Buy the Bitcoin, Sell the News: ETF Edition

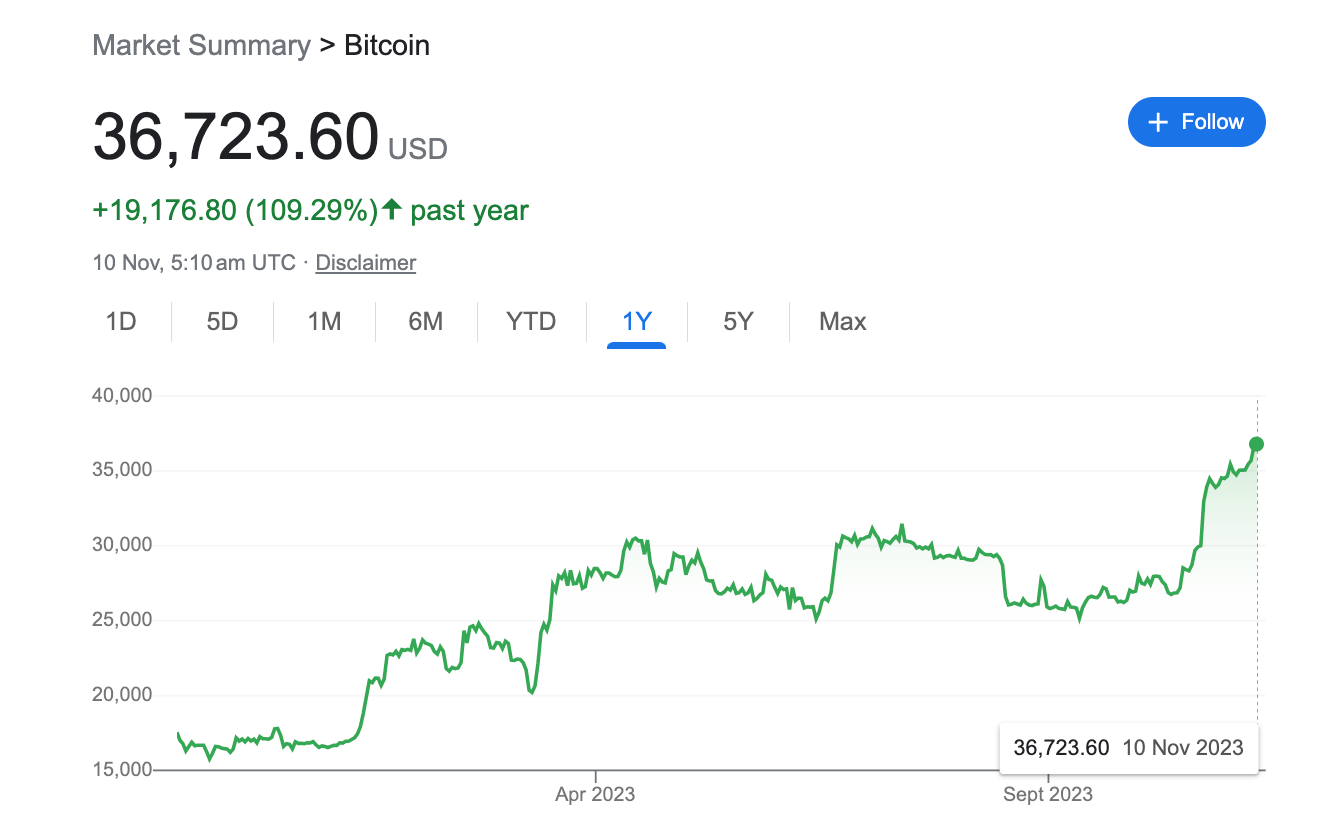

As excitement surrounding the impending approval of Bitcoin ETFs increases, so does the price of Bitcoin. Sitting at yearly highs of $36K to $37K, Bitcoin is up more than 100% over the past year. It's a similar story for Ethereum too, which is up over 60% from last year.

However, as the SEC's approval becomes increasingly inevitable, are we facing a "buy the rumour, sell the news" situation?

On Thursday, a Nasdaq filing showed that a corporate entity, iShares Ethereum Trust, had been registered in Delaware. iShares is the name of BlackRock's ETF division, confirming BlackRock's Ethereum ETF plan.

BlackRock has made first step towards filing for a spot Ether ETF. I just confirmed on the website myself. Nice catch by @SummersThings https://t.co/mLKIhKdiI6

— Eric Balchunas (@EricBalchunas) November 9, 2023

The filing reportedly preempts potential SEC objections such as surveillance-sharing concerns by stating prices for CME Group's ether futures match spot ETH prices.

BlackRock set the ball rolling with its Bitcoin ETF application back in June, with the likes of WisdomTree, Invesco, Fidelity, Valkyrie Digital and ARK Invest following suit.

Yesterday also marked the first day of the SEC's "window" in which it could approve the original 12 Bitcoin ETF applications. When the SEC previously delayed its deadline for BlackRock, Bitwise and VanEck, it chose 8 November as the final day of the comment period.

The window lasts until November 17 and marks the first opportunity for approval since a US court ruled that the SEC must review Grayscale's Bitcoin ETF application.

After 17 November, the comment period for Global X Bitcoin Trust, Hashdex Bitcoin ETF and Franklin Bitcoin ETF will recommence, with no decision being made on them until after 23 November.

Bloomberg analyst James Seyffart puts a 90% chance on approval before 10 January 2024.

New Research note from me today. We still believe 90% chance by Jan 10 for spot #Bitcoin ETF approvals. But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur pic.twitter.com/u6dBva1ytD

— James Seyffart (@JSeyff) November 8, 2023

Baked or Underbaked?

Anticipation of Bitcoin ETF approvals has resulted in Bitcoin rising over 30% over the past three months. This begs the question as to whether the approval is already baked into its price.

'Crypto Titans' author Markus Thielen doesn't think so. Pointing to the launch of CME Bitcoin Futures in 2017, Thielen highlights how Bitcoin surged 288%.

"While the Bitcoin ETF by BlackRock (and others) is also highly anticipated, the narrative appears to mimic the CME Bitcoin Future launch," he states.

"This is why we could argue that Bitcoin might continue to rally until the US-listed Bitcoin spot ETF starts trading, and any announcement of the launch date might cause a parabolic price rise."

In another post, Thielen said that a break above $36,000 could cause Bitcoin to rally to the next technical resistance level at $40,000 and potentially rise to $45,000 by the end of 2023.

Bitwise Asset Management's chief investment officer, Matt Hougan, echoed a similar message. In a recent interview, Hougan said "It’s not at all priced in because the people who are going to buy this ETF are not aware that it’s coming or most likely coming; the majority of advisors who are the natural audience for this ETF don’t expect it to come until 2025 or later.”

“If the people who are going to buy this ETF don’t think it's going to be approved in the next two months, then I don’t see how it’s priced in.”

However, JP Morgan disagrees. Analysts there believe the crypto rally looks "overdone."

"First, instead of fresh capital entering the crypto industry to be invested in the newly-approved ETFs, we see as a more likely scenario existing capital shifting from existing bitcoin products such as the Grayscale bitcoin trust, bitcoin futures ETFs and publicly listed bitcoin mining companies, into the newly-approved spot Bitcoin ETFs," the JP Morgan analysts said.

Blockhead's Take

Bitcoin's and Ethereum's recent price surge is undoubtedly a result of Bitcoin ETF applications garnering favourable odds. To this extent, yes much of the news is baked in. That said, it does not rule out more room for Bitcoin's price to grow.

Let's not forget why the market is excited about Bitcoin ETFs in the first place: liquidity. As Gemini co-founder Tyler Winklevoss told Blockhead, "[Crypto ETFs] are going to bring a ton of liquidity and price discovery."

"We have many institutional customers, and they range from proprietary trading firms to large macro hedge funds," he continued. "And I think we're going to see 10x that once ETFs arrive."

Anticipation for Bitcoin ETFs has driven up Bitcoin's price but approval itself will unlock a treasure chest of reasons for Bitcoin's price to rise even further.

We also don't need to look too far to predict how the market will respond to official approval, thanks to Cointelegraph's infamous blunder. Last month, the publication erroneously reported that the SEC had approved BlackRock's Ishares spot Bitcoin ETF. The fake news triggered a 10% surge in Bitcoin's price.

Whilst this was fake news, it revealed that the market was ready to pounce at the mere announcement of the SEC's approval.

As always, this isn't investment advice. Trusting Blockhead for non-erroneous news is good advice though.

Elsewhere:

- BitMEX's Arthur Hayes Stirs the Pot with 'Bad Gurl' Digest, Eyes Yellen's Market Moves: His latest blog entry, cheekily titled "Bad Gurl," takes a deep dive into the financial sea, where US Treasury Secretary Janet Yellen captains the ship of the global economy. Hayes is spinning a yarn about the good ship US Treasury, ready to unleash a tidal wave of short-dated bills. This could send the US stock market and other treasure troves like crypto and gold on a joy ride to Valhalla. The twist? With traditional booty offering the excitement of a sunken chest, Hayes reckons cryptocurrencies are about to get a love letter marked X on the investor's map. "The smartest trade is going long crypto. There is nothing else that has outperformed the increase in central bank balances sheets like crypto. The first stop is always Bitcoin. Bitcoin is money and only money. The next stop is Ether. Ether is the commodity that powers the Ethereum network which is the best internet computer," Hayes said.

- Bitdeer to Unleash NVIDIA's AI Might in Asia with New Cloud Service: Bitdeer, crypto tycoon Wu Jihan's mining company, is set to launch an AI-focused cloud service in Asia, leveraging NVIDIA's formidable DGX SuperPOD. Dubbed 'Bitdeer AI Cloud', this venture marks a significant step for Asia's digital landscape, promising to democratize access to high-end AI computing. It's not just an upgrade; it's a revolution, offering the raw power of NVIDIA's AI prowess to businesses large and small. Slated for an early 2024 launch, this service aims to supercharge everything from generative AI to data-heavy projects, positioning Bitdeer as a pivotal player in the region's tech evolution.

- SC Malaysia Greenlights CoKeeps as First DAC: In a significant development for Malaysia's burgeoning crypto scene, CoKeeps has been crowned as the country's first fully approved Digital Asset Custodian (DAC) by the Securities Commission (SC) Malaysia. This approval marks a major milestone in legitimizing and safeguarding cryptocurrency transactions in the region. CoKeeps promises to revolutionize the way digital assets are handled, offering robust safeguarding solutions in a regulatory-compliant manner. CoKeeps said it is currently engaging with other regulated entities in the capital market such as recognised market operators, including digital asset exchanges for digital currencies and initial exchange offerings for digital tokens. “Fund managers and various financial institutions are incorporating the digital asset class to broaden their offerings. This expansion necessitates ready-made solutions, such as ours, to ensure compliance” Suhanna Husein, CEO of CoKeeps, said.

- A Fresh Start for Celsius: Exiting Bankruptcy with New Plan: In a significant turnaround, crypto lender Celsius Network, has been cleared to exit bankruptcy. With a customer base of over 600,000 and holdings of about $4.4 billion in interest-bearing accounts at the time of filing for bankruptcy, the company's restructuring plan marks a pivotal moment in its recovery. According to a Reuters report, the reorganised business will be managed by Fahrenheit LLC, a consortium that includes hedge fund Arrington Capital, and it will focus on mining new bitcoin and earning staking fees by validating blockchain transactions. The plan includes a settlement that pegs its proprietary crypto token, CEL, at 25 cents. The company has said that it would return about $2 billion in cryptocurrency to account holders.