Table of Contents

It's been a fantastic week for the Web3 world, as your favourite crypto/digital asset media company announces its successful fundraising round. NVIDIA also had something to celebrate but let's be honest, its news was overshadowed by Blockhead's.

Bitcoin has been slightly down over the past five days whilst Ethereum is slightly up. Overall, a relatively sidewise trading week compared to last week.

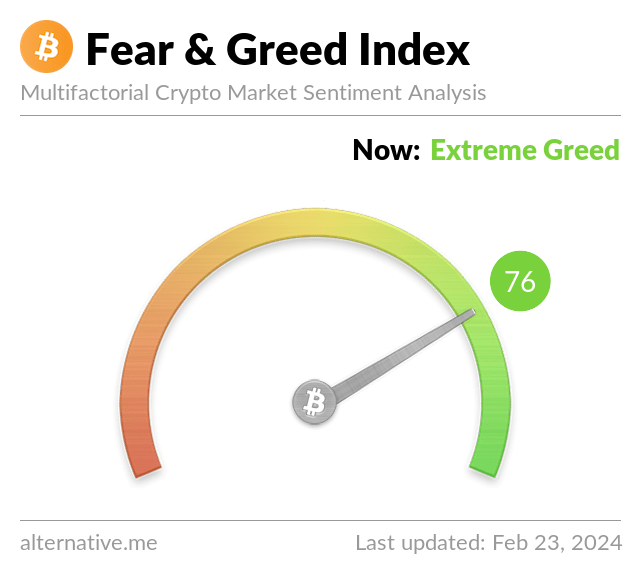

However, risk appetites on the Fear & Greed Index have entered "Extreme Greed" at 76, up from last week's 72.

The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Perhaps everyone just wants a piece of the Blockhead pie now.

Blockhead Secures Funding Led by Franklin Templeton

You probably know by now, and it's probably the only news you need to be aware of this week. (Please read on anyway).

Blockhead, a Singapore-based digital assets media publication, has announced the successful completion of its investment round. The investment is led by Franklin Templeton, (NYSE: BEN), one of the largest global asset managers with approximately US$1.5 trillion of assets under management.

The investment will also allow Blockhead to evolve its business model to become a leading digital assets research platform in the region. The research platform, dubbed BRN, augments their current media product offering and will serve as a comprehensive resource for institutional and high-net-worth investors, offering insights, analytics, and market intelligence on the digital assets and cryptocurrency landscape.

NVIDIA's AI Winning Streak is Good News for Web3

NVIDIA's stock price continues to soar through the stratosphere, fuelled by its prowess in the AI sector. But having once shunned crypto as not bringing "anything useful for society,” are there still lessons the Web3 can learn from the tech titan about AI's future?

In its most recent earnings call, held yesterday, NVIDIA reported a net income boost of 769% from last year to $12.29 billion and a total revenue boost of 265% to $22.10 billion, obliterating expectations of $20.62 billion.

Bitcoin ETF Hype Reaches New Heights

It's time to talk about Bitcoin ETFs again as trading volumes surge 1000%. We've been avoiding the elephant in the room for a while now. After a burst of spot Bitcoin ETF updates at the start of the year, we took a break from laboring about the "revolutionary" financial products. Not because we're too cool for school but because Bitcoin ETF news quickly became repetitive, dry, and let's be honest, predictable.

We're now revisiting the Bitcoin scene as there have been some new developments that we probably shouldn't overlook.

Hong Kong Sets New Standards for Digital Asset Custody

In a move to bolster the security and integrity of digital asset custodial services, Hong Kong's finance regulator issued a comprehensive circular on February 20, 2024, outlining new guidelines for authorized institutions (AIs) engaging in the custody of digital assets.

HKMA's said decision to introduce new guidelines stems from the recognition of the growing interest among AIs in providing custodial services for digital assets. As these services expand, the need to safeguard client assets against theft, fraud, and mismanagement becomes increasingly critical.

Ethereum Hype is More Than Just ETFs - Here's Why

By now, you should be more than familiar with the hype behind Ethereum ETFs. TradFi money, liquidity, Web2-Web3 bridge, wider adoption, you get the idea. Even former Bitcoin hater turned believer, Larry Fink, can "see value in having an Ethereum ETF."

But what about the Ethereum blockchain itself?

Why Asian Family Offices Are Aping Into Digital Assets

Family offices in Asia are ramping up their exposure to digital assets to diversify portfolios and boost returns.

Digital asset holdings account for under 0.5% of the assets under management (AUM) of family offices in the Asia-Pacific region but 9% of these offices without current crypto holdings intend to venture into this asset class.

Crypto venture capital, which is less liquid, saw a decrease in 2023, reaching a record low after dropping to one-third of VC investments in the previous year.

Cake DeFi Investor Settles Dispute With Hosp, Chua; "Regrets" Personal Remarks

A settlement has been reached between Bake's (formerly Cake DeFi) Julian Hosp and U-Zyn Chua, and early investors John Rost and Howard Fineman.

Rost said he "regrets" statements directed at Hosp, his wife, and Chua. Bake has been shrouded in drama over the last few months, and this uncertainty has resulted in the value of the DefiChain (DFI) token plunging; it's down 85% over the past year.

In December, Chua initiated the process to wind up the entire company. The application was heard before the High Court on Friday, 22 December 2023, one month after a layoff involving 30% of staff at the firm. Chua said that Hosp had kept him out of the loop and unilaterally carried out the cuts.

Events

Onchain 2024

Saison Capital, a Singapore-based venture capital firm and subsidiary of Saison International, has announced the inaugural launch of ONCHAIN 2024, marking Asia's first RWA conference.

Taking place on 26 April 2024, 9 am - 5 pm (ICT), in SO/Bangkok Hotel, Bangkok, Thailand, the event features an impressive lineup of speakers and attendees from TradFi institutions including Citibank, Standard Chartered, SCBx, Woori Bank, and SBI Holdings, as well as real-world asset (RWA) leaders including Helicap Group, Evertas, HELIX, D3 Labs, OpenEden and Rakkar Digital.

“The trend of tokenizing RWAs has gained momentum in 2023 despite depressed markets across traditional finance and crypto," said Qin En Looi, Partner at Saison Capital. "The launch of ONCHAIN 2024 aims to bring more partners into the conversation to shape the financial ecosystem of the future."

Early bird tickets, priced at S$99, are available now. But as the exclusive supporting partner for ONCHAIN 2024, we've got an exclusive 20% discount on tickets for the Blockhead family. Simply use the promo code 'blockhead' at checkout to unlock this special offer.

Money 20/20 Asia

Money20/20 Asia is making its way to Bangkok this April! Rub shoulders with 3000+ of the greatest minds in the money ecosystem, from crypto and Web3 to fintech, startups, investors, and beyond.

Expect game-changing connections and boundary-pushing content from this year’s edition - over 120 speakers from companies like Bitkub (Thailand’s largest crypto exchange), Asia Crypto Alliance and BitRock Capital are already on board to talk about the future of money in Asia.

Because we’re a media partner of the event, you can save up to USD$300 when you register using the code BHD300 by 23 February (yes, today's the last day you can use this code) at https://bit.ly/46jSw01.

Elsewhere