"Most Violent Night" in Gaza But Bitcoin Surpasses $30K, Solana Hits $30

As the world mourns the countless lives lost in the Middle East, the markets are showing their own kind of despair. Last week, concerns that the conflict between Israel and Hamas may escalate and draw in the United States led to wild stock market fluctuations.

17 days in and the war is intensifying. 400 were killed in last night's attack, with journalists describing it as the "most violent night yet."

However, oil prices saw a dip on Monday as diplomatic steps were made in the conflict - at least on paper.

"Israel agreed to hold off its attack on Hamas following pressure from the U.S.," ANZ Research said. "This eased concerns that the Israel-Hamas war would spread across the Middle East and disrupt supplies."

Things are even more promising on the crypto front. Bitcoin finally reached its elusive $30K target and Solana reached its goal of $30.

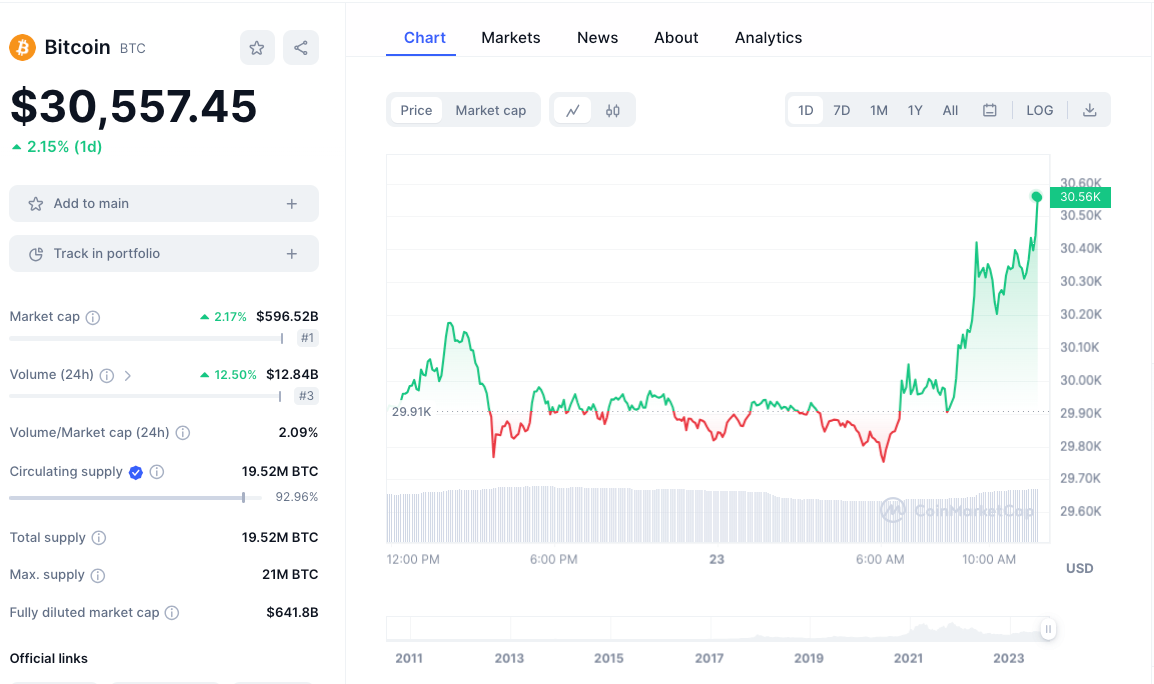

Bitcoin's Boom

Bitcoin's performance is typically a signal of the wider cryptocurrency market's strength. Historically (albeit crypto's history is rather brief) cryptocurrency was marketed as a hedge against TradFi's woes with Bitcoin serving as "digital gold."

But as we discussed earlier this month, the fable proved a fallacy as events such as the Ukraine-Russia conflict sent Bitcoin cratering along with the stock market. Thus, uncertainty surrounding the Israel-Hamas conflict would assumedly lead to uncertainty in the stock market, and consequently the crypto market.

To much of our surprise, Bitcoin has not only held its ground since the start of the conflict but has hit its $30K price target for the first time since July 2023.

Much of Bitcoin's strength can be attributed to the drama ensuing between the industry and the SEC. On Thursday, the regulator dropped its charges against Ripple's top executives, Chris Larsen and Brad Garlinghouse for allegedly violating federal securities laws concerning XRP crypto transactions.

The move marks a significant victory for Ripple, a leading player in the crypto space and the wider industry.

Additionally, Bitcoin ETF's seem to be imminent. Despite Cointelegraph's blunder of misreporting that BlackRock's Bitcoin ETF application had been approved, the industry still remains confident that the SEC will cave.

“I’m quite hopeful that these [ETF] applications will be granted, if only because they should be granted under the law,” Coinbase’s chief legal officer, Paul Grewal said on Friday.

JP Morgan echoed a similar message, stating, “Bitcoin ETFs will arrive in a few months.”

The dance between regulators and crypto enterprises is proving to be a pivotal waltz.

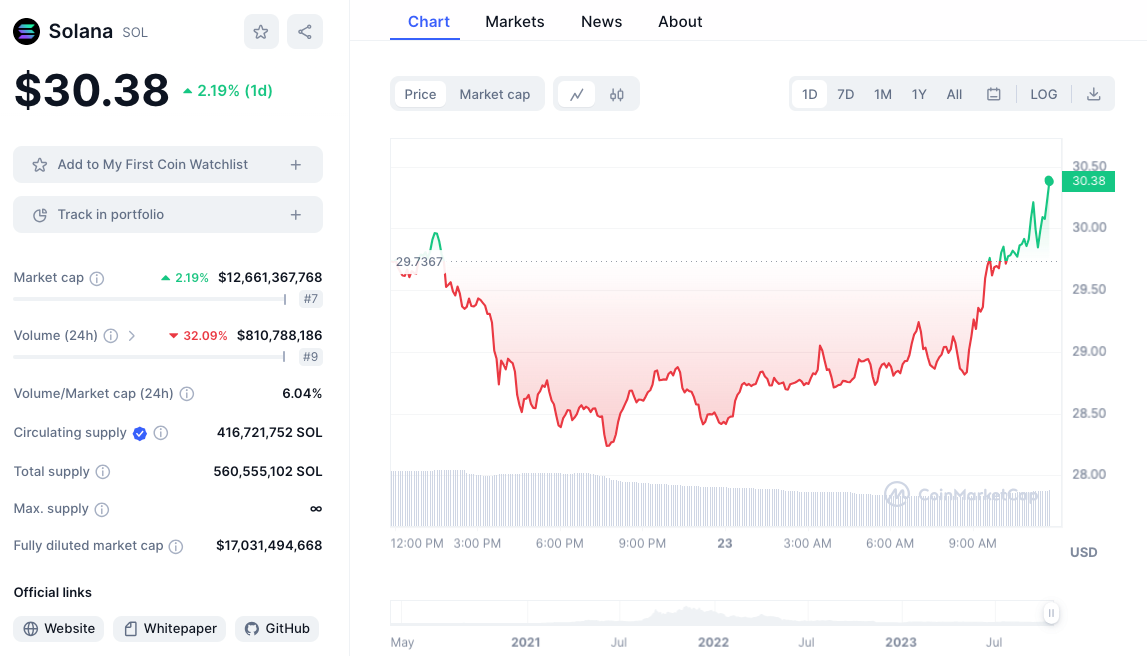

Solana's Surge

Hate to say we told you so, but Blockhead felt this one coming. Earlier this month, we extensively explained why Solana had the potential to hit $30, despite sitting at $23 at the time.

Encouraging figures such as yearly TVL highs, lucrative partnerships including Visa, poor competition and a strong Q3, were all highlighted as key drivers for Solana to hit $30.

Known as the "Ethereum Killer," Solana has finally reached its $30 target. Aside from the points highlighted above, its strong fundamentals, intricate infrastructure, developer support, scalability and ever-growing ecosystem have solidified Solana as a key industry leader.

Strength in the wider crypto market also bolstered Solana's trajectory over the past few weeks, sharing much of the good news Bitcoin received recently too.

very impressed with $SOL price action this week.

— Bluntz (@Bluntz_Capital) October 20, 2023

todays PA most likely a breakout on the btc pair and looking like a whole year of accumulation on not just usd but sol/btc is close to coming to an end.

once it breaks $32 the flood gates get unleashed, thats still 20% higher but… https://t.co/5o1hFWjbYr pic.twitter.com/lsItTVaqIC

Even more encouragingly, crypto natives believe a target of $32 could send Solana significantly higher. "Once it breaks $32, the floodgates get unleashed," wrote pseudonymous analyst Bluntz on X.

$32 would see the ETH killer at highs not seen since July but if Bitcoin managed to hit its July high, Solana could too.

Blockspaces

Be sure to tune in tomorrow to Blockhead's inaugural Twitter Space - Blockspaces. In this week's episode, we're diving deep into the swirling currents of Bitcoin's potential 2024 bull run.

With the Bitcoin Halving on the horizon and the tantalizing tease of a BTC spot ETF, the crypto waters are bubbling with anticipation. But what's the real deal behind the halving? How does it impact miners, and what ripple effects might it have on the broader Bitcoin ecosystem?

And let's not forget the recent media frenzy around Blackrock's rumoured iShares spot Bitcoin ETF approval. Was it just a flash in the pan, or a sign of bigger waves to come? As deadlines pass and heavyweight fund houses jostle for a piece of the BTC spot ETF pie, we ponder the inevitable: is it a matter of "if" or "when"?

Follow Blockhead on X to ensure you don't miss out!

Elsewhere:

- Cryptocurrency Speculation Meets Astrology – Thai Investors Seek Cosmic Insights: In an unconventional twist, some Thai investors are reportedly relying on astrology and tarot card readings to guide their cryptocurrency investments. While financial analysts often use data and charts for predictions, it appears that a segment of Thailand's crypto community is exploring mystical methods to foresee digital asset trends, Cointelegraph reported, citing a thread on Reddit. Blockhead says, whatever works!

- Developer Activity Soars – Ripple (XRP) and zkSync Among the Leaders: A recent report highlights positive developer growth in the blockchain and cryptocurrency space. Notable projects like Ripple (XRP), TON, zkSync, and StarkNet are reportedly seeing increased developer activity. This surge in development activity is often indicative of a project's vitality and potential for future advancements. While Ripple faces ongoing legal challenges, its developer community remains active. Similarly, zkSync and StarkNet's growth reflects the broader interest in layer 2 scaling solutions, and TON's resurgence is noteworthy. However, the report notes that fewer new developers are exploring crypto, and newcomers tend to dominate around market peaks.

- FTX Creditor Claims Surpass 50 Cents on the Dollar: Creditors of the failed crypto exchange are experiencing a more optimistic outlook as recent reports indicate potential recoveries of over 50 cents on the dollar. While the specifics are yet to be finalized, this development offers a glimmer of hope for those impacted by the exchange's financial woes.