Table of Contents

Singapore has labeled cryptocurrency as a "higher risk" in a new report related to money laundering.

In its Money Laundering National Risk Assessment report, the Monetary Authority of Singapore (MAS) highlighted increased risks in the digital assets sector, pointing to a rise in reported cases and token exploitation.

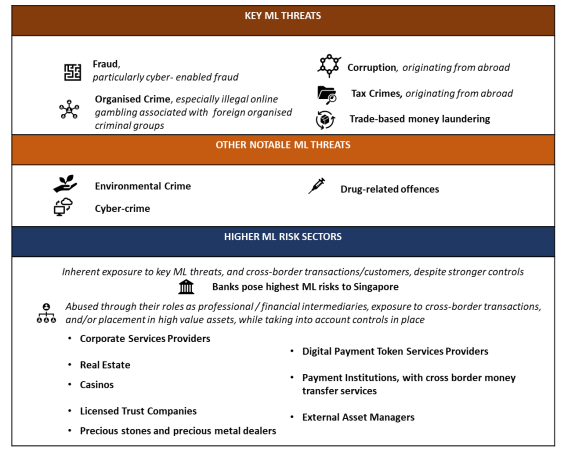

"The banking (including wealth management) sector is assessed to pose the highest money laundering (ML) risks, while among the designated non-financial businesses and professions sectors, corporate service providers pose higher ML risks," the report stated.

Digital payment token service providers, cross-border money transfer providers, as well as licensed trust companies, the real estate sector, and precious metals dealers were also highlighted as risks.

In one example, the report described how "love scams" deceived victims into sending funds to other "pass-through" accounts via a remittance service or wire transfer. A new method of scamming involves perpetrators instructing victims to purchase and transfer bitcoins directly to the perpetrators.

Another example involved victims being deceived into revealing their banking login details which were then used to create false accounts with digital payment service providers.

"Maintaining Singapore's reputation as a trusted hub is important for our continued dynamism as a business and financial center," said Thong Leng Yeng, executive director of the Anti-Money Laundering Department at the Monetary Authority of Singapore.

"It is therefore important for us to ensure that our anti-money laundering regime is robust and risk-focused."

An increased number of suspicious transaction reports involving digital tokens were filed in Singapore, according to the report, while an "upward trend in requests for assistance" was also recorded.

The report comes almost one year after Singapore's biggest money laundering bust in which S$3 billion was seized. Earlier this month, the last of 10 foreigners to be arrested in the bust was sentenced to 17 months in jail.

Originally from China, 36-year-old Vanuatu national Dubai property broker Su Jianfeng pleaded guilty to money laundering and forgery. 12 other charges including forgery, money laundering, and manpower-related offences for illegally hiring a persona chef, were also considered.

Su will forfeit S$178.9 million of his assets as part of his sentence, including S$26.5 million in cryptocurrency. Other assets Su will forfeit include S$2.4 million worth of 49 luxury bags, S$1.1 million in jewelry, and S$63.9 million across 12 properties.