Table of Contents

Contagion continues in the FTX saga as Solana becomes the next under the spotlight. FTX founder Sam Bankman-Fried has long been a supporter of Solana, which up until two weeks ago has worked favourably for the blockchain. However, concerns about SBF and FTX’s relationship with Solana have led exchanges to temporary suspend support for stablecoins listed on the blockchain.

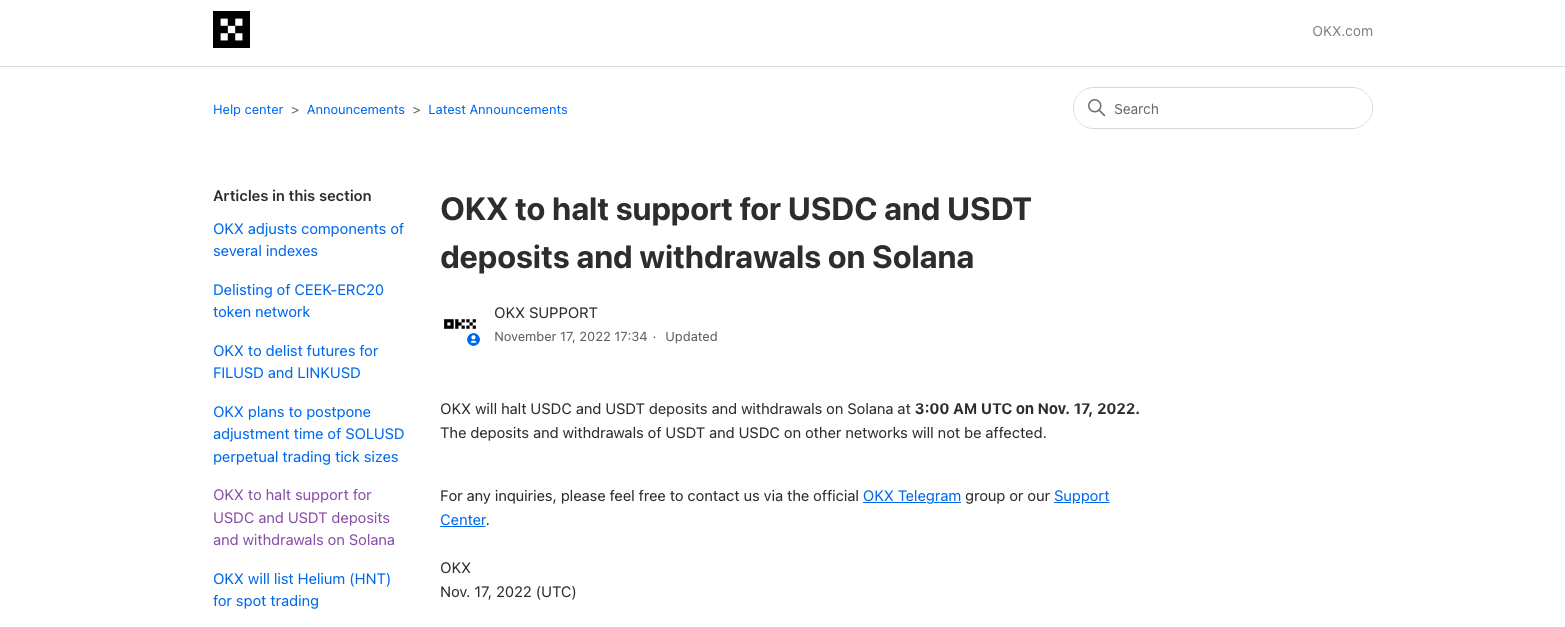

On Wednesday evening, OKX stated it would delist USDC and USDT tokens starting at 3:00 AM UTC on Nov. 17, suspending deposits and withdrawals for the tokens on Solana. “The deposits and withdrawals of USDT and USDC on other networks will not be affected,” the exchange added.

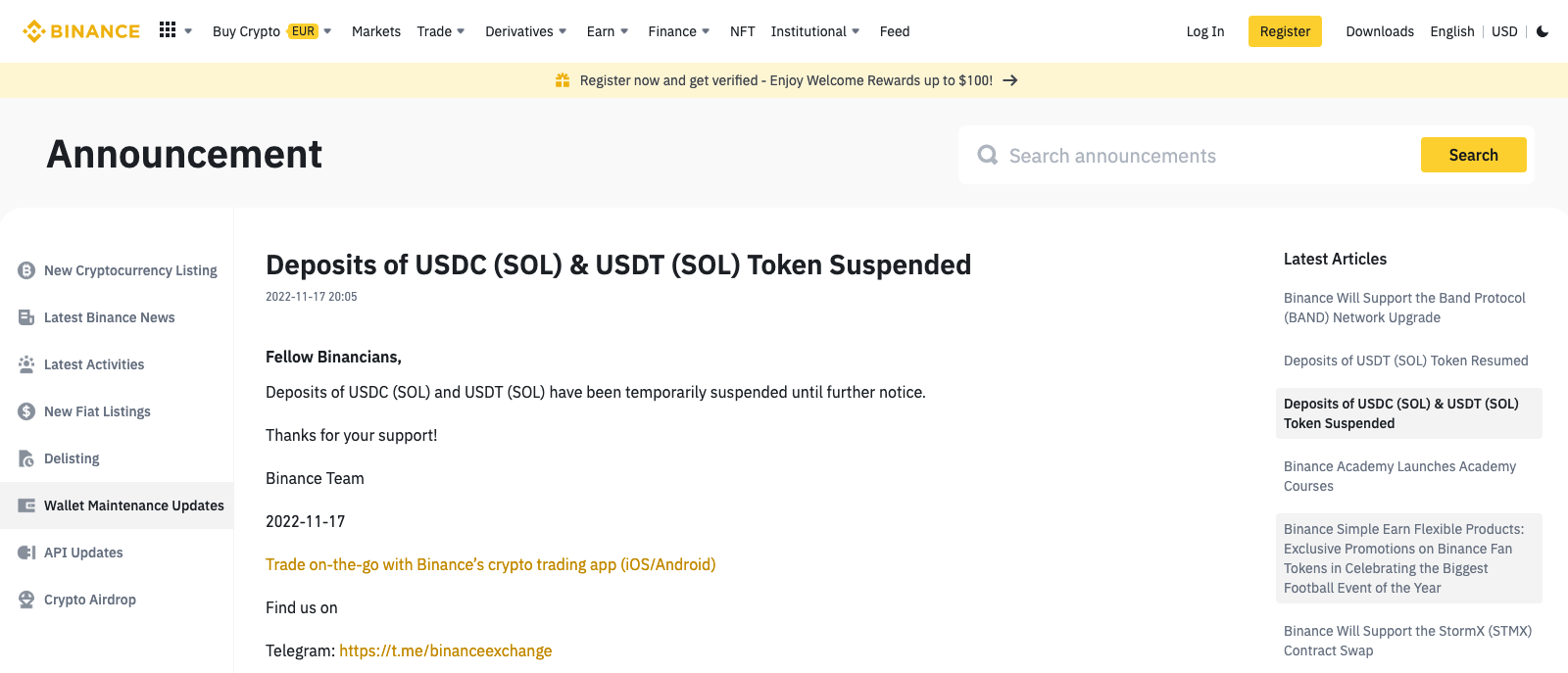

Shortly after on Thursday, Binance issued a similar announcement. “Fellow Binancians, Deposits of USDC (SOL) and USDT (SOL) have been temporarily suspended until further notice,” the exchange stated. Bybit and BitMEX also followed suit.

None of the exchanges expanded on why the tokens were suspended but Binance has since resumed deposits for the stablecoins.

US$5 billion of USDC is on Solana, accounting for 11% of its total market cap whilst the blockchain has US$1.9 billion of USDT, making up 1.3% of its total value.

SBFolana

Since FTX’s collapse, SOL has tanked over 50% as concerns about the FTX x SBF x Solana relationship grow.

Alameda Research was the biggest backer of SOL, holding US$292 million of unlocked SOL, US$863 million of locked SOL, and US$41 million of SOL collateral. What’s more, one of Solana’s biggest draws was SBF, FTX and Alameda support. As protos explained, “some of Solana’s flagship projects were more dependent on SBF’s empire than elsewhere.”

Read more: Temasek Writes Off $275m FTX Investment, “Irrespective of the Outcome”

Solana-based protocol Sollet, which issues FTX/Alameda-backed wrapped Bitcoin and Ethereum for the Solana DeFi ecosystem, has seen its assets rapidly de-peg. Over the week, SoBTC has lost 95% of its value, while SoETH is down 83%. As of 10 November, Sollet-based assets on Solana in circulation is valued at approximately US$40 million.

With SBF, FTX and Alameda no longer in the picture, Solana’s performance is already suffering too.

Solana Whale (3oSE9CtGMQeAdtkm2U3ENhEpkFMfvrckJMA8QwVsuRbE) is in liquidation and currently has 2,450,418.5 SOL (worth over $51 million) in collateral and 44,871,609.6 USDC in debt. However, Solana is currently facing congestion due to the update of the oracle. pic.twitter.com/qJKMViJeQK

— Wu Blockchain (@WuBlockchain) November 9, 2022

SBFUD

With concerns already circulating about the SBF-Solana relationship, the latest move by exchanges to halt support for USDC and USDT on the blockchain has compounded the FUD.

As always, crypto Twitter was the first to (over)react. “Send $sol to 0 already,” responded one tweeter to news of OKX’s announcement.

Read more: Malaysia’s Luno Community Spreads Mega FUD After Genesis Suspends Withdrawals

“4 exchanges halted USDC/USDT on Solana this looks not a normal maintenance to me. something is wrong,” feared another.

Another simply tweeted, “If you have any #USDC or #USDT on #Solana it’s time to bail! Exchanges are removing Solana based stables. You may be trapped if things escalate. Better safe than sorry, right? 😅”

Send $sol to 0 already

— only21m (@bearslayer5) November 17, 2022

4 exchanges halted USDC/USDT on Solana this looks not a normal Maitanaince to me. something is wrong.

— ₿⭕nske (@B0NSke) November 17, 2022

If you have any #USDC or #USDT on #Solana it’s time to bail!

— Duo Nine | discord.gg/ycc (@DU09BTC) November 17, 2022

Exchanges are removing Solana based stables.

You may be trapped if things escalate.

Better safe than sorry, right? 😅 pic.twitter.com/gvcZt88LUT

Solana fam

FUD is a powerful tool, and was one that CZ skillfully capitalised on to quash his competitor. Binance has yet to clarify exaclty why it temporary halted support for USDT and USDC on Solana but even its brief suspension sent shockwaves through the space.

However, where there are NGMI vibes there are always WAGMI vibes too. Predictably, one triumphant supporter of SOL’s survival is the Solana Foundation. The group revealed it only held US$1 million worth of cash or equivalent assets on FTX as of November 6, accounting for less than 1% of its funds.

It also holds approximately 3.24 million shares of FTX Trading LTD common stock, along with about 3.43 million FTT tokens and 134.54 million SRM tokens from DEX Project Serum.

The foundation also stated that “most of the largest DeFi projects on Solana had limited or no exposure to FTX.”

Read more: Genesis Halts Withdrawals But Singapore Arm “Not Technically Bankrupt”

Support was also seen by Coinbase Cloud, which posted a 13-tweet thread to “highlight Solana’s latest technical progress for the community.”

“Coinbase Cloud has been supporting @Solana since their earliest testnets,” the dapp platform wrote, describing themselves as a “leading validator.”

“There are two improvements that stand out: – The network has been upgraded to fix the issues that led to prior outages – As a testament to the efficacy of these upgrades, the network continues to run under meaningful load and it has done so successfully over the past two weeks,” Coinbase Cloud wrote.

“The Solana network, handicapped with a portion of stake offline, is still running under increased load. It hasn’t halted or stopped a single time. To say that things have improved would be an understatement. The recent upgrades have been crucial.”

“Looking forward to the future, there’s numerous improvements expected on the horizon,” Coinbase Cloud concluded, highlighting Firedancer as one to watch.

Elsewhere, Solana fans are reminding each other that Kraken still offers loyal support for the blockchain. “Hey @solana fam 🫡 @krakenfx supports SOL USDC Buy, trade, deposit, withdraw.. it’s all one USDC! Plus, the mobile app is incredibly beautiful. Give it a go 🤝” one Solana enthusiast tweeted.

1/ Coinbase Cloud has been supporting @Solana since their earliest testnets. As a leading validator, we wanted to highlight Solana’s latest technical progress for the community. 🧵

— Coinbase Cloud (@CoinbaseCloud) November 17, 2022

Hey @solana fam 🫡

— Bill King™️ (@BillKingTM) November 17, 2022

@krakenfx supports SOL USDC

Buy, trade, deposit, withdraw.. it’s all one USDC!

Plus, the mobile app is incredibly beautiful. Give it a go 🤝 https://t.co/8XhXkVqswb

GG Solana?

It’s hard to drown out the FUD surrounding Solana, especially on social media. However, taking a step back, Solana’s ties with FTX doesn’t seem too damaging, at least nothing that the foundation is unable to recover from.

That said, it’s the perception that drives human behaviour and ultimately market prices. If developers are deterred to build on Solana due to fears of it being less stable than before, and if market participants are unwilling to hold SOL for similar reasons, Solana’s days could be dwindling irrespective of how the foundation perceives it. At this point, restoring Solana’s reputation is more important than recovering lost FTX funds, but this could be easier said than done.