Table of Contents

As the SEC greenlights the first Ethereum spot ETFs, a familiar battleground is emerging: the fee war. Just like with the launch of Bitcoin spot ETFs in January, issuers are vying for market share by offering the lowest possible fees.

Franklin Templeton ignited the Ethereum ETF fee war by disclosing a 0.19% annual sponsor fee in its amended S-1 filing. The firm will also waive fees for the first $10 billion in assets for the first six months.

While this is the first public declaration, other issuers like VanEck and Invesco Galaxy are expected to follow suit.

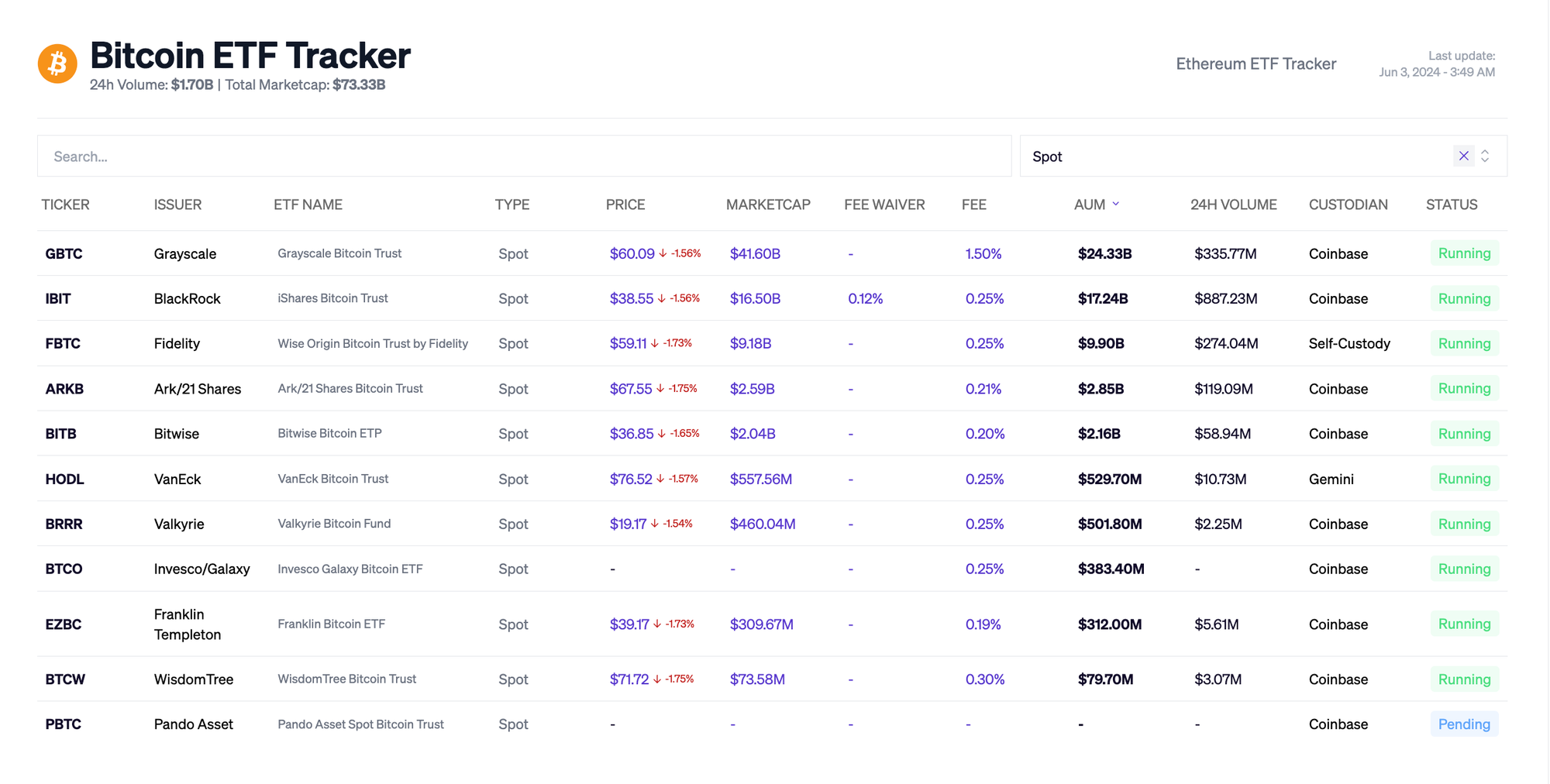

This scenario mirrors the intense competition seen during the Bitcoin spot ETF launch. Issuers like Bitwise and Valkyrie waived fees altogether for the first six months or initial inflows, while others like Grayscale and ProShares quickly adjusted their fees downwards. VanEck also temporarily removed its management fee for its Bitcoin ETF, HODL, from 12 March 2024 until 31 March 2025, for the first $1.5 billion of the trust's assets.

Beyond the Fee

The Ethereum ETF fee war presents an opportunity for investors to access the world's second-largest cryptocurrency through a regulated and familiar investment vehicle. However, it's crucial to look beyond the headline fee and consider the broader context when making investment decisions.

While fees are undoubtedly a significant factor, the race for Ethereum ETF dominance is likely to be more nuanced, and as if the spot Bitcoin ETF race is any indicator, the lowest fees don't always mean the highest inflows.

Established asset managers with a proven track record attract investors seeking stability and experience, as seen by the massive inflows into BlackRock's IBIT, even though its fees aren't the lowest.

In fact, IBIT has surpassed Grayscale's Bitcoin Trust (GBTC) to become the world's largest Bitcoin ETF, touching the $20 billion mark in a mere 137 days.

For industry participants, the fee war underscores the growing competition and innovation within the digital asset ETF landscape. It also highlights the need for issuers to differentiate themselves beyond fees and cater to the diverse needs of investors in this rapidly evolving market.