Table of Contents

The cryptocurrency market is experiencing a surge, and Binance Launchpool, a platform for project launches facilitated by the world's largest exchange, Binance, is a key player in this ecosystem. Launchpool allows users to stake their BNB tokens (Binance Coin) to receive early allocations of tokens from promising new projects.

Data from Coinmarketcap shows that Binance currently has a daily trading volume of $41 million with over $124 billion in assets. While Binance Launchpool has captured the attention of investors and traders, it has also served as a mechanism to drive demand for Binance Coin (BNB) while offering opportunities for users to participate in token offerings.

While Launchpool offers an attractive way for users to participate in token offerings, it's important to examine how it impacts BNB itself. Here are some key factors to consider:

- Demand Driver vs. Market Reflection: Does Launchpool truly create new demand for BNB, or does it simply reflect existing market enthusiasm for new projects, which in turn fuels BNB staking for access? The recent surge in BNB's price could be more a reflection of broader market sentiment than solely due to Launchpool activity.

- Limited Scope of Scarcity: Staking for Launchpool demonstrably reduces circulating supply of BNB in the short term. However, the overall impact on scarcity might be limited, especially as new BNB is constantly being created through issuance.

- Long-Term Lockup vs. Short-Term FOMO: Launchpool encourages long-term staking, but the lure of potential high returns from new tokens can also attract short-term investors driven by Fear Of Missing Out (FOMO). This can create volatility as these investors unlock their staked BNB to participate in new offerings.

Our previous coverage of BNB, on 5 March, when the token stood at around $400, predicted $500 within the month, if the $455 resistance level was crossed.

Beyond BNB Benefits

Despite these considerations, Launchpool offers several advantages beyond just boosting BNB:

- Accessibility for Retail Investors: Unlike traditional token offerings that often favor large investors or early adopters, Launchpool offers a more inclusive approach, allowing a wider audience of retail investors to participate.

- Vetting and Credibility: Binance leverages its network to identify promising projects, potentially offering users access to vetted opportunities. This due diligence process can enhance the overall credibility of the Binance ecosystem.

- Innovation Catalyst: By providing a platform for emerging projects to gain traction, Launchpool fosters a vibrant environment for innovation within the cryptocurrency space.

Ether.fi Launch

Binance recently announced Ether.fi as its 48th project on the Launchpool, with the appeal of Binance Launchpool lying in its accessibility and inclusivity. Unlike traditional token offerings that often favor large investors or early adopters, Launchpool opens the door for participation to a wider audience of retail investors.

By staking BNB, users not only contribute to the growth of the Binance ecosystem but also stand to benefit from the potential upside of newly launched tokens.

Moreover, the structure of Binance Launchpool encourages long-term engagement and commitment. Staking BNB locks up the assets for a predetermined period, fostering a sense of loyalty and dedication among participants. This mechanism not only stabilizes the BNB ecosystem but also instills confidence in investors, knowing that their contributions are instrumental in shaping the future of the platform.

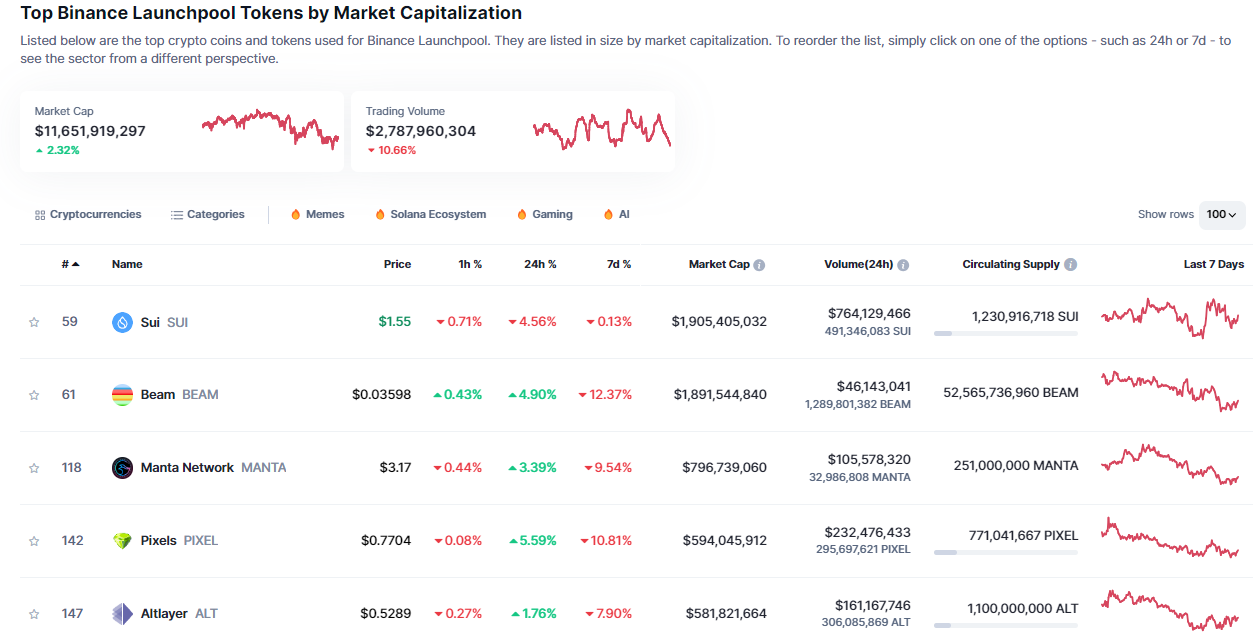

The success of Binance Launchpool is underscored by its track record of hosting high-quality projects with strong fundamentals. So far, 47 unique projects have been launched on the Binance Launchpool with a combined marketcap of $11.6 billion.

Outlook

With the bullish sentiment returning to the market and new projects launching, this has started to drive demand for BNB in anticipation of new launch pools. Over the past two weeks, BNB’s price has surged over 75%, rising from $349 to over $600.

A look at the technical indicators show that capital inflows were a key metric in the price surge with the Chaikin Money Flow (CMF) reaching +0.40. This highlighted the inflow of large purchases for BNB.

The future success of Binance Launchpool likely hinges on a delicate balance. It needs to maintain its appeal to new projects while ensuring the quality and legitimacy of those ventures. Additionally, striking a balance between short-term participation and long-term commitment from BNB stakers will be crucial for sustained growth.

If Launchpool can navigate these challenges, it can continue to be a cornerstone of the Binance ecosystem, driving user engagement and potentially propelling BNB to new heights. However, the extent to which Launchpool is the sole driver of BNB's success, or simply riding a broader market wave, remains to be seen.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.