Table of Contents

Speculation among traders that this year's rise to numerous milestones has been overdone drove stocks to tumble. The biggest drags were big tech firms, which had fuelled the recent rally.

Weakness in the most prominent category of the S&P 500 weighed on overall sentiment just as investors were trying to make sense of mixed employment data.

Nearly $4.5 billion was pulled out from tech funds last week, after a trillion-dollar rally in tech stocks, suggesting the market is clearly heating up.

Even as bond traders are pricing in a full 25 basis point (bps) rate cut in June, investors will look to Tuesday's US inflation data for the Fed's rate path cues.

Rate cuts are coming, but the pace and the depth are up for debate.

Market participants anticipate almost 1 per cent of Fed easing by year-end, as shown by the repricing of swap contracts that forecast the Fed's rate levels.

That is down from about 150 bps in early 2024 but slightly higher than the 75 bps late in February.

The see-sawing of rate cut bets points to uncertainty surrounding a US economy showing signs of strength and a disinflationary scenario setting in.

Investors waited for further information on whether the recent rise in consumer prices was a temporary glitch and a signal that the disinflationary trend had reached a dead end.

Warnings of impending consolidation in the absence of new catalysts have been prompted by the S&P 500's overheating, which hit 16 record-high closings this year.

Will the Fed's " higher for longer" narrative stick with more stick inflation readings?

Tuesday's inflation data should bring some clarity to the proceedings.

Dollar's Worst Sell-Off This Year Not Done Yet?

Despite the biggest sell-off this year for the dollar, Wall Street isn't prepared to pare its bets on further declines.

The dollar fell for six consecutive sessions, marking the longest losing streak in five months. With a 1.1% dip to start the week, the gauge is ready to extend its worst fall of the year.

Even as the European Central Bank and the Bank of England have softened their inflation rhetoric more than the US Fed, the dollar finds itself on the sell list of investors.

The so-called monetary policy deviation game is clearly out of the window.

Despite a better-than-expected February nonfarm payrolls figure, the dollar continued its falls on Friday.

Unemployment rose to 3.9% and previous data adjustments were downward, giving dollar bears plenty to gnaw on.

On the other hand, the British pound is performing better than over 90% of major global currencies, reflecting a better growth prospect for the island nation.

In 2024, out of more than 140 global foreign exchange rates, just eleven currencies have done better than sterling.

Among them are smaller and less liquid ones like Sri Lankan, Kenyan, and Zambian currencies.

Yen Stands Tall But Weighs on Other Japanese Assets

Rising expectations that the Bank of Japan will increase interest rates pushed the yen higher and damaged exporters, sending Japanese stocks down to their worst level since October 4. The two indexes fell more than 2%.

Speculation that the Bank of Japan is contemplating abandoning its yield curve management programme.

A growing number of policymakers are inclined towards eliminating negative rates in anticipation of higher wage rises this year have both contributed to the expectation that the BOJ would make policy adjustments at its meeting on March 18-19.

On Monday, data showed that the economy narrowly escaped a recession at year's end, adding weight to the argument that the BOJ should hike rates for the first time since 2007.

Monday saw the yen's fourth consecutive day of gains as it moved up against the dollar, reaching 146.98.

After recovering its 1989 peak early this year, the Nikkei finally broke beyond the crucial 40,000 threshold not long ago. The cheap yen and rising shareholder returns have attracted foreign investors to Japan's largest corporations.

It appears the 145/$ level is the next target for the yen, and a breach there may lead to a rapid decline towards 140.

After a more than 2% drop in the Topix, investors will be keeping an eye on whether the BOJ decides to purchase exchange-traded funds.

While the index fell by a comparable amount in the early trading session in October, the last time the central bank bought ETFs was in the same month.

The BOJ will begin purchasing the funds if the benchmark gauge falls by a minimum of 2%, according to previous observations.

THE WEEK AHEAD

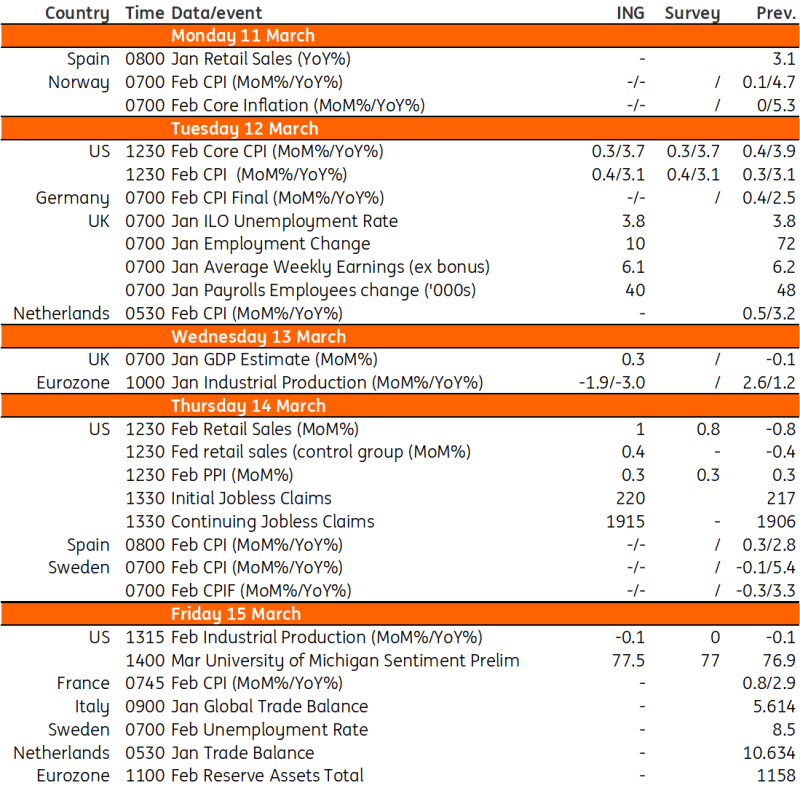

This week sees a flurry of US data releases, including CPI, retail sales, and industrial production - markets will look for cues from these data on the Fed's decision-making.

Over in the eurozone, surveys are likely to hint at weakness in industrial production data. In the UK, the Bank of England will be keeping a close eye on wage growth.

Macro Data Calendar

US: Inflation in Focus

Federal Reserve Chair Jerome Powell’s testimony to Congress was perhaps not quite as hawkish as feared in the wake of strong jobs, growth and inflation data. He certainly did not scare off markets and instead, Powell suggested that officials are "not far” from having the confidence to “dial back” on the restrictiveness of monetary policy.

This week’s data calendar includes CPI, retail sales and industrial production, but on balance, they are unlikely to be weak enough to trigger the Fed choosing to ease policy imminently.

Core inflation was far too hot for comfort last month, rising 0.4% month-on-month rather than the 0.2% or below that markets would want to see to before gaining any confidence that inflation is returning to 2% year-on-year.

With housing dynamics looking more unsettled and recent insurance and medical cost hikes still coming through, economists look for a 0.3% month-on-month increase, which remains too high for the Fed.

Meanwhile, retail sales should rebound after January’s weather-related weakness.

We already know car sales were firm in February, while higher gasoline prices should also be supportive.

However, the control group – which is more closely aligned with broader consumer spending trends by stripping out some of the more volatile items – is unlikely to remain strong.

Industrial production may post another monthly decline given the ISM manufacturing index has contracted for 16 consecutive months.

All in all, the Fed is increasingly inclined to move policy back to a more neutral level, but this week’s data won’t be enough to trigger a near-term move. Markets continue to favour June as the starting point for rate cuts.

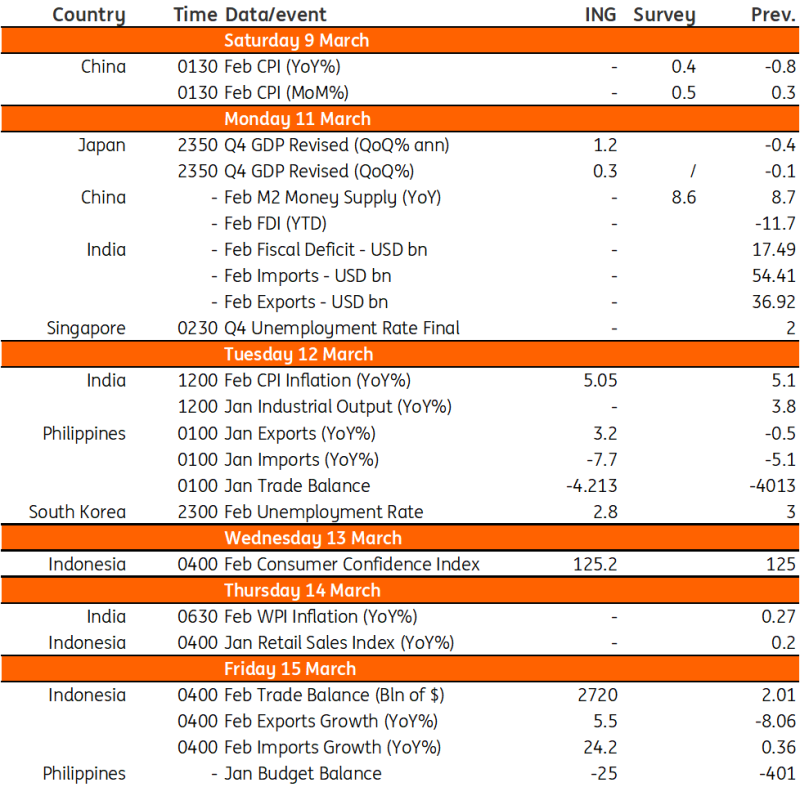

Asia Week Ahead

This week features China's decision on the medium-term lending facility. Meanwhile, regional economies release trade figures and India reports inflation.

Macro Data Calendar

Emerging Markets & Default Risks De-leveraging

Bonds that were about to collapse are now rallying as the possibility of government defaults in developing nations decreases. As a result, junk-rated sovereign debt is having its best start to a year since before the pandemic.

Gains that were expected to be fading have been prolonged by the possibility of a flood of investments in Egypt, a change in leadership in Pakistan, and a resurgence of political pressure for change in Argentina. Ten nations are currently exhibiting bond market crisis indicators, which is half the number compared to 2022.

Junk bond prices have been rising recently as many of the world's worst nations have made headway in their discussions with the International Monetary Fund and implemented free-market reforms.

That has reawakened a need for risk among investors, particularly as market participants assess when the Federal Reserve and other prominent central banks would ease interest rates.

Sub-Saharan Africa has had the steepest drop in risk premiums, with a spread of 644 basis points compared to over 1,000 in May 2023.

The premium that investors seek for holding speculative-grade sovereign bonds as opposed to US Treasuries has dropped 56 basis points this year, due to the skyrocketing prices of junk bonds.

The corresponding rise in the credit spread between investment-grade bonds and US Treasuries is about 11 basis points. The credit spread between investment grade and junk bonds has now fallen to a two-year low, a touch over 500 basis points.

Some of the sovereigns that investors were apprehensive about not too long ago are now among the world's top gainers this year.