Table of Contents

Welcome to Blockhead's Daily Digest, your go-to source for staying informed on the dynamic and ever-changing world of cryptocurrency. Whether you're a seasoned investor, blockchain enthusiast, or simply curious about the latest developments, we've got you covered with the most comprehensive news and analysis.

Ask any crypto aficionado and they'll tell you how the US Securities and Exchange Commission (SEC) has become the industry's nemesis over the past few months. Filing lawsuits against the likes of Coinbase, Ripple and Binance, as well as claiming jurisdiction over the entirety of Ethereum, the SEC has made very few friends in the crypto space.

That is, until now. In an applauded move, the SEC has taken aim at Hex founder Richard Heart by charging him with conducting unregistered securities offerings that raised over $1 billion, extending to PulseChain, PulseX, and Hex.

Heart and PulseChain are accused of using $12 million of investor funds to buy "exorbitant luxury goods," including cars, watches and a 555-carat black diamond. Hex was marketed by Heart as a high-yield "blockchain certificate of deposit,", offering a staking feature with returns of 38%.

The SEC alleges Richard Heart used at least $12 million in investor funds to purchase luxury goods. Lol. pic.twitter.com/IfMOBmTM3l

— Tiffany Fong (@TiffanyFong_) July 31, 2023

Investor funds were allegedly recycled to make the project appear more lucrative and thus deceived clients. The SEC alleges Hex tokens offered no utility other than to make people "rich" and its staking program was designed to manipulate the token's price and served no technical purpose.

The lawsuit stated Heart claimed Hex "was built to be the highest appreciating asset that has ever existed in the history of man." It also contains quotes from Heart's live streams in which he said, "If you want to get rich, [Hex is] built for that."

Nonetheless, Heart is still attempting to pull at the heartstrings, claiming he is "doing the best [he] can to make the world a better place" despite growing up poor and living in a warehouse.

I grew up poor. I lived in a warehouse. I worked hard and eventually raised $27,500,000 for charity. Wrote free self help books, free self help videos, called the Bitcoin top at $65,000 years ago. The last time I was at my moms house I installed a bidet for her. I did everything…

— Richard Heart (@RichardHeartWin) August 3, 2023

Some, including Coindesk, struggle to sympathise with Heart's victims due to the entire project being built on greed. Others, including us, are looking forward to the justice brought upon him.

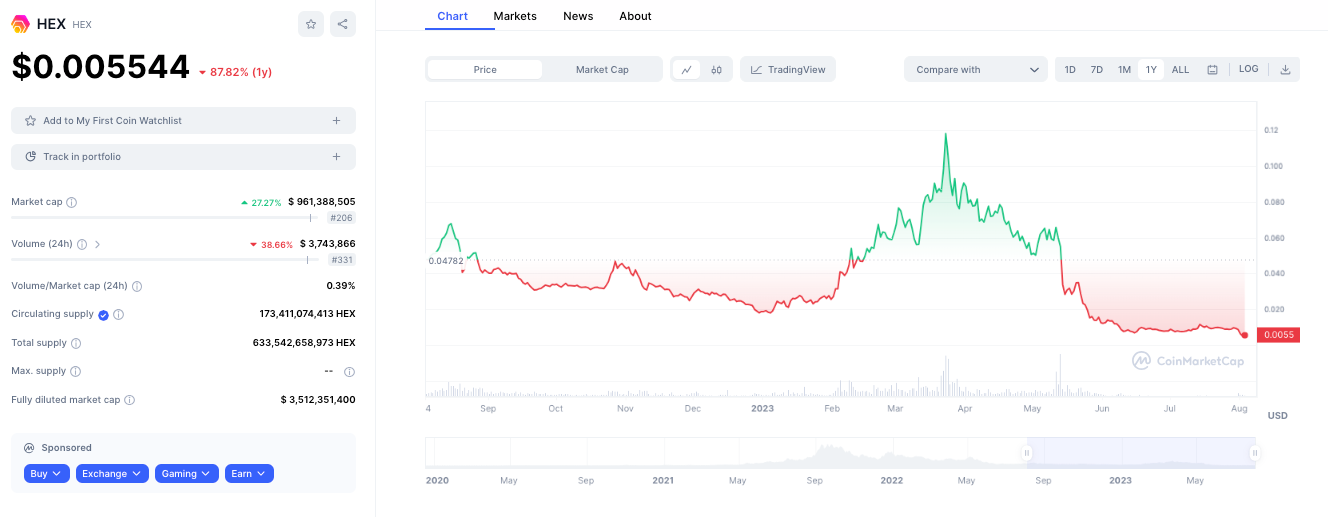

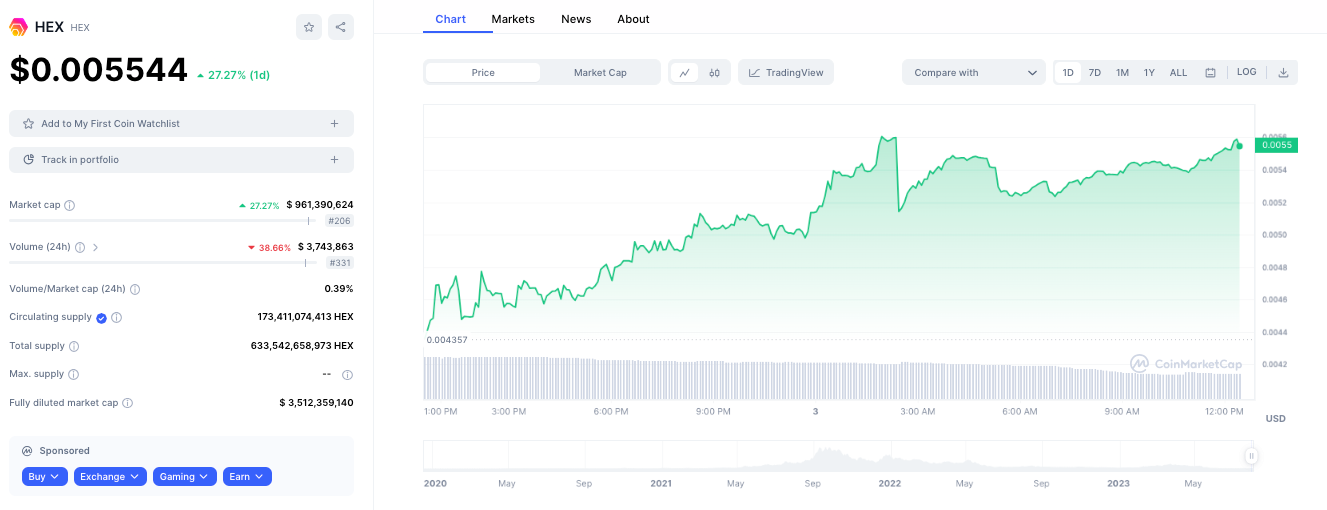

Hex token is down almost 90% over the year but interestingly is up nearly 30% today. That's crypto for you.

Elsewhere:

- A Third Half: Litecoin has completed its third "halving" event, cutting block rewards from 12.5 LTC to 6.25 LTC for miners. Occurring every four years, halving reduces the rate at which new LTC is introduced into circulation, thereby controlling inflation. On this trajectory, block rewards will eventually approach zero around 2142 upon reaching the maximum cap of LTC supply. LTC fell over 6% following the halving.

- Starting Thai Startups: Thailand-based venture capital firm, KX, has backed two blockchain and crypto startups, Magic and Transak. KX participated in Magic’s $52 million funding round in May, as well as Transak’s $20 million raise. The group's aim is to accelerate decentralized commerce within the Web3 ecosystem. KX's move comes as Thailand continues to embrace the industry.

- Shanghai Eyes Singapore and Hong Kong: Shanghai planning to construct a blockchain infrastructure hub link with Singapore and Hong Kong by the end of 2025. The partnership will involve applications in fields such as digital assets, transportation, industrial internet-of-things, supply chain finance, and carbon management. A blockchain network is planned to be built with dedicated computing power clusters to support Shanghai's blockchain initiatives. Shanghai aims to become a global leader in digital asset economies, with a focus on Web3, blockchains, NFTs, and the metaverse.

- Binance Thrives in China, or Does It?: Binance reportedly conducted $90 billion per month of business in China despite the country's crypto ban. The transactions make China the exchange's biggest market, accounting for 20% of its worldwide volume. However, Binance has since refuted the claims. “The Binance.com website is blocked in China and is not accessible to China-based users," a Binance spokesperson said to Cointelegraph.

- No Consensus on Consensys: Consensys, the developer behind MetaMask, is facing a lawsuit from entrepreneur Joel Dietz who claims he was written out of MetaMask's history. According to Dietz, he created the IP for what became MetaMask in 2014 with his project called Vapor. Dietz accuses Aaron Davies, who he hired, of conspiring with Consensys and betraying him. Consensys denies the claims, stating Dietz was not the founder of MetaMask.