Table of Contents

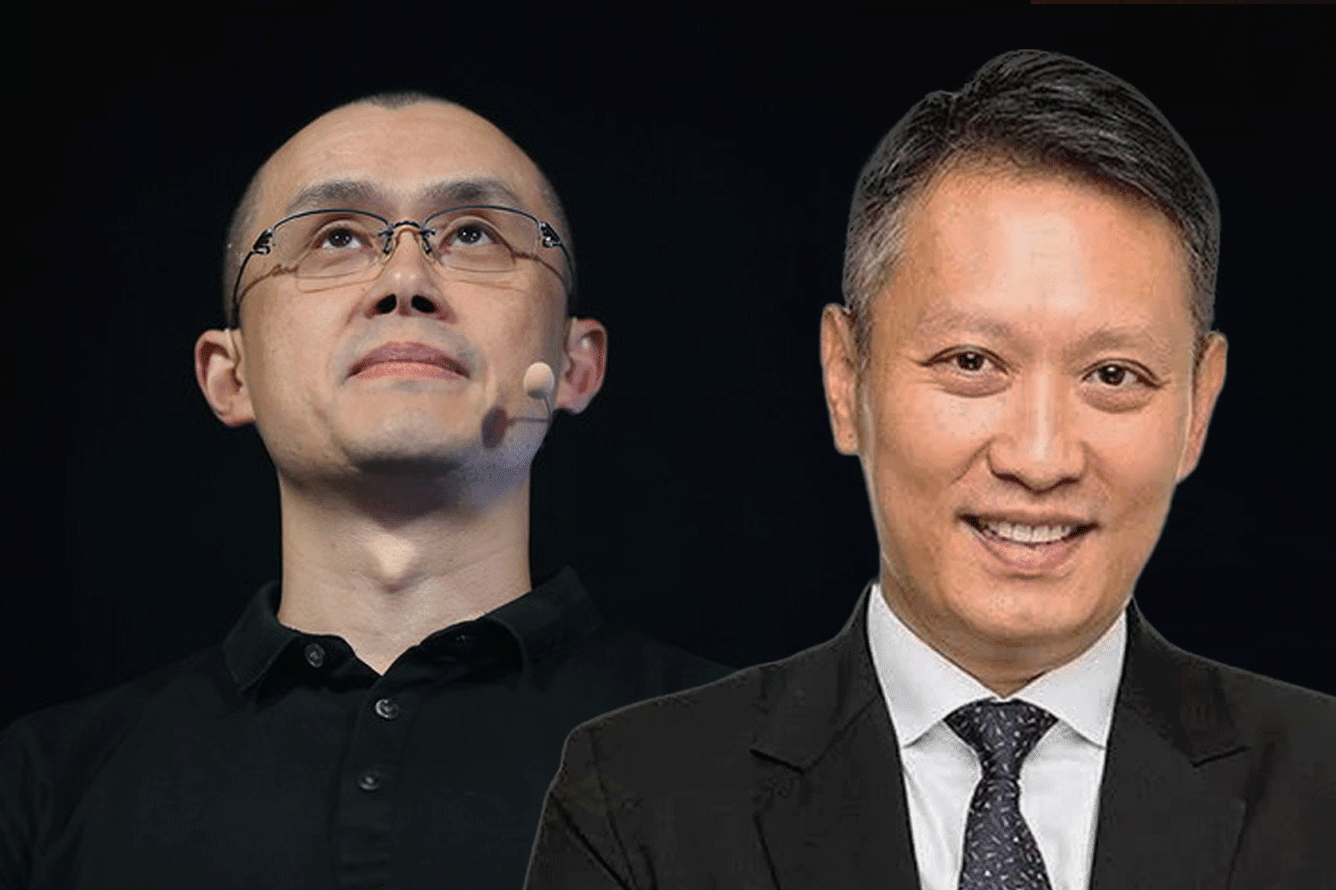

By now, you'll be well aware that Changpeng Zhao (CZ) has resigned from the beast of an exchange that is Binance. Singaporean ex-MAS director Richard Teng has taken the reins as CEO, following in the few legal footprints left by CZ.

Over $1 billion has left the world's largest crypto along with CZ as users withdrew their funds in response to the crypto titan pleading guilty to anti-money laundering violations in the US.

Binance was fined $4.3 billion whilst CZ himself agreed to pay a $50 million penalty.

These withdrawals are not necessarily a reflection of the confidence the market has in Teng but rather, the lack of confidence in Binance's overall position.

As Blockhead contributor Anndy Lian explains, CZ's supporters were disappointed in his resignation and "if not handled properly they may lose trust or interest in the exchange."

"Moreover, CZ’s departure could also create a power vacuum or a leadership crisis within, as Teng may face resistance or opposition from some of the existing executives or employees who are loyal to CZ or who have different views or agendas," Lian states.

Of course, the Binance fallout is serving as good news for its competitors. Crypto trading giant OKX saw its largest daily inflow of $152 million. Bybit enjoyed a $50.9 billion inflow and Bitstamp attracted $30.5 million.

“We anticipate that this will accelerate the outflow of projects, exchanges, founders and firms from direct U.S. regulatory purview,” crypto market maker Auros COO Jason Atkins told The Block. “Compliance will now be a non-negotiable so as to minimize lapses in the AML and KYC requirements in the U.S., irrespective of the country of incorporation.”

Coinbase has experienced a continuous rise in its stock price too, rising 12% over the past few days and more than 41% throughout the past month.

Reacting to Binance's news, CEO Brian Armstrong took to Twitter to emphasise the importance of compliance.

"Since the founding of Coinbase back in 2012 we have taken a long-term view. I knew we needed to embrace compliance to become a generational company that stood the test of time," he said. "This meant we couldn't always move as quickly as others... Today's news reinforces that doing it the hard way was the right decision."

Since the founding of Coinbase back in 2012 we have taken a long-term view. I knew we needed to embrace compliance to become a generational company that stood the test of time. We got the licenses, hired the compliance and legal teams, and made it clear our brand was about trust…

— Brian Armstrong 🛡️ (@brian_armstrong) November 21, 2023

Other winners include degens who jumped onto meme coins aptly titled $CZ and $TENG, enjoying returns of up to 100,000% and 14,000% respectively.

4 Fingers, Big 4 Audit, FUD 4 Real

The image of CZ holding up four fingers has become a meme of its own. Stemming from an initial tweet he wrote earlier this year, the figure reflects CZ's fourth item on his "Do's and Dont's" list: Ignore FUD.

Will try to keep 2023 simple. Spend more time on less things. Do's and Don'ts.

— CZ 🔶 Binance (@cz_binance) January 2, 2023

1. Education

2. Compliance

3. Product & Service

4. Ignore FUD, fake news, attacks, etc.

In the future, would appreciate if you can link to this post when I tweet "4". 🙏

— CZ 🔶 Binance (@cz_binance) March 3, 2023

With CZ finally exiting Binance, it's now time to re-evaluate the FUD surrounding the exchange and whether we can apply his advice to his own firm.

As mentioned, Binance is set to pay a fine of $4.3 billion. A simple glance at Binance's proof-of-reserves will indicate that the exchange backs customer assets one-to-one.

"People can withdraw 100% of the assets they have on Binance. We will not have an issue at any given day," CZ reassuringly said in an interview. "In crypto, there's no central bank printing money to bail out banks when there's a liquidity crunch. Crypto businesses have to hold user assets one-to-one, and that's what we do - it's very simple."

According to Binance, the exchange has $6.35 billion in total assets, which means it should be able to easily pay off the $4.3 billion fine without eating into customer funds.

Also, if you look at Binance Corporate's crypto holdings, they have $6.35 billion in total assets, of which $3.19 billion are stablecoins.

— Sjuul | AltCryptoGems (@AltCryptoGems) November 22, 2023

So, Binance will be able to easily pay the fine without selling their crypto assets, which shows the strength of its balance sheet. pic.twitter.com/doOqZDpBGf

However, Binance has refrained from disclosing its liabilities. When FTX collapsed, eyes predictably turned to Binance. At that time, CNBC’s Becky Quick pressed CZ on whether Binance could handle a $2.1 billion payment.

“Would you be able to handle it if somebody asked you for $2.1 billion back?” Quick asked him.

“We are financially OK,” CZ replied, failing to provide a direct answer.

When Quick pressed him on getting a Big 4 auditor to vet his firm, CZ claimed none wanted to work with him.

"A Big 4 auditor would reveal [problems]," Quick said. "If you're saying that some of them don't want to work with you, that raises questions too. They don't want to work with you because you don't have the files and the data that would make them feel comfortable to give their stamp of approval?"

In response, CZ pushed the blame onto the auditors. "Many of them don't know how to audit crypto exchanges," he said.

CNBC’s Andrew Ross Sorkin pointed out that Coinbase has a Big 4 auditor, to which a flummoxed CZ replied, "I don't look at Coinbase."

Star Trek or Fiction?

In CZ's internal letter addressed to Binance staff, the now-former-CEO turned to Star Trek for words of wisdom. “I need everyone to continue performing admirably,” he said, lifting from the 2009 Star Trek film.

Exclusive: Binance founder Zhao Changpeng CZ issued an internal letter saying "I will have to deal with some pain, but will survive", quoting Star Trek (2009) , "l need everyone to continue performing admirably". pic.twitter.com/m9w4hywIPm

— Wu Blockchain (@WuBlockchain) November 22, 2023

Binance users will now have to decide how much of what CZ told them is fiction, like his Star Trek quote. Last year, CZ was reluctant to answer whether Binance could cover a $2.1 billion fine. Its current $4.3 billion penalty is more than double that.

Whilst its proof-of-reserves points to a $6.35 billion asset stronghold, Binance's reluctance to permit an audit means its liabilities could diminish this number substantially.

Perhaps Teng will straighten up Binance's financials, in line with regulatory demands. But the truth could be painful to hear.

Elsewhere