Table of Contents

As many currencies continue to reel from depreciation shocks, a surprising crypto narrative has emerged.

Crypto markets are mostly traded and quoted in dollarized terms, which means that they can serve as a natural hedge in today’s macro forex environment.

Despite a lot of nationalistic rhetoric on "de-dollarization" i.e., to reduce dependency on the US dollar (USD), it is upended by the surging popularity of crypto in falling currency regimes around the world, from Argentina to Nigeria to Turkey.

Flight to Stablecoins as Dollar Proxy

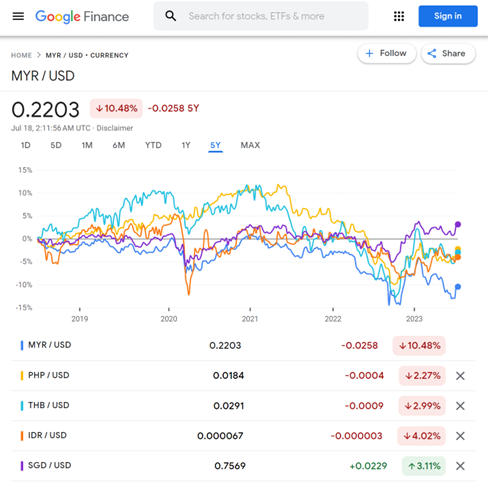

The Malaysian ringgit (MYR) was among the hardest hit Asian currencies in the first half of 2023, along with the Japanese yen (JPY) and Chinese yuan (CNY). Historically, MYR was pegged to the USD during the 1998–2005 period but the ringgit has not recovered to that level and tested record lows against the dollar several times in the past year.

Bread-and-butter issues caused by the weak currency have become political fodder for Malaysia’s upcoming polls. Heady food prices are expected to rise further by up to 20% in the following months. Netizens can be seen commiserating on r/Malaysia threads on Reddit (for instance: here and here).

Meanwhile, the local crypto community is making lemonade.

“Crypto may appear to be a speculative trading asset class but it has positive correlation to the USD bucket. By hedging to crypto, we will see a premium of 58% in terms of return on investments when compared to holding only MYR,” claimed Vincent Yeo, the CEO of PeerHive.

The interest rate differential makes crypto an obvious choice: “For comparison, Malaysia’s OPR (overnight policy rate) stands at 3% while US Fed Funds rate stands at 5.25%.” As a result, Yeo reasoned that the “currency flight from lower interest rate country to high interest rate country is bound to happen.”

Since stablecoin values are pegged to a numéraire or reserve currency like USD, they can mitigate the high price volatility of crypto and provide ready liquidity for users who move in and out of decentralized applications.

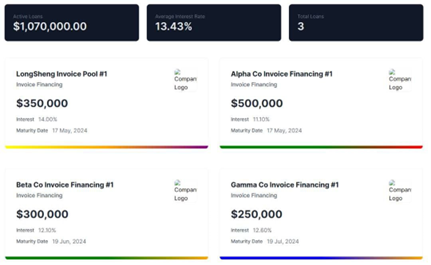

PeerHive, a DeFi platform that connects SME borrowers in need of funding with lenders worldwide, issues a USD-backed stablecoin. Its users are allowed to invest their stablecoin position "through the investments of private loan offers from SMEs, with an average return of 8-15% APY (annual percentage yield).” This according to Yeo, gives “a better rate of return than holding on to MYR while having foreign currency exposure.”

Others like Navonil Roy, CEO of LandOrc, an NFT-powered real estate lending platform, share a similar view: “I see people are hedging currency depreciation by buying relatively more stable currencies. These purchases are definitely happening in fiat within Malaysia and reflected in the long queues at foreign exchange outlets.”

While stablecoin activity is “not visible” physically, he observed that it is “the expression of the same trend but in a different form.”

Tax Avoidance or Tax Evasion?

Stablecoins play an important role as a gateway to the universal DeFi ecosystem, and as a medium of exchange due to their namesake stability. From what we gathered from our interviews, stablecoins are also being used for an unintended benefit – tax planning.

For Roy, the benefit of stablecoins is that they “allow for more predictability in tax computation.” For Yeo, “the price stability of using a stablecoin will significantly remove capital gains tax on their portfolio holding.”

Another source disclosed to us: “People are converting MYR into USDT as a proxy hedge to USD because if you convert MYR into USD bank deposit, the cost is higher (due to conversion cost from MYR to USD, then back to MYR).” Effectively, the outcome of this is that “the MYR they make are converted and moved offshore for tax avoidance,” he said.

There are two things to unpack from this new function creep. First, stablecoins can reduce transaction costs as they enable investors to trade crypto without having to convert back to fiat currency. Investors can park their crypto in USDT form as "dry powder" and call them on demand, given that crypto exchanges commonly offer USDT trading pairs. Second, it appears that there is an incentive to optimize one’s tax position with stablecoins.

To be clear, tax avoidance is legal – but tax evasion is not. The former refers to the lawful actions taken to reduce tax liability or to maximize after-tax income, while the latter involves the deliberate concealment or under-declaration of income information to the tax authorities. There is often a thin line between the two, however.

Marcus Tan, a digital assets lawyer who also heads compliance for a top exchange, acknowledged that “nothing prohibits a willing buyer and seller in accepting USDT or other crypto as an alternative to the legal currency (MYR).”

Such usage of USDT is currently “not subject to practical monitoring and observation by the authorities.” And therefore, he empathized that the authorities “would be having difficulties in tracking and assessing one for taxation purposes, if that person chooses not to self-declare any income derived or accepted in the form of USDT or other crypto.”

In any case, Tan warned that “business income or earnings derived or generated from crypto must be declared in parallel with the normal income obtained in the form of MYR. The public has no means in avoiding or evading tax just because he or she obtained income or revenue in the form of crypto.”

Foreign-Sourced Crypto Income Liable?

Malaysia does not tax capital gains. Major financial hubs such as Hong Kong, Singapore, and Switzerland adopt this approach as well.

Based on the Guidelines on Tax Treatment of Digital Currency Transactions released by the Inland Revenue Board of Malaysia (IRB), crypto transactions that are made for the purpose of passive investment (usually over a long term), rather than as an active revenue-generating business, are not taxable.

In the event that IRB discovers “any element of active investment using crypto, the gain obtained from the disposal is subject to tax. Active investment means that the person uses crypto as trading in a regular manner to earn revenue or income,” Tan explained.

By the same reasoning, stablecoin income are not liable for tax if they are capital in nature.

But there’s a catch! Stablecoins are not approved for listing in any of the licensed crypto exchanges in Malaysia; and they cannot be bought or traded in any of those venues. Which means that investors have to source from unofficial corners of the market, purportedly out of Malaysia.

This is where it gets dicey. Malaysia uses a territorial tax system rather than a residential tax system, so only locally sourced income is taxable while those that are foreign-sourced is not. Once MYR is converted into stablecoins on foreign exchanges, some argue that tax can be avoided.

Still, others like Yeo are of the opinion that the overall tax status “remains unclear due to the nature of decentralization.” Blockhead was unable to verify this with examples.

To his point, a recent report by the International Monetary Fund (IMF) on Taxing Stablecoins admitted that “most jurisdictions currently have not adopted a clear position on the income tax treatment of stablecoins as an asset class.” Nonetheless, “the vast majority effectively treat crypto assets as property for income taxation purposes even when used as a means of payment,” wrote IMF.

The Taxman Has the Last Word

Pursuant to the Guidelines and normal taxation principles, Tan clarified that “any business income or revenue derived or generated from or in the form of crypto is subject to tax declaration unless any specific exceptions apply.”

“Foreign sourced income is also subject to tax, provided the assessment and taxation methodology follows the existing taxation law. The income derived or generated from or in the form of crypto is actually subject to the same treatment as MYR, save and except several exceptions,” he added.

We reached out to the Malaysian tax authorities (IRB) for this article, and they were quick to reply, specifically in relation to stablecoins:

Regardless of whether “the reference asset may be fiat money, exchange-traded commodities or a cryptocurrency; as digital currencies are treated as intangible assets for taxation purposes, any digital currency needs to be valued in MYR,” said Ranjeet Kaur, director of the CEO’s Office.

And “if the profit or appreciation in value is revenue in nature, it is taxable once realized.”

At the very least, this means that your foreign stablecoin holdings would be valued in the domestic currency and taxed according to the rules that apply.

Now you know.

Disclaimer: #NotTaxAdvice