Table of Contents

For the better part of 2021, the crypto space reeked of desperation, with dodgy (and even “legitimate”) personalities either shamelessly shilling the possibility that something as volatile as crypto could actually become the world’s de facto currency, or changing their social media profile pictures to an Adjective Animal NFT which more than often, as its name suggests, looked suspiciously similar to a certain blue-chip NFT.

Spurred by a bull run, investors blindly aped into dog-themed tokens, VCs sprayed and prayed, and the metaverse was suddenly a tangible place to live and work.

Then came Web2.5, born out of the sudden realisation that Web3 isn’t going to be a walk in the park. It’s basically the industry saying: “Look, we’ve blown this way out of proportion, and we’re probably not going to make it, so let’s just tell everyone that the halfway point will suffice for now.”

And then in 2022, some of crypto’s biggest smart alecs decided to go full on Wolf of Wall St on the market, sending it on a death spiral and breaking countless hearts and banks in the process.

So as the year comes to a close, let’s review the list of crypto supervillains who pooped on 2021’s much-missed bull party, and are definitely not receiving any presents from Santa this Christmas.

Do Kwon – TerraForm Labs

This pompous, Kim Jong Un-looking MF is one of the main reasons why our crypto portfolios are down 70% this year. Kwon’s algorithmic-i-don’t-even-know-how-stablecoin TerraUSD (UST) suddenly became unstable overnight, causing the perpetually-anxious crypto markets to suffer a panic attack and then a subsequent full-blown cardiac arrest.

What made things worse was the fact that the Luna Foundation Guard (LFG) and Do Kwon had purchased large quantities of bitcoin (believed to be somewhere around 80,000 BTC) to store in reserves, should UST unpeg, which meant that their sell-off only exacerbated the market crash.

Kwon once said: “I don’t debate the poor on Twitter, and sorry I don’t have any change on me for her at the moment.” He was responding to British economist Francesca Coppela’s tweet that self-correcting mechanisms – such as the kind adopted by UST – will likely fail if large amounts of investors abruptly head for the exit door.

Read more: “You’re Not Answering the Question”: Laura Shin Grills Do Kwon

On the surface, Kwon’s arrogance contributed to the downfall of Terra because he refused to acknowledge the flaws of the Terra ecosystem. But one cannot help but wonder if he genuinely believed in the success of Terra, or perhaps it was all just an elaborate facade to conceal the fact that he deliberately planted the chinks in Terra’s armour.

Read more: Su Zhu, Do Kwon Take Higher Ground Against SBF for Market Manipulation

Crypto winter was sparked by Terra’s downfall, so the only present Kwon deserves is a visit from the police.

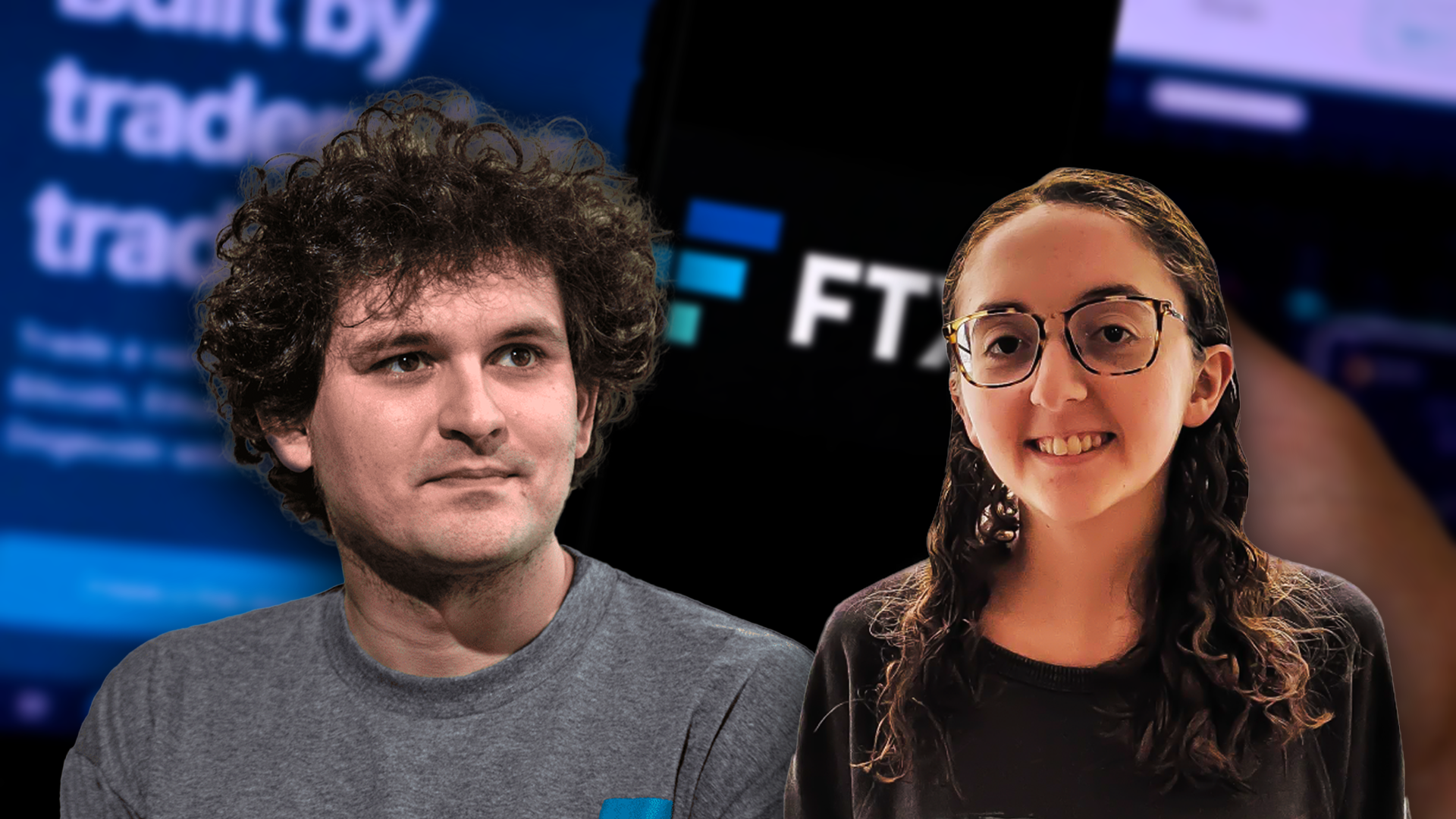

Sam Bankman-Fried (SBF) and his side-chick Caroline Ellison – FTX

Crypto is ending the year with a new final boss: former FTX CEO Sam Bankman-Fried.

FTX’s trouble first came to light when a private financial document reviewed by CoinDesk revealed that its sister firm, Alameda, has a balance sheet reportedly “full of FTX’s FTT token,” which meant that the hedge fund was essentially resting on a self-conjured token, and not an independent asset like a fiat currency. Alameda was reportedly helmed by Caroline Allison, a self-proclaimed “Potterhead” who is also rumoured to be SBF’s ex-girlfriend.

Despite news of Coindesk’s allegations, SBF was seen busy playing League of Legends. In a screenshot circulating on Twitter, it appeared that SBF logged on to the game amid FTX’s early chaos and played multiple games for a collective time of over one hour across 24 hours.

FTX subsequently collapsed under the weight of US$32 billion worth of risky bets, with the company eventually filing for a Chapter 11 bankruptcy in the US.

“Any apology from me would ring hollow… no one gives a sh*t right now… I don’t know, sh*t’s complicated… it is what it is,” Bankman-Fried said in an interview with crypto whistleblower Tiffany Fong.

As reported earlier today, SBF is set to be remanded in the Bahamas’ notorious Fox Hill prison. We wonder what sort of “presents” SBF would soon be receiving in there…probably just the Epstein treatment. It is what it is.

Su Zhu & Kyle Davies – Three Arrows Capital (3AC)

Founded by Su Zhu and Kyle Davies in 2012, 3AC was one of crypto’s biggest hedge funds, with stakes in some of the industry’s key players including Terra (LUNA), BlockFi, and Deribit.

However, the founders’ ego grew along with the size of the fund, and 3AC began taking risky bets. When Terra eventually collapse in May, a domino effect occurred, and 3AC failed to meet its margin calls. It subsequently became insolvent and could not repay its US$665 million loan from Voyager Digital, causing the crypto brokerage to file for bankruptcy. Approximately 27 companies were reportedly exposed to 3AC, and its collapse only worsened the contagion sparked by the downfall of Terra (LUNA).

The whereabouts of both Zhu and Davies remains a mystery following the collapse of their respective firms and coins. Neither are yet to be held fully accountable for their crimes and have taken an uncooperative and evasive stance with law enforcement. However, both men have suddenly emerged on Twitter again, and have even adopted self-righteous personas to weigh in on the FTX collapse.

Read more: Su Zhu, Do Kwon Take Higher Ground Against SBF for Market Manipulation

No presents for being hypocritical.

Alex Mashinsky – Celsius Network

Terra’s implosion saw the crypto markets take an initial nose dive between May to June this year, which sparked a bank-run style series of withdrawals from crypto lender Celsius Network – probably crypto winter’s first casualty without taking into account Terra (LUNA).

In July, the company eventually announced it had initiated Chapter 11 bankruptcy proceedings.

Court filings spanning over 14,500 pages have revealed that Celsius Network executives withdrew substantial funds ahead of halting withdrawals for the platforms users.

The document, uploaded by Gizmodo, shows the transactions of all Celsius users, including purchases, withdrawals and interest earned. Former CEO Alex Mashinsky and ex-CSO Daniel Leon had been accused of withdrawing US$17 million in between May and June 2022, ahead of withdrawal suspension and the company’s bankruptcy.

The document also revealed that Mashinsky’s wife withdrew over US$2 million on 31 May.

FTX was even interested in making a deal with Celsius but walked away because of the state of its finances, two sources told The Block. The platform had a US$2 billion hole in its balance sheet, and FTX found the company too difficult to deal with, one of the sources told the publication.

In September, Mashinsky resigned from his role, stating that his role as CEO had become an “increasing distraction”.

No presents for being dodgy and abandoning ship.

The “not that naughty but still kinda sus” list

Changpeng Zhao (CZ)- Binance

Don’t be fooled by CZ’s understanding smile and cute little bald head.

CZ is crypto’s most powerful middleman right now, an ironic statement considering the fact that crypto is supposed to be all about decentralisation and self-custody.

You have to give it to the guy. Prior to the market downturn, CZ was worth a whopping US$96 billion (by the way, so much for a crypto being a more equitable form of finance), and with what was arguably his biggest competitor now sitting in a Bahamian prison cell, CZ and Binance are poised for further domination.

At present if Binance were to collapse, BTC would likely go to 0 within minutes. The bad news is that investors are actually growing skittish about the exchange’s less-than-satisfactory proof of reserves, after the Wall Street Journal identified a number of red flags in the report.

CZ isn’t “naughty” yet, but he’s quite possible crypto’s secret “Bond Villain” now.