Table of Contents

Like its folklore namesake, Robinhood has found itself on the wrong side of the law. Perhaps drawing too much outlaw inspiration, Robinhood has been cast by the SEC as yet another crypto-service platform that violates securities laws.

"On May 4, 2024, RHC (Robinhood Crypto) received a 'Wells Notice' from the Staff of the SEC (the 'Staff') stating that the Staff has advised RHC that it made a 'preliminary determination' to recommend that the SEC file an enforcement action against RHC alleging violations of Sections 15(a) and 17A of the Securities Exchange Act of 1934, as amended," Robinhood said in a filing on Monday.

Steal From Crypto, Give to the SEC

In a blog post, Dan Gallagher, chief legal, compliance and corporate affairs officer at Robinhood Markets, said the firm is "disappointed" by the regulator.

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business,” Gallagher said.

The Wells Notice is not a formal prosecution or regulatory enforcement document. It is an early warning that the SEC will take enforcement action against suspicious projects.

Nonetheless, Robinhood remains relatively unshaken and confident that it did not violate any laws. “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law,” Gallagher said in the blog post.

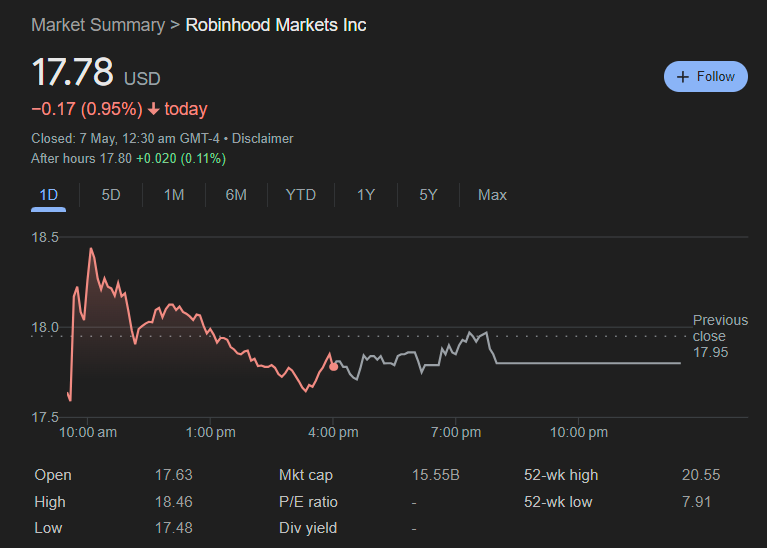

Its stock price seems unbothered too, rising 2% following a dip in the red following the Wells Notice news. The firm is set to announce its quarterly earnings on Wednesday.

Band of Crypto Merry Men

Robinhood isn't the first crypto-related firm to have received a Wells Notice from the SEC. Ripple, Coinbase, and most recently, Consensys and Uniswap have all been recipients of the infamous Wells Notice.

The SEC's insistence on throwing lawsuits at crypto companies has resulted in the industry banding together and fighting the regulator in a unified battle.

Coinbase CEO Brian Armstrong has long supported Ripple's plight with the SEC. "The Ripple case seems to be going better than expected. Meanwhile the SEC is realizing that attacking crypto is politically unpopular (because it harms consumers," he tweeted as the XRP-SEC case was unfolding.

The Ripple case seems to be going better than expected. Meanwhile the SEC is realizing that attacking crypto is politically unpopular (because it harms consumers). https://t.co/ePLnbqNLwU

— Brian Armstrong (@brian_armstrong) October 26, 2021

Ripple CEO Brad Garlinghouse has also backed Coinbase's corner too. “The judicial system continues to slap down the SEC because they’re overreaching, they’re overstepping what the laws say," Garlinghouse said in response to an SEC v Coinbase hearing.

"That’s a reason why they lost the case against Ripple. It’s the reason why they lost the case against Grayscale. It’s the reason why they were dragged kicking and screaming to have an ETF. Thus, you know, as I was quoted, I think Gary Gensler hasn’t been acting. He’s been acting on his own agenda, not the people’s agenda in the United States.”

Coinbase's chief legal officer, Paul Grewal, also supported Consensys's lawsuit against the SEC for its "unlawful seizure of authority” over Ethereum. "The SEC’s unlawful seizure of authority over ETH would spell disaster for the Ethereum network, and for Consensys," Consensys's suit claims.

On X, Grewal stated, "I know ETH is a commodity. You know ETH is a commodity. The CFTC knows ETH is a commodity. It's time for the SEC to admit that it still knows ETH is a commodity too. No more games. Thank you to @Consensys for standing up against the SEC's unlawful expansion of authority."

I know ETH is a commodity. You know ETH is a commodity. The CFTC knows ETH is a commodity. It's time for the SEC to admit that it still knows ETH is a commodity too. No more games. Thank you to @Consensys for standing up against the SEC's unlawful expansion of authority. https://t.co/8w7A4PBwUK

— paulgrewal.eth (@iampaulgrewal) April 25, 2024

When the SEC took aim at Uniswap, the firm pointed towards the regulator' battle with Coinbase as part of its defence. "Taking into account the SEC's ongoing lawsuits against Coinbase and others as well as their complete unwillingness to provide clarity or a path to registration to those operating lawfully within the U.S., we can only conclude that this is the latest political effort to target even the best actors building technology on blockchains," it stated.

Telling Regulators to Friar Tuck Off

The SEC might enjoy flexing its power in front of the crypto industry but fortunately, even Gensler and his merry men are still held accountable by higher powers.

Last month, two SEC lawyers were forced to resign after a federal judge slammed the regulator for its "gross abuse" of power in one of its cases.

In July, the SEC accused crypto platform Digital Licensing Inc AKA DEBT Box and its executives of defrauding investors of at least $49 million. Robert Shelby, the federal district court judge in Salt Lake City who is hearing the case, froze the company's assets and put the firm into receivership at the SEC's request.

However, Shelby has since discovered that the regulator may have made “materially false and misleading representations.” Shelby went on to sanction the regulator for “gross abuse of the power entrusted to it by Congress” and ordered the SEC to pay some of DEBT Box’s attorney’s fees. Michael Welsh and Joseph Watkins who served as lead attorneys on the case firmly encouraged to step down.

DEBT Box filed motions last week requesting $1.5 million in fees and other costs incurred in the case from the SEC, which dismissed their case without prejudice.

Ripple's Garlinghouse said on X that it "felt apropos that we file our response on the same day that 2 SEC lawyers “resign” for their (mis)conduct in the Debt Box case."

"The US will be picking up the pieces of the agency’s disastrous policies long after Gensler is gone," he said.

Feels apropos that we file our response on the same day that 2 SEC lawyers “resign” for their (mis)conduct in the Debt Box case…

— Brad Garlinghouse (@bgarlinghouse) April 23, 2024

The US will be picking up the pieces of the agency’s disastrous policies long after Gensler is gone. https://t.co/vQMHKG5kbW

Elsewhere