Table of Contents

Just when we thought regulators were softening up on the crypto scene, new demands from these government bodies in Hong Kong, the US and South Korea are suggesting otherwise.

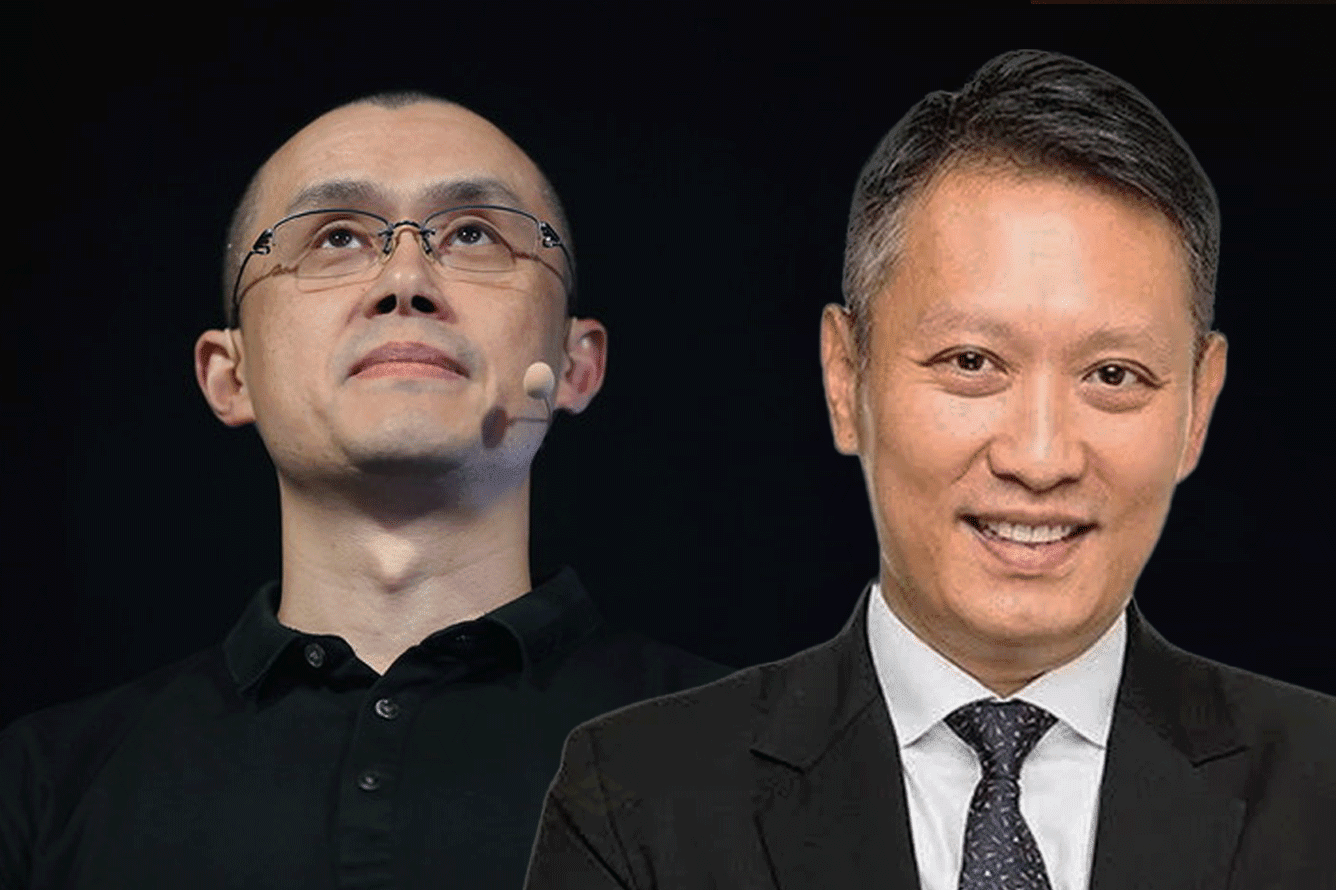

Last month, the SEC made its biggest kowtow to the crypto industry: approving Bitcoin ETFs. It was a long and arduous journey, which some might say came at the expense of Binance CEO Changpeng Zhao - but that's a story for another day (or you could just click below).

ven

Fast forward just shy of a month, and regulators are already back on the prowl, flexing their power towards the crypto industry.

Ripple vs SEC, Part MMXXIV

As ongoing as The Simpsons, no one exactly asked for another season of Ripple and the SEC, but here it is anyway.

In this latest chapter, the SEC has demanded that Ripple produce 2022-2023 financial statements, XRP institutional sale contracts, and a response to an interrogatory on 11 January.

Technically, the SEC vs Ripple case already came to a close last year. The regulator had sued the crypto firm over three years ago for "unregistered" sales of XRP. Ultimately, the regulator dropped its charges against Ripple's top executives, Chris Larsen and Brad Garlinghouse.

Southern District Court of New York Judge Analisa Torres determined that sales of XRP to institutional investors were unlawful securities sales, but "blind bid" sales to retail were not.

However, on Monday, the court granted the SEC's motion to extract the requested information from Ripple so it can determine appropriate penalties.

Ripple argued that its financial health is irrelevant to the case but the court said it saw "no basis to short-circuit that inquiry by denying access to readily available information that may be probative to the remedy stage."

The move comes just days after Ripple announced a return to the US. On LinkedIn, Ripple's senior director, W. Oliver Segovia, said that 90% of its business is conducted outside the US but revealed the firm will announce product updates driven by its money transmitter licenses (MTLs) that "cover the majority of the US states."

Apply or Shut Down, Declares Hong Kong

Having opened the floodgates to retail crypto last year, Hong Kong's Securities and Futures Commission is now taking a more conservative approach to crypto.

The regulator cautioned exchanges that if they have not applied for a virtual asset trading platform licence by 29 February, they will be forced to shut down by 31 May.

Julia Leung, the SFC’s chief executive officer, said in a statement, “The Commission would be on a stronger footing to keep investors out of harm’s way and bring wrongdoers to justice when financial crimes nowadays come in any shape and form, as well as to bring the full range of resources and tools at its disposal to achieve positive regulatory outcomes.”

Fourteen firms have applied for licenses in Hong Kong but only two - OSL and HashKey Exchange - have received approval.

The SFC also warned investors to check if the platforms they are using have applied for a VATP license, as exchanges can still operate whilst applying.

“For investors dealing with VATPs operating in Hong Kong which are not on the [application list], they are urged to make preparations early, before 31 May 2024, such as by closing their accounts with these VATPs or transferring to SFC-licensed VATPs for trading virtual assets,” the SFC said.

“The SFC strongly urges investors to trade virtual assets only on SFC-licensed VATPs because they may leave themselves unprotected by trading on unlicensed platforms."

The warning comes as investigations are being carried out on fraudulent Hong Kong crypto platforms including JPEX.

Crypto Executive Vetting in South Korea

South Korea’s Financial Services Commission (FSC) has proposed that new crypto execs must obtain regulatory approval before commencing their duties.

The FSC said it intends to “improve” pain points of current local crypto laws. If approved, new executive hires in South Korea would only be able to start work when the FSC approves personnel change applications, giving the financial watchdog more authority over the sector.

These amendments will be revised by the Ministry of Government Legislation and a voting process by the FSC, and could be enacted by the end of March.

It also proposes that the FSC will have the authority to suspend the review of a crypto company's license regulation if the company or its members are being investigated by regulators.

A company's registration can also be revoked by the FSC if it violates the Act on Corporate Governance of Financial Companies by hiring without adhering to the proposed vetting process.

Last month, an official from FSC told local media that the SEC's approval has not prompted the country's regulator to reconsider its stance.

“The SEC also reluctantly allowed virtual asset ETFs on a limited basis in response to the court decision,” the official said.

The FSC expressed concerns including unauthorized fund outflows, money laundering, and potential speculative losses. These concerns were pivotal in their decision to maintain the ban, first imposed in December 2017, which prohibits financial institutions from investing in cryptocurrencies.

However, Sung Tae-yoon, the chief of staff for policy of the presidential office, said the South Korean government is looking to introduce foreign affairs into local regulations. The announcement is thought to be linked to crypto ETFs.

The presidential office's push for Bitcoin ETFs also coincides with an ongoing discussion in the country about crypto tax.

Jeong Jung-hoon, deputy minister of the tax and customs office for South Korea’s Ministry of Economy and Finance, said that the National Assembly is weighing up abolishing crypto asset gains from income tax for financial investments.

President Yoon Suk-yeol's administration intends to eliminate taxes on financial investments like stocks and funds to bolster the wealth-building and financial planning efforts of its citizens.

The new tax regime will start on 1 January 2025. Citizens with more than 2.5 million Korean won ($1,865) in crypto asset gains will be subject to a 22% tax. The government plans to submit an amendment later this month.

Elsewhere