar Zombies" took a critical stance on Ripple. The article argued that Ripple has failed to achieve its initial goal of disrupting the dominant SWIFT system for international payments. The article pointed out that Ripple's blockchain processes transactions with minimal fees, but generates very little revenue itself, raising questions about its long-term sustainability. Additionally, the article highlighted the rise of stablecoins like Tether (USDT) as potentially more efficient solutions for international payments.

Ripple supporters counter these arguments by pointing to ongoing pilot programs with financial institutions. They argue that Ripple's technology offers advantages beyond just transaction fees, such as faster settlement times and increased transparency. Additionally, they believe that regulatory clarity, potentially aided by Ripple's political contributions, could pave the way for wider adoption of XRP.