Table of Contents

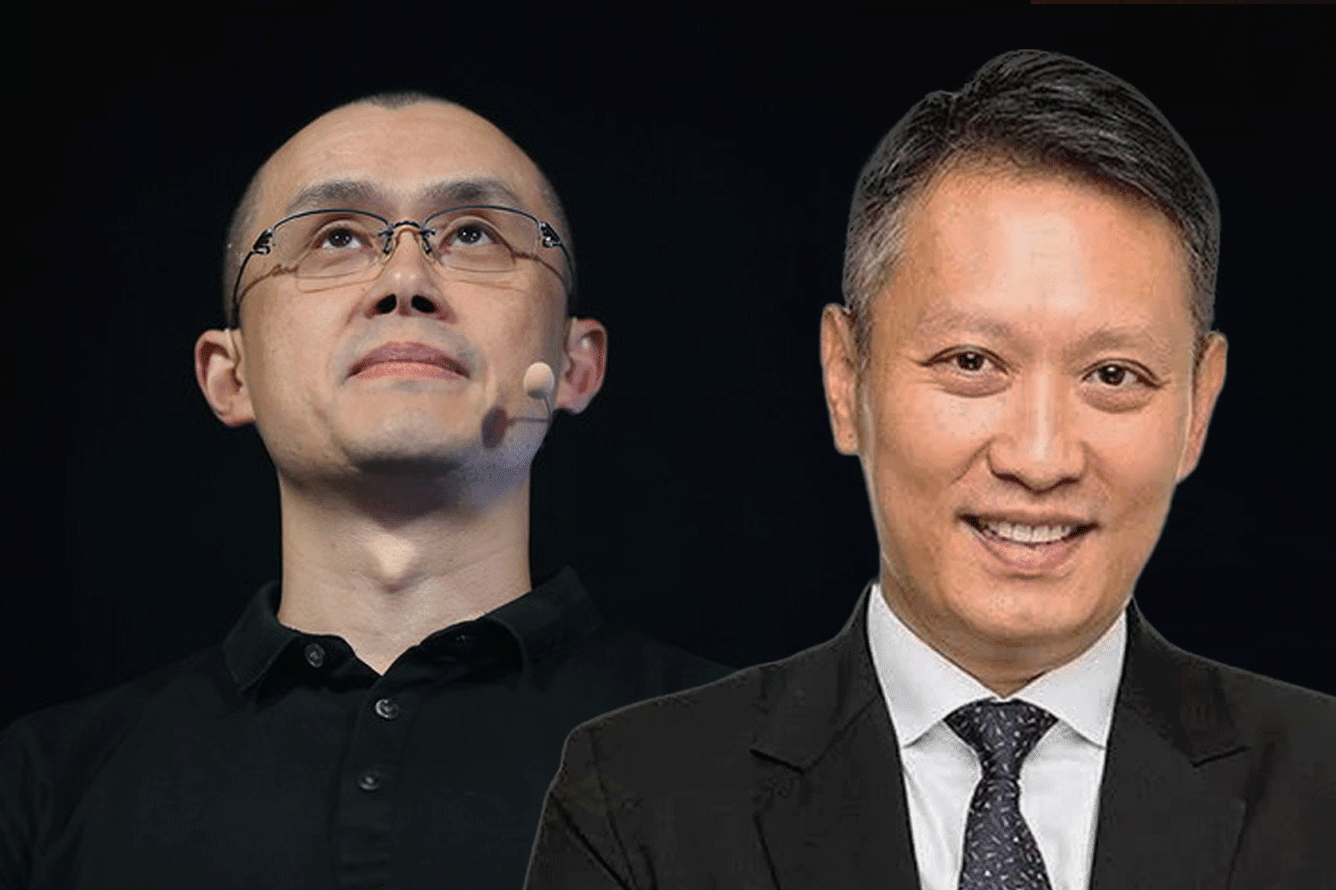

Binance's new CEO wants you to believe that the world's largest crypto exchange is in good hands.

Just days after CZ's resignation, Richard Teng published a blog titled "My First Blog as Binance’s CEO" in which he attempted to reassure users and the wider market that Binance is safe and secure.

Talking Without Saying Anything

In his post, Teng offered general and hollow remarks expected from a CEO. He commended the foundation Binance has built and vowed to lead the team through growth and success.

"A cornerstone of this organization has always been the idea that innovation should bring value to users," he wrote. "The best way to put this principle into practice – the Binance way – is to consistently deliver best-in-class products that people use and find valuable... As Binance’s new CEO, I am determined to keep steady on this course."

No, we didn't learn anything from that either.

Again, Teng repeated Binance's party line of "the freedom of money" - a phrase CZ repeatedly mentioned during his tenure.

Stronger Than Ever?

A phrase we weren't expecting to come up was "Binance is stronger than we have ever been." Considering the exchange is facing a $4.3 billion fine, we're struggling to see how it can possibly be in its strongest position ever.

But let's hear him out.

According to Teng, Binance has "systematically worked to address its past compliance issues through a series of significant efforts to recruit, hire, and retain the right personnel to strengthen Binance’s compliance program and culture."

Teng went on to claim that Binance's fundamentals are "very strong." He even wrote "very" in bold.

In a recent interview with Fortune, Teng went even further and described Binance's fundamentals as "extremely strong."

"Binance continues to operate the world's largest cryptocurrency exchange by volume but our capital structure is debt-free, our expenses are modest, and, despite the low transaction fees we charge our users, we have robust revenues and profits," Teng wrote in his blog.

"But most importantly, we take our responsibility as a custodian very seriously and maintain 1:1 backing for every user asset. Your assets are protected.

From our proof-of-reserves system, which we have continuously improved since it was first implemented more than 12 months ago, to our Secure Asset Fund for Users (SAFU) emergency fund, we are committed to ensuring you feel secure in the integrity of our platform."

Proof-of-Nothing

Despite Teng's compelling language, the new CEO offered nothing in the form of evidence to support his claims.

When Fortune pressed Teng on when Binance would disclose the composition of its board and publish financial statements, Teng "declined to provide specifics, but said he has a 'robust timeline.'"

Rival exchange Coinbase has offered such transparency for years.

According to Binance's proof-of-reserves, the exchange has $6.35 billion in total assets, which means it should be able to easily pay off the $4.3 billion fine without eating into customer funds.

However, Binance has refrained from disclosing its liabilities. Back when FTX collapsed, eyes predictably turned to Binance. At that time, CNBC’s Becky Quick pressed CZ on whether Binance could handle a $2.1 billion payment.

“Would you be able to handle it if somebody asked you for $2.1 billion back?” Quick asked him.

“We are financially OK,” CZ replied, failing to provide a direct answer.

Teng's claim of Binance being "extremely strong" fundamentally feels eerily familiar and uncomfortable.

Please Support Me

Perhaps feeling his sentiment wasn't compelling or sincere enough, Teng addressed Binance users directly.

"You have my word that I will do everything in my power to ensure that you remain the center of all that we do. You should feel confident in the financial strength, security, and safety of the company," Teng wrote.

Teng even went as far as pleading with his customers, ending his message with "Please support me in this journey."

But until Binance offers true transparency, the market understandably will likely regard this as lip service.

Elsewhere