Table of Contents

Over the past 48 hours, the crypto market has experienced a consolidation with the top cryptocurrencies going through a correction phase. This offers short-term profit opportunities for intraday traders.

One of such opportunities is Polygon's MATIC. The altcoin suffered a massive dip in mid-March, dropping from $1.28 to $0.94. While buyers have held the $0.94 floor over the past week, MATIC’s price action hasn’t been able to break past the selling resistance at $1.06.

This has kept MATIC in a compact range on the four-hour timeframe with $0.94 acting as the lower limit and $1.06 acting as the upper limit.

With the general market correction in progress, MATIC has dipped again to the $0.94 lower limit. This offers a short term trading window for buyers to maximize, riding the price action back up to $1.06, due to the strong buying pressure at $0.94.

The on-chart indicators shed more light on the trade opportunity. Even though the Relative Strength Index (RSI) fell sharply due to the selling pressure, it showed a quick uptick to hint at sufficient buying pressure around the $0.94 support.

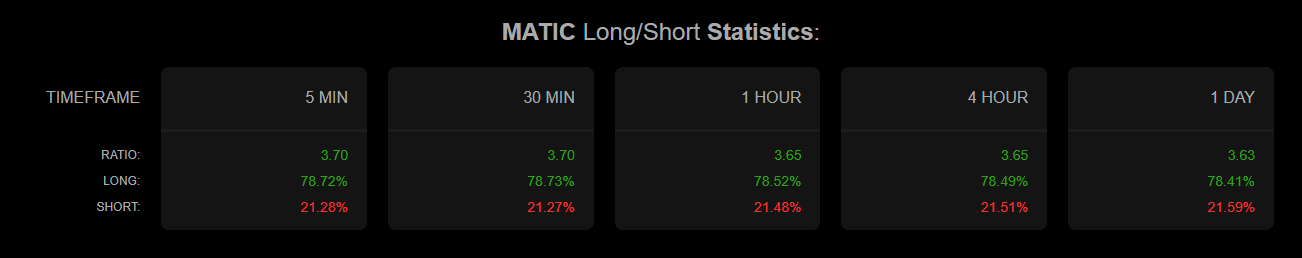

Furthermore, futures market data from Coinalyze showed that long positions were in the majority, highlighting market participant’s sentiment in MATIC making a strong recovery from the support level.

Combined, it added further evidence to the bullish outlook from $0.94. On the flip side, if the selling pressure persists, a four-hour candle close below $0.94 would invalidate the setup with stoploss advised at $0.85.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.