Table of Contents

Investors were listening to recent speeches by Federal Reserve speakers to get clues about how interest rates will change in the future. At the same time, the stock market went up because people were excited about technology companies again.

The S&P 500 set its fifteenth record of the year with a rise above 5,100 on Friday but paused near those highs on Monday.

Traders should have paid more attention to bad economic data because they thought the Fed might cut interest rates as early as June. Two-year US rates fell after Fed Governor Christopher Waller said he wanted the bank to hold more short-term Treasuries.

A measure of chipmakers went up more than 4%, which helped the tech-heavy Nasdaq 100 go up more than 1.5% last week. Nvidia led the way in megacap gains.

Almost every company in the S&P 500 had a great fourth-quarter earnings report. It was expected to grow by 1.2% before the season but grew by close to 8%.

Those beats made the financial volatility less severe.

Over the last two months, people who bet on when the Fed would start cutting rates have been putting off their wagers.

Fewer people expected monetary policy to ease at the beginning of the year, which didn't help markets. This happened just as earnings season was about to get going. Still, 76% of S&P firms reported good surprises, which is higher than the average of 74% over the last ten years.

Analysts are also struggling to keep up with a stock market rise that is already way above what they thought would happen when 2024 started.

This is because Wall Street experts needed to learn about the AI craze.

This year, the S&P 500 is up more than 7%. Last year, it rose by 24%, and ssevral Wall Street firms have already raised their expectations for the index. Four months in a row, the S&P 500 has gone up. At the end of February, it went up by 5%.

However, a BofA stock indicator that takes the average advice of Wall Street analysts on allocating equity moved closer to showing a "sell" signal than a "buy" signal last month.

This was the first time since April 2022 that it had done this. It's still not in the "sell" zone but in the "neutral" zone.

Bond yields fell to an all-time low after a big deal in futures for five-year Treasury notes at a price close to their face value.

The bulk of the action was followed by remarks by Fed Governor Waller to reduce the pace at which the bank removes Treasury assets from its balance sheet.

Rates will likely stay at their highest level in 22 years at the Fed's next meeting on March 19–20. The first-rate cut in the US is expected later this year.

Officials are closely monitoring the unexpected increase in consumer prices in January to see if it was an isolated incident or a barrier to achieving reduced inflation.

If robust economic growth causes the Fed to postpone its rate-cutting intentions, bond rates will soon return to 5%.

The world's financial markets are experiencing a period of extreme optimism even if the Fed, so to speak, is withholding the punch bowl.

For Sustained Dollar Losses, a Higher Bar?

March may not give conclusive answers on US inflation, the economy or when the Fed will cut, but it will tell us whether markets now require sharper US data declines to re-enter easing bets.

The dollar may still not have a clear path in March, but markets think that pressure to sell the USD will strengthen from the second quarter.

The market has completely factored in durable US inflation and activity statistics.

Investors are expecting three 25-basis point cuts by December since there is a more hawkish stance at the moment, and it is improbable that a rate cut will come before June.

This is leading to a strong dollar.

As we enter a new month, markets may still rely heavily on US data. However, February data, beginning with payrolls, will likely show some softness.

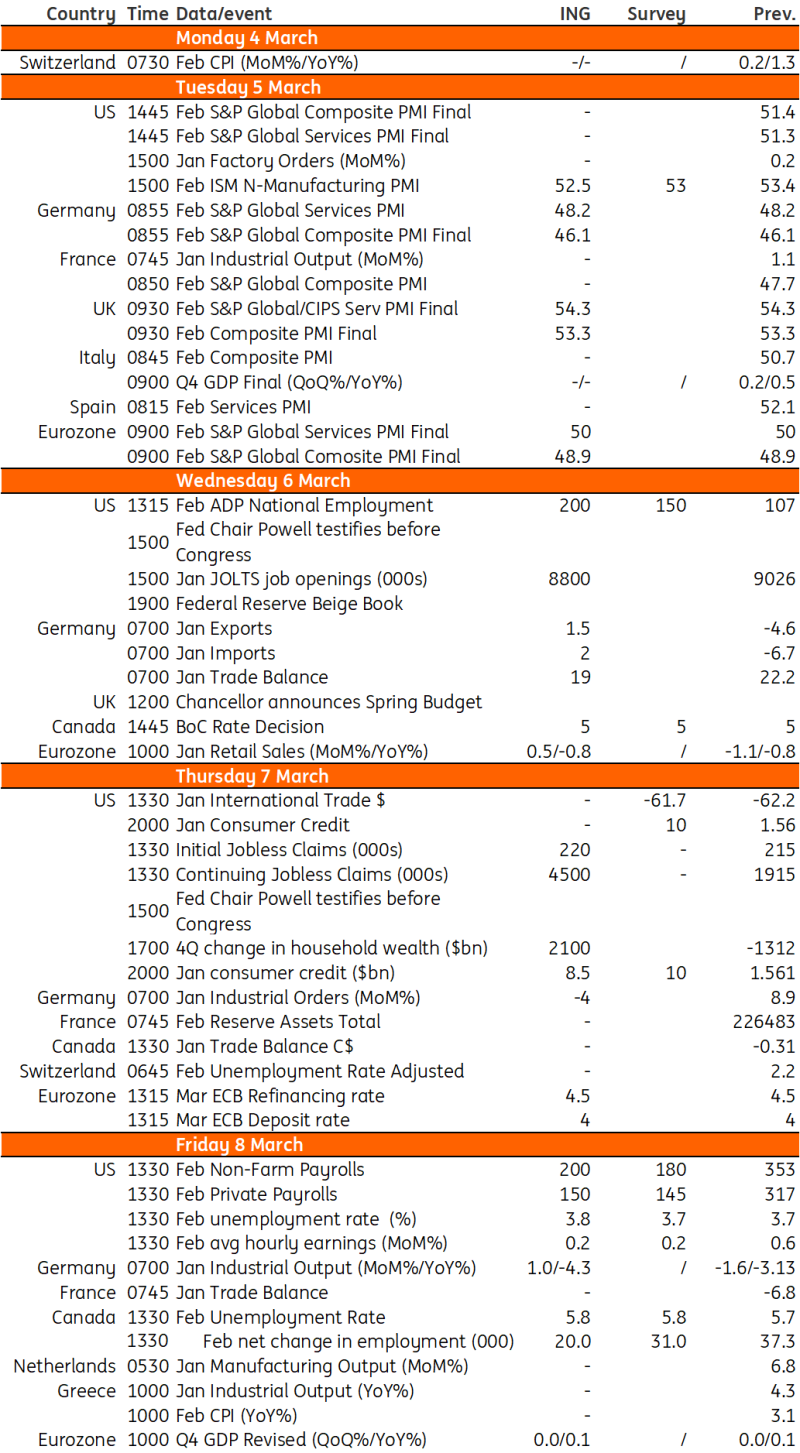

THE WEEK AHEAD

An important week in the US will see Fed Chair Jerome Powell testifying before Congress, as well as the release of February's jobs report following a blowout in January.

In the eurozone, markets expect a small uptick in February retail sales, while the scope for UK tax cuts looks limited ahead of the Spring Budget.

On the other hand, the Bank of Canada is expected to hold rates at 5%.

Macro Data Calendar

US: Fed Chair Jerome Powell's Capitol Hill Testimony

This week is big for markets because Federal Reserve Chair Jerome Powell will speak before Congress about the economy and monetary policy.

Like his most recent speech, he is ready to move monetary policy away from limiting and towards a more neutral position.

However, officials need to see evidence to support this action.

An interest rate cut will likely happen later because GDP growth is strong, the job market is still tight, and inflation is too high.

Regarding economic data, Friday's February job report will be the most important. This is because January's report showed a huge increase of 353,000 jobs, and November and December reports were revised upwards.

Investors will be able to get a better idea of what the numbers mean as the week goes on, and we will hear from the ISM and NFIB about what their members are going through.

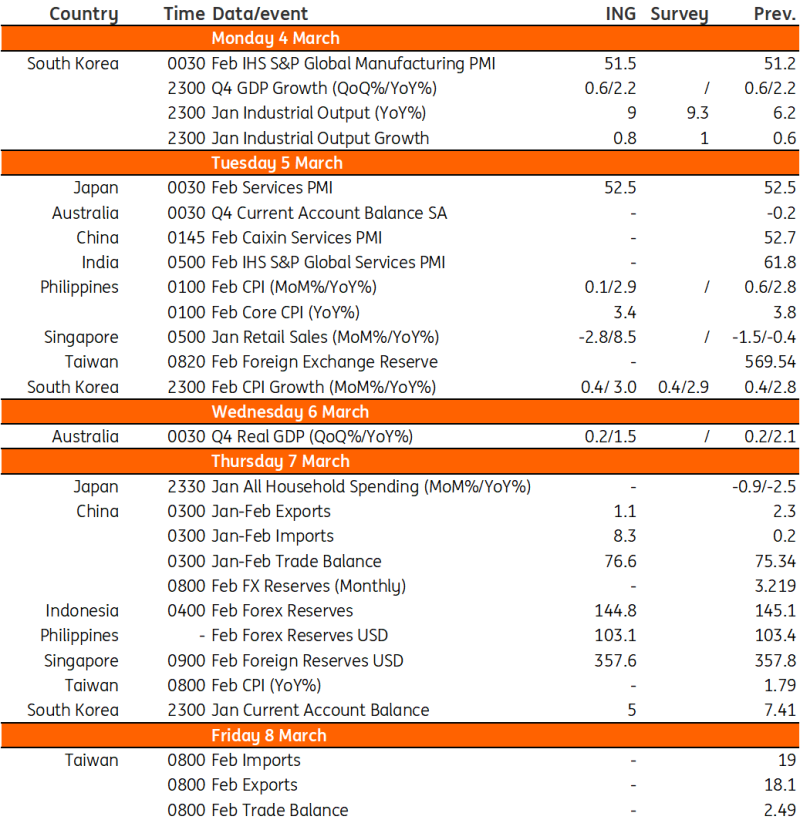

Asia Week Ahead

This week features China's Two Sessions meeting and GDP from Australia and South Korea.

China's decision to forego a press briefing at the Annual Legislative Meeting would make history. Li Qiang will be the first Chinese Premier to skip a press interaction after the meeting in 30 years, which will further fuel investor concerns about the government's lack of transparency.

Still, investors will watch for significant emphasis on this year's economic efforts to stabilise foreign investment.

Macro Data Calendar

China's Annual Legislative Meeting in Focus

The Chinese government will meet for its yearly Two Sessions. The most important thing to keep an eye on is the government work report on March 5.

This is when the yearly economic goals and policy direction for the year will be announced.

Markets think that the growth goal will stay at about 5% and that a fiscal deficit to GDP goal of around 3.5% will show that policy is more helpful.

Also, the markets will be very interested to see if the words "prudent monetary policy" and "proactive fiscal policy" that have been used for the past few years are changed in any way.

As for numbers, this week we will also get China's trade and inflation numbers.

From January to February, markets expect imports to grow quickly again, but exports to grow more slowly.

Also, inflation will likely rise in February. Data from a lot of different sources shows that food prices went up over the Lunar New Year break. This should help get CPI inflation back to positive levels.

But the cancellation of a press briefing after the annual meeting will only add to global concerns about China's slowing economy and add to economic data print suspicions further.