Table of Contents

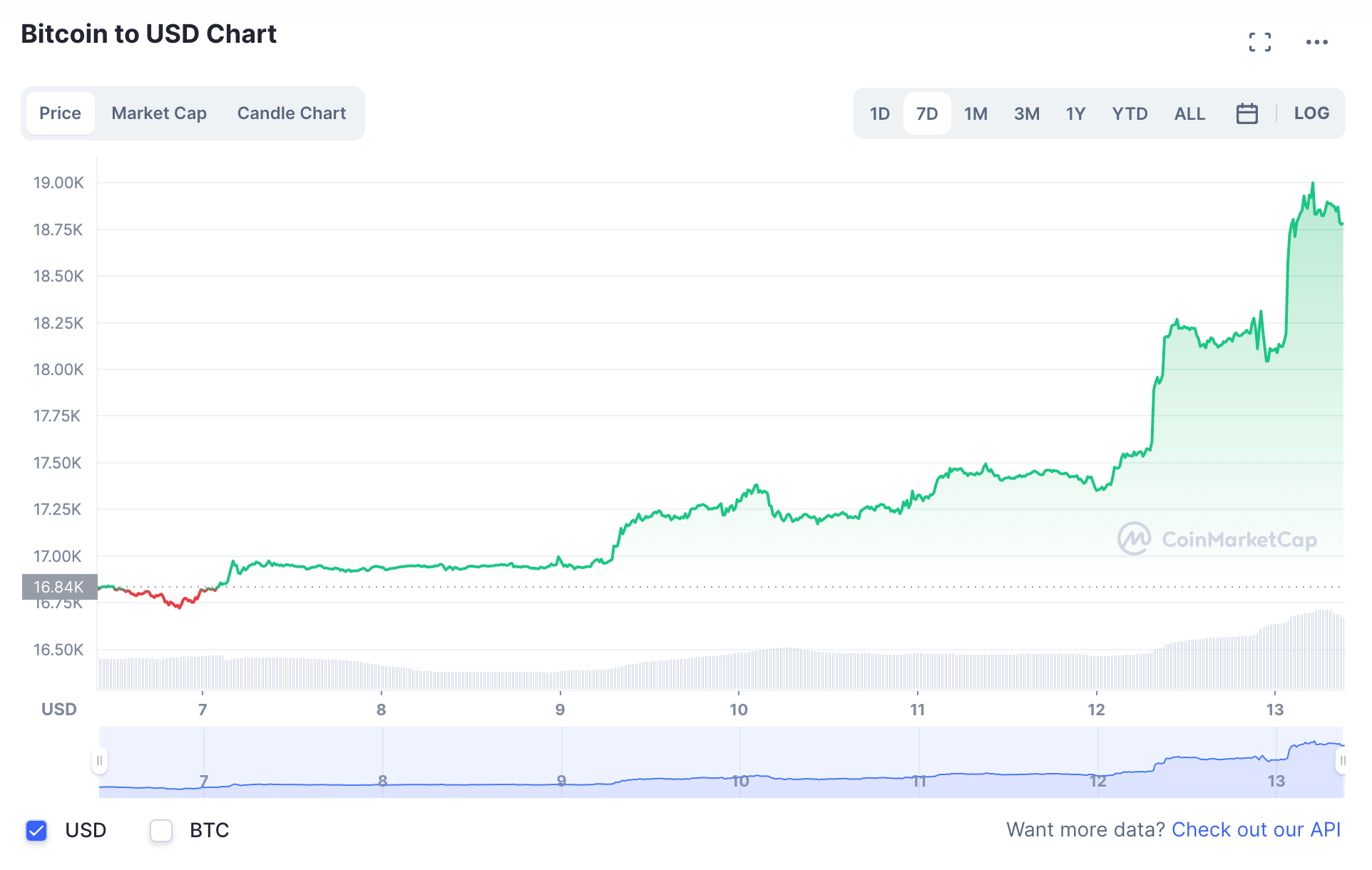

Bitcoin and other cryptocurrencies climbed on Thursday, with the world's largest cryptocurrency touching US$19,000 after positive inflation data injected some much needed life into the markets.

At the time of writing, Bitcoin (BTC) is exchanging hands at US$18,801.22 (+11.65%) while Ethereum (ETH) is trading at US$1,407.25 (+12.33%). Major altcoins such as BNB , Polkadot (DOT), and Avalanche (AVAX) have also been trading in green within the same period.

The release of the latest US Consumer Price Index (CPI) print has bolstered the narrative that inflation is waning, offering a potential window of opportunity for risk assets. The CPI rose 6.5% in December from a year earlier, in line with expectations and down from a 7.1% increase in November. Investors are now hopeful that inflation is on a more sustained downward trend, and that less aggressive rate hikes are imminent.

While the dormant crypto markets will likely be rejuvenated by the improving sentiment and the recent short squeeze, Thursday's cooler inflation data was also mixed with a strong labour market report, and hence it might be too early and even naive to think that the broader financial market is on a highway to recovery.

"The nearing of the end of Fed tightening gave risky assets an initial boost, but that is quickly fading away. Bitcoin was unable to break the $18,500 barrier, which suggests price might remain trapped in the trading range that has been in place over the past couple of months," said Oanda's Edward Moya on Thursday.

Voyager-Binance deal to advance

A US judge has approved the proposed US$1 billion sale of Voyager Digital's assets to Binance US.

Under terms of the deal, about US$1 billion worth of assets that Voyager holds on behalf of its customers would be taken over by Binance, which will then provide account holders the option to withdraw.

The deal, if successful, will see Voyager customers recover 51% of their capital. It will first require approval from the majority of Voyager's customers in the coming weeks.

Voyager initially agreed to sell itself to FTX as part of its plan to liquidate in bankruptcy, but Binance US hijacked the deal in December. The bid is 27% lower than FTX‘s bid, which came in at $1.4 billion before the exchange collapsed last month. Voyager declared bankruptcy in June, citing heavy exposure to 3AC.

Polygon community proposes hard fork

Ethereum Layer 2 scaling solution Polygon is set to undergo a hard fork early next week, according to a blog post published on Polygon Labs' website Thursday.

The development was first introduced to Polygon's community in December, and is finally taking place after a month of debate among community members and developers.

Polygon Labs said that the hard fork will help to prevent network gas fee spikes (usually seen during periods of network congestion) and address chain reorganisations (when a blockchain produces blocks at the same time, mostly due to congestion or a bug).

While the network is significantly more scalable than Ethereum, it has still experienced periods of overload and high gas fees, as seen earlier this year when popular NFT game “Sunflower Farmers” clogged the network and sent network fees soaring.

📢 GET READY FOR THE HARDFORK 🔥

— Polygon (@0xPolygon) January 12, 2023

The proposed hardfork for the #Polygon PoS chain will make key upgrades to the network on Jan 17th.

This is good news for devs & users -- & will make for better UX.

You will NOT need to do anything differently. Details:https://t.co/RaBWDjEGrI pic.twitter.com/nipa15YQdZ

SEC interrupts Genesis-Gemini showdown

The US Securities and Exchange Commission (SEC) has gatecrashed the recent public spat between Gemini and Genesis, with the financial watchdog alleging that both entities offered and sold unregistered securities to retail investors through the Gemini Earn crypto asset lending program.

"Through this unregistered offering, Genesis and Gemini raised billions of dollars’ worth of crypto assets from hundreds of thousands of investors. Investigations into other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing," the SEC said in a press release on Thursday.

1/ It’s disappointing that the @SECGov chose to file an action today as @Gemini and other creditors are working hard together to recover funds. This action does nothing to further our efforts and help Earn users get their assets back. Their behavior is totally counterproductive.

— Tyler Winklevoss (@tyler) January 12, 2023

Responding to the charges on Twitter, Gemini co founder Cameron Winklevoss said that the allegations were "super lame" and a "manufactured parking ticket." He also noted that Gemini had been discussing the Earn program with the SEC “for more than 17 months," but the regulator never raised the prospect of any enforcement action until after Genesis paused withdrawals on November 16t.

Read more: Gemini's Winklevoss Demands Sacking of DCG Chief

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$901.86 billion, a 1.63% increase since yesterday. The total crypto market volume over the last 24 hours is US$59.93 billion, a 40.23% increase.

Elsewhere, data from WuBlockchain's statistics indicates that spot trading on major exchanges fell 42.8% month-on-month in December. The three smallest decreases were Bitget (-8%), Crypto.com (-23%), and BitMart (-27%). The top three decreases were Phemex (-76%), Bitfinex (-58%) and Gate (-57%).

Derivatives trading on major exchanges fell 47.6% in December from the previous month. Three of the smallest decreases were Crypto.com (-10%), Mexc (-25%) and Bitget (-28%). The top three declines are Phemex (-85%), Deribit (-62%) and Bitfinex (-60%).

Fear & Greed Index

Risk appetites in crypto remain sapped – the Crypto Fear and Greed Index currently stands at 31, indicating “ fear.” The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.