Table of Contents

Institutional demand for digital assets in Asia is continuing to grow, according to a new survey from SBI Digital Assets Holdings.

The subsidiary of Japanese asset manager SBI Holdings revealed that almost 60% of Asian institutional investors had gained crypto exposure last year; 40% of those are looking to grow their exposure.

An additional 25% intend to significantly increase their investment volume in the sector. 60% of respondents also saw an increase in exposure to digital assets over the past year.

“This trend indicates the growing recognition of digital assets in diversifying investment portfolios,” the report said.

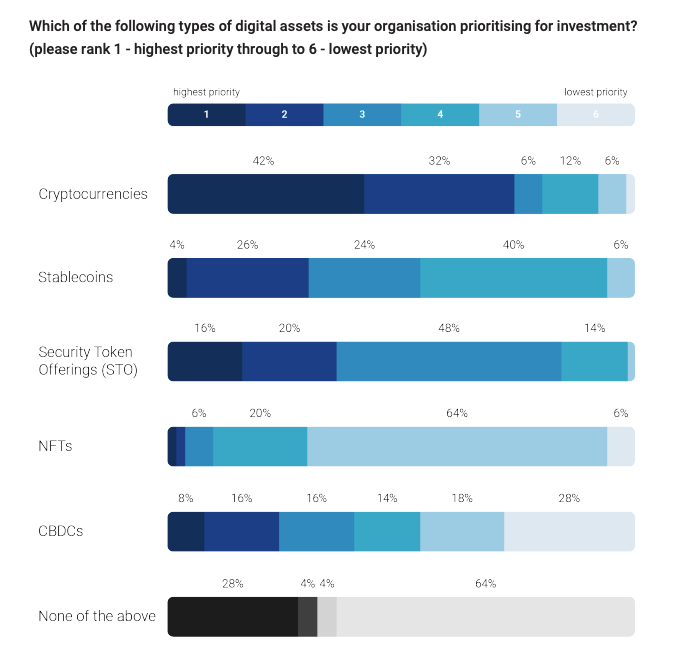

Looking ahead, 33% believe CBDCs will see the biggest adoption over the next three years. 23.5% think cryptocurrencies will take the crown while 21.6% predict tokenized securities will draw the most attention. 62% of institutions reported that their clients have expressed interest in tokenized securities.

"The call for institutional-grade market infrastructure should not be seen as a barrier, but rather an opportunity for collaboration and innovation," said Winston Quek, Head of Capital Markets Centre of Excellence, SBI DAH and CEO, SBI Digital Markets.

"The need for trust presents opportunities for us to create strategic solutions, working with regulators and industry players so that institutions can capitalise on the benefits that blockchain can offer. We believe that a trusted ecosystem, with access to a broader network, and compliant infrastructure will increase institutional adoption."

Last week, Morgan Stanley revealed holdings in Bitcoin ETFs amounting to over $270 million. The American multinational investment bank disclosed its exposure in recent filings with the SEC in Grayscale Bitcoin Trust (GBTC) and ARK 21Shares Bitcoin ETF (ARKB).

Other institutional giants investing in Bitcoin ETFs over recent weeks include Millennium Management which injected $2 billion in multiple Bitcoin ETFs. Bracebridge Capital also reported owning $262 million of ARKB and took the crown of the largest holder of Blackrock’s IBIT with an investment of $81 million.