Table of Contents

Filecoin (FIL) made a bullish comeback from the $5.2 support level with buyers looking to reverse the trend of recent losses. Bulls maximized the buying strength at the support level, replicating the mini price rebound in mid-April.

If the buying pressure is sustained till the $6 price zone, it could provide viable long entries for buyers with a lot of upside in the short to medium term.

State of Filecoin

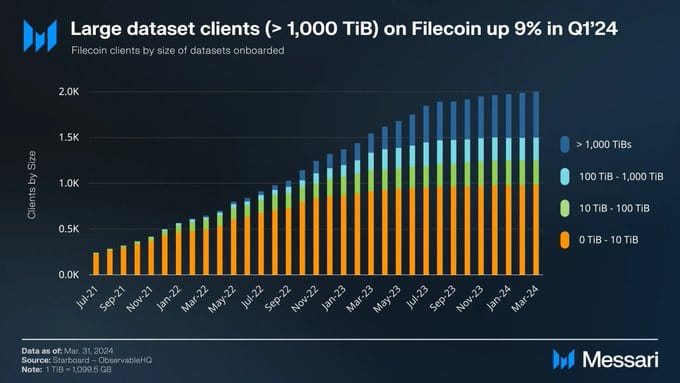

A recent report released by Messari on Filecoin’s Q1 2024 performance showed that the decentralized data storage marketplace was making significant strides across key metrics.

Its active on-chain deals recorded a 9% increase from Q4 2023. This reflected in Filecoin’s utilization moving from 18% in Q4 2023 to 23% in Q1 2024. Consequently, its Total Value Locked (TVL) on the Filecoin Virtual Machine (FVM) hit over $600 million, representing a 2x quarter-on-quarter increase.

This strengthened Filecoin’s position as one of the leading DePins for data storage solutions.

Indicators Present a Bullish Outlook

The Relative Strength Index (RSI) rose sharply from the oversold zone to within the edge of the neutral 50. This highlighted the influx of buys, as FIL rebounded strongly from the support level.

Similarly, the Moving Average Convergence Divergence hinted at a bullish crossover, although it wasn’t solid as of the time of writing.

With an entry level of $6, FIL could potentially yield returns of up to 28% at the $7.5 to $7.8 price zone in the short term.

However, a retest of the support level would invalidate the bullish move and could keep FIL stuck in the price range between $5.2 to $6.3.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.