Table of Contents

After a mammoth airdrop this week that saw 728 million tokens distributed to 1.3 million addresses, the Starknet (STRK) token began trading at an ambitious $5, momentarily reaching a fully diluted value of $50 billion.

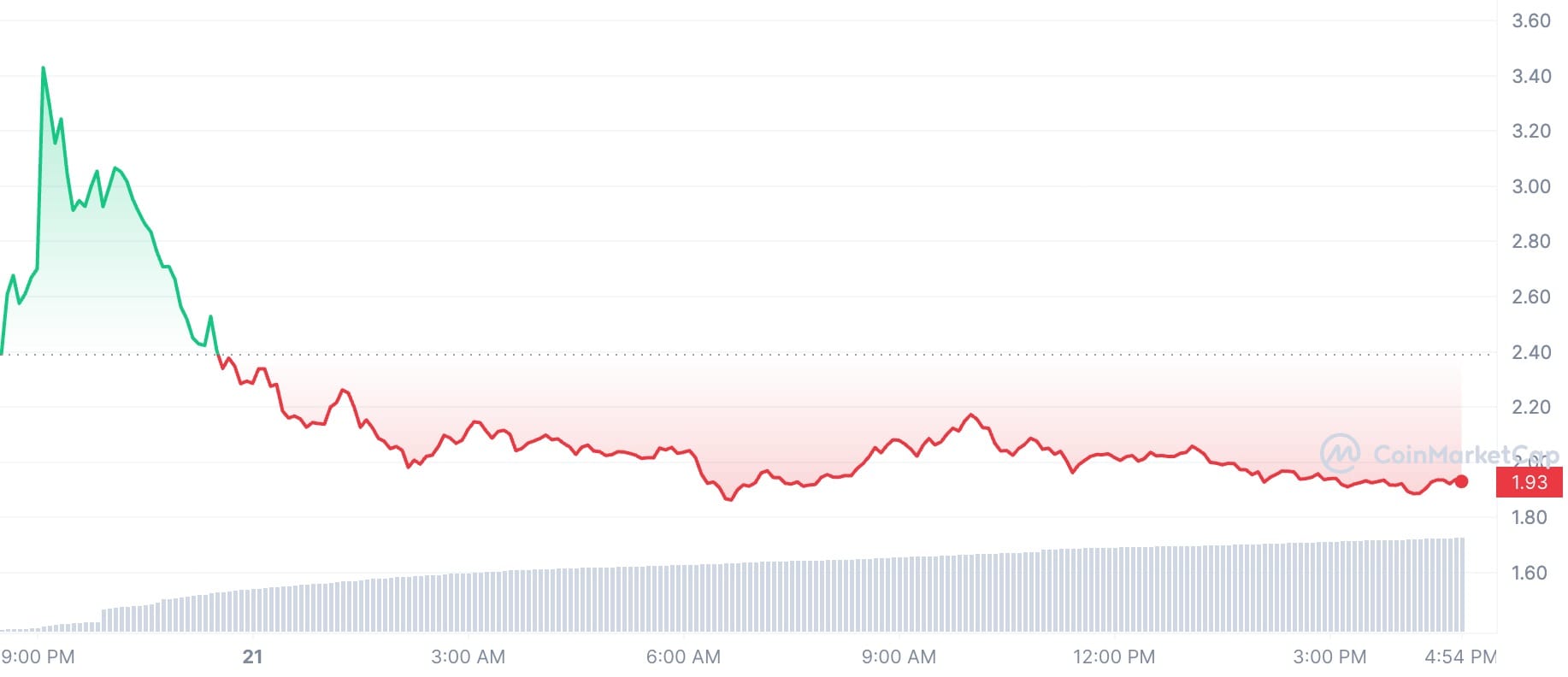

However, the initial euphoria was short-lived, as the token's price experienced a volatile opening, eventually slumping back to $3.50, and then further down to $1.94 amidst strong selling pressure. The token's FDV currently stands at around $19.5 billion.

Starknet is an Ethereum Layer-2 network that leverages a ZK-Rollup solution for scaling decentralized applications. For investors and spectators alike, Starknet's foray into the market has been nothing short of a whirlwind. The stark contrast between the token's initial valuation and its subsequent market performance serves as a vivid reminder of the unpredictable nature of cryptocurrency investments.

The initial market cap of $3.64 billion, while impressive, quickly adjusted to the realities of market dynamics and investor sentiment, settling at a more modest $1.4 billion. According to Coindesk, only $3 million worth of STRK futures were liquidated, suggesting most of the selling pressure was spot-driven.

The distribution strategy of Starknet, allocating over 50% of STRK’s supply to the Starknet Foundation for community airdrops, grants, and donations, was a bold move aimed at fostering a robust community around its Layer 2 solution. But not all users were satisfied, saying that the project's token distribution plan's focus on developers meant that their most valuable users weren't rewarded appropriately.

And this unhappiness was evident in the aftermath of the airdrop, which revealed a tendency among recipients to sell rather than stake their tokens, despite an enticing initial staking Annual Percentage Yield (APY) of 12%.

The integration of STRK into platforms like Binance, offering flexible products and futures, underscores the token's potential for broader adoption and utility within the crypto ecosystem. However, the immediate aftermath of the airdrop highlight the challenges projects face in balancing distribution strategies with market stability.