Table of Contents

FTX is expecting to repay customers who lost their money on the bankrupt crypto exchange.

In a bankruptcy hearing in Delaware on 31 January, FTX attorney Andy Dietderich said the company has been negotiating with bidders and investors since October 2023 but revealed none were interested in contributing funds to rebuild the exchange, Bloomberg reported on Wednesday.

It was previously reported that FTX was selling its cryptocurrency holdings to repay its customers but not in full.

FTX has now decided to abandon relaunching its exchange and is liquidating all its assets to repay its customers in full.

“FTX was an irresponsible sham created by a convicted felon,” Dietderich remarked. “The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in a dumpster were simply too high.”

Restructuring advisers are examining all of the millions of claims that have been filed against FTX to determine their legitimacy.

“I would like the court and stakeholders to understand this not as a guarantee, but as an objective,” Dietderich said. “There is still a great amount of work, and risk, between us and that result. But we believe the objective is within reach and we have a strategy to achieve it.”

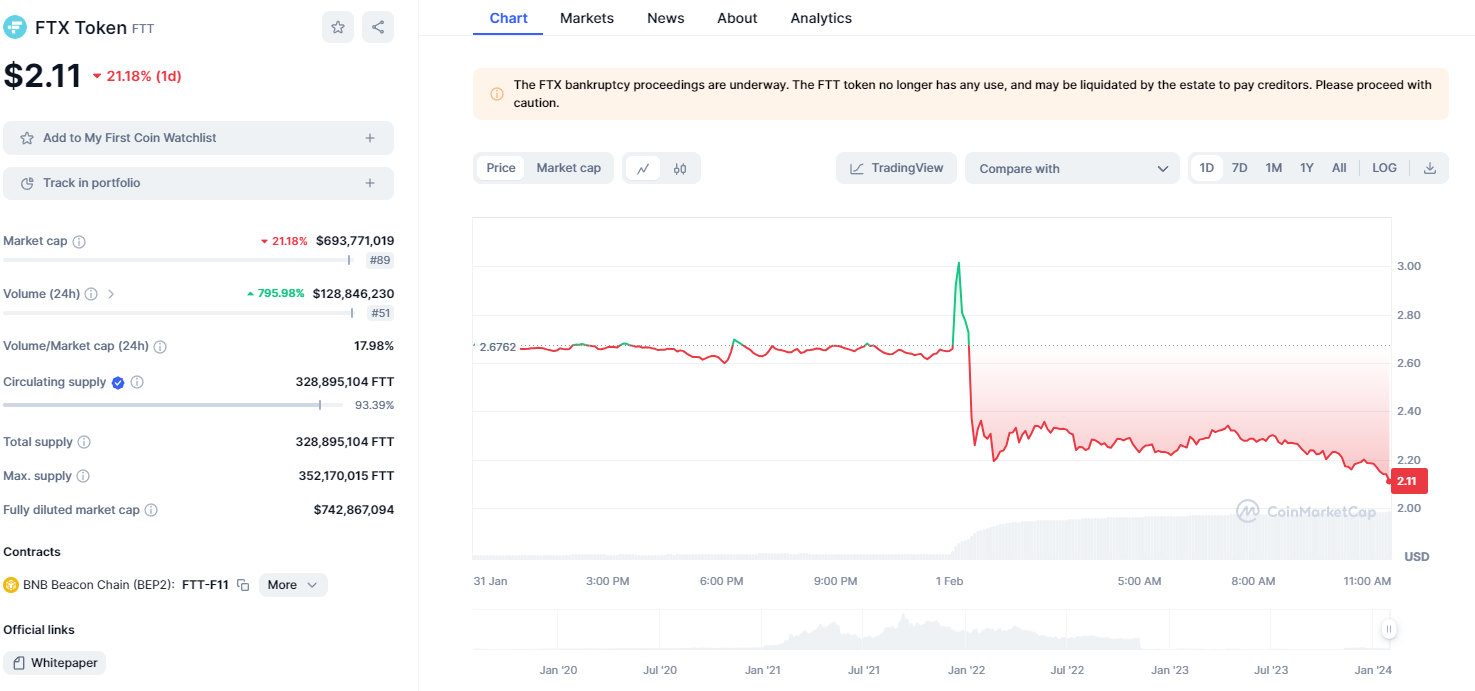

FTX's token FTT is down over 20% following the news.

Sam Bankman-Fried's crypto exchange had an estimated $8.7 billion shortfall when it filed for bankruptcy in 2022. Around $6.9 billion has been recovered since.

FTX and Alameda Research have doubled their cash pile from $2.3 billion in October 2023 to $4.4 billion by the end of the year. The firm raised another $1.8 billion by 8 December by selling some of its digital assets.

Earlier this month, FTX sold close to $1 billion worth of shares (22 million) in Grayscale's GTBC fund after the firm transformed it into a spot Bitcoin ETF.