Table of Contents

The Blockchain Founders Fund, established in 2018 and headquartered in Singapore, has made a significant impact in the venture capital landscape, particularly in the realm of blockchain and cryptocurrency startups. Its diverse portfolio boasts impressive names like Uniblock, Futureverse, LunarCrush, GRID, and even Limewire, offering a blend of support to both experienced and emerging entrepreneurs in the digital frontier.

At the heart of this dynamic firm is Tobias Bauer, a key partner whose expertise extends beyond investment strategies to nurturing the next generation of startup talent. Bauer's commitment to innovation is evident in his role as a mentor for several prestigious accelerators, including 500 Startups, APX, PlugAndPlay, and NUMA New York, as well as his involvement as a Venture Partner at Republic.

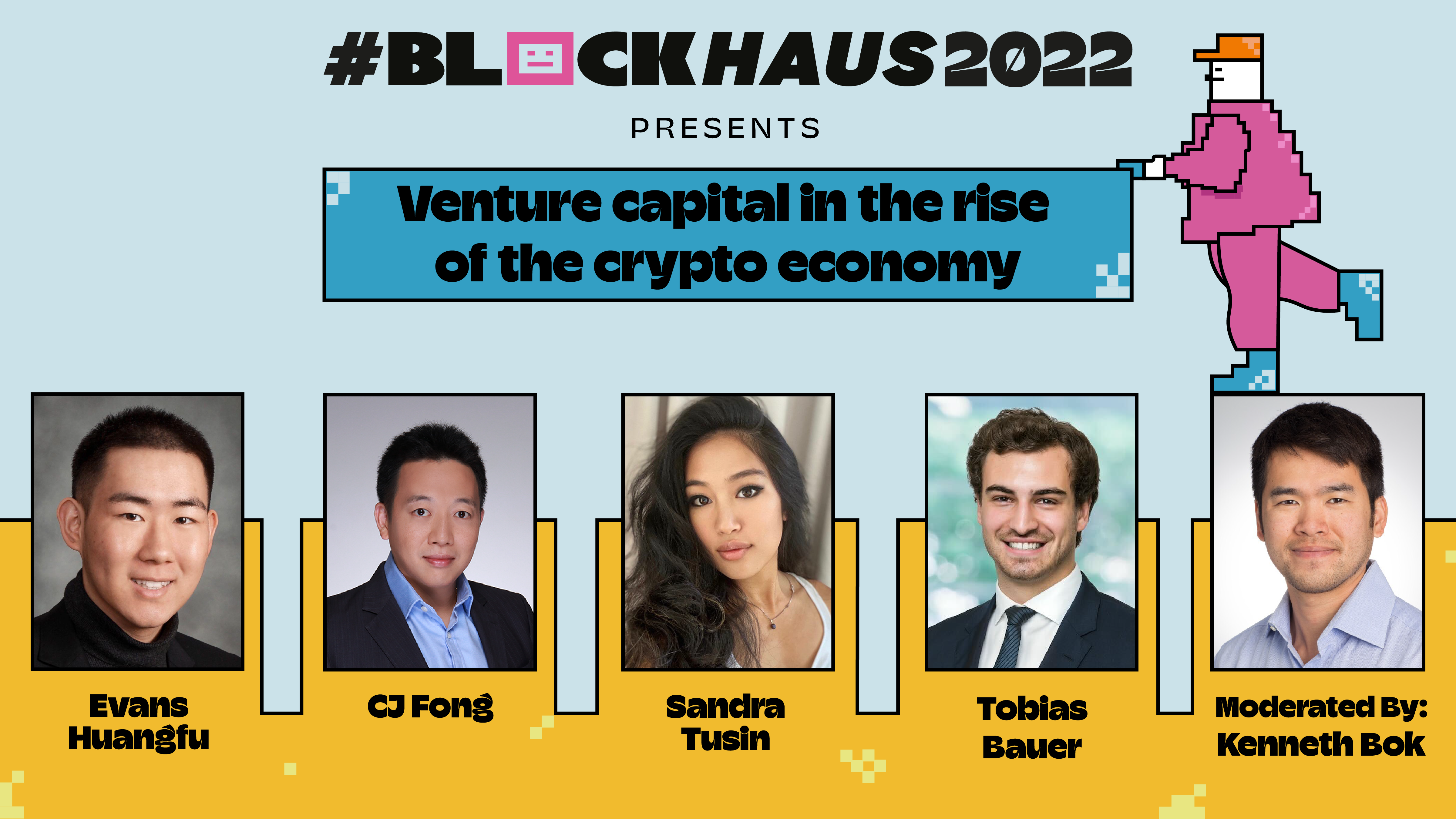

Bauer's rich background in the venture capital sphere includes his time with Chinaccelerator's investment team and a stint working for the German Government in Thailand, lending a global perspective to his current endeavors. His insights into the evolving landscape of venture capital, especially in the context of the burgeoning crypto economy, were highlighted during his participation in Blockhead's Blockhouse 2022 event.

With an upcoming speaking engagement at the Fixed Income & FX (FIFX) Leaders Summit APAC in Singapore, slated for 22-23 November 2023, Bauer's perspectives on blockchain's latest developments are highly anticipated.

In anticipation of his appearance at the FIFX Leaders Summit APAC 2023, Blockhead seized the opportunity to delve into a conversation with Bauer, aiming to uncover the emerging trends and future trajectories in the world of blockchain and digital finance.

Blockhead: With the likes of Solana and Celestia intensifying the competition in the blockchain space, what can we expect from the sector in 2024?

Tobias Bauer: In 2024, the blockchain sector is poised to see significant advancements, particularly with modular technology like Celestia redefining the development landscape. This will enable a more seamless user experience in the crypto space, with intuitive asset swaps and streamlined smart contract creation.

I’m anticipating a big shift towards modularity, with developers focusing less on specific chains and more on interoperability. The integration of Web2 developers into Web3 through community support will also accelerate innovation. The result will be a more accessible and collaborative ecosystem, fostering rapid development and easier entry for new talent into the field of decentralized applications.

BH: What does blockchain have in store for institutional investors?

TB: I expect blockchain to revolutionize institutional investment by introducing the tokenization of massive asset classes like derivatives and debt, which are worth trillions of dollars. This will democratize investing by allowing fractional ownership of traditionally large-scale assets. Institutions will gain access to new avenues for liquidity, and smaller investors will be able to participate in markets previously beyond their reach.

Blockchain's ability to tokenize real-world assets is a game-changer, offering more inclusive investment opportunities and injecting fresh capital into the crypto space. I think we can expect to see a significant shift in how institutions engage with these tokenized assets, providing both innovation and stability within the financial sector.

BH: How does Singapore fare in the Asian blockchain landscape? What are the challenges facing the region?

TB: Singapore obviously stands out, with its strong investor-friendly reputation and clear regulatory framework but it does face competition from regional players like Hong Kong. Despite Hong Kong's close ties to China and its role as a testing ground for blockchain innovations supported by the mainland, Singapore's neutrality and established financial infrastructure give it an edge.

The region as a whole has struggled with challenges such as geopolitical risks, banking regulations, and sanctions, which inevitably funnel holding companies towards Singapore's stability.

This being said, Singapore's stringent approach to crypto, particularly in advertising and the complexities of banking for crypto-related businesses, presents its own hurdles. While Dubai is emerging as a contender aiming to establish itself as a crypto hub, its multiple jurisdictions also introduce complexity. Across the region, we’ve seen an increased emphasis on Know Your Customer (KYC) and Know Your Business (KYB) regulations, reflecting a response to concerns like money laundering in the crypto space.

BH: How much is too much regulation?

TB: The question of over-regulation in the crypto space is quite nuanced; it's not about the quantity but the quality and timing. I may hold a controversial opinion but I believe effective regulation is crucial for broader adoption, ensuring user protection and market stability. Despite this, I do think that reactive measures, as seen post-FTX, can stifle innovation by creating an atmosphere of fear among developers and entrepreneurs.

I look forward to a balanced approach, where regulation is developed in collaboration with industry experts—similar to decentralized autonomous organizations (DAOs), which lack a centralized authority and operate on community governance—is essential. The real challenge lies in crafting regulation that supports innovation while safeguarding participants, ensuring that the rules evolve alongside the technology rather than lagging behind or hindering progress.

BH: How can Web3, and ultimately blockchain, restore its reputation and perhaps differentiate itself from crypto?

TB: I don’t believe the trial of Sam Bankman-Fried is so much a reminder of the dangers within Web3 as opposed to a reminder of what can happen when centralization and insufficient oversight meet. Similar situations have occurred throughout history in traditional businesses and they will again - the crypto angle just makes it more newsworthy and plays into fearmongering. Still, due to the fact this case was related to crypto, Web3 and blockchain must emphasize their foundational principle: decentralization to improve trust. This means reducing single points of failure, such as individuals with unchecked power.

Transparency and decentralization are the core of what differentiates blockchain fundamentally from centralized entities. Additionally, adopting regulatory frameworks that align with these principles can further safeguard against misuse, without killing innovation. The community should advocate for responsible innovation with clear governance to ensure blockchain’s potential is realized ethically and sustainably, distinguishing itself from the reputational damage caused by centralized crypto organizations.

BH: Is AI the real industry disrupter, not blockchain?

TB: No, AI and blockchain are both formidable disruptors in their respective domains, and it’s not a matter of one versus the other. AI excels in tasks that involve learning and decision-making, often surpassing human capabilities, especially in data-rich environments. On the other hand, blockchain introduces unprecedented security and decentralization to data management and transactions. They both have their benefits.

The true innovation lies in integrating AI with blockchain, leveraging AI’s processing power to enhance blockchain efficiency and utilizing blockchain to secure AI’s data processes. In the future, the distinction between these technologies will blur as they combine to create solutions that are more powerful than the sum of their parts. What ultimately counts is the value these innovations bring to the table — their ability to solve real problems in a manner that customers find worth paying for.

BH: What are investors looking for in Web3 companies now?

TB: Investors have moved beyond the hype in the industry to focusing on the fundamental business aspects of Web3 companies. They are looking for revenue-generating businesses that demonstrate a clear understanding of unit economics and offer a strong product-market fit.

The evolution has been from a tech-centric to a business-centric approach where the sustainability and strength of the business model take precedence over the technological aspects.

BH: What are the biggest mistakes and lessons learned in your Web3 VC career?

TB: One of the things that I learned very, very early in my career is that while many founders may be incredibly technically adept, they often lack the skills required to build a sustainable business. I note this because, especially in this space, many VCs get overexcited by the technology and invest in founders who can’t execute. Early involvement in crypto does not necessarily translate to business acumen.

Another issue I’ve seen is investments based on the number of token holders. Token holders are not always product users, and community building is far more complex and challenging than founders initially thought. A key takeaway is the importance of strategic due diligence and not being swayed by community size or hype alone.

BH: Can you give us a sneak peek of what you will be talking about in your upcoming panel discussion?

TB: The panel will discuss the democratization of investment opportunities through digital assets, highlighting how blockchain and tokenization are opening up investment possibilities to a broader audience, enabling participation with lower capital requirements.

BH: Why is the FIFX Leaders Summit APAC 2023 a must-not-miss event?

TB: Why would you miss an assembly of top-tier speakers and organizations that are instrumental in shaping the future of digital assets? Fixed Income & FX presents a valuable opportunity to network with a diverse group of investors, founders, and thought leaders in a setting that is conducive to fostering innovation and driving the industry forward.

As a media partner for the event, Blockhead subscribers can enjoy 20% off ticket rates when using the code “BLOCKHEAD20” to get tickets here.