Table of Contents

Lets be honest, all this talk about focusing on web3 and web2.5 over the past few months by evangelists is white noise at this point. When we have recent events like FTX’s fall from grace, “industry leader” speeches about the potential and the future of web3 tech are all for naught when the reality seems like those that aren’t in the inner circle are being indoctrinated to being their exit liquidity.

Yet, the cycle continues and we find ourselves in an extended bear market with an all too familiar playing field for startups to continue building and delaying their monetizing strategies. Reality is going to set in for some of these projects, that the work done for building has to be paid.

Coupled with liquidity crunches setting in from the contagion aftermath, web3 companies and VC LPs looking to raise for the next round are expected to go through the cycle in hard mode, giving up more control in exchange for survival capital. Capital allocators that have been on the sidelines are now frothing at the mouth in excitement to comb through projects and re-evaluate those that were previously deemed worthy in this space.

Also welcome other industry players with cash who wants to co-invest.

— CZ 🔶 Binance (@cz_binance) November 14, 2022

Crypto is not going away. We are still here. Let’s rebuild.

2/2

Business as usual for some web3 verticals

“We actually think that this is a pretty good time to do it because most of these projects valuations are much more reasonable than they were a year ago,” said CZ talking about collaboration via his industry recovery fund at his Twitter AMA earlier this week.

Read more “Exchanges are Inherently Risky Businesses”: CZ Talks Contagion Impact on Twitter AMA

Since the Binance announcement, other Layer 1s in the market have also jumped in with the announcements of their own capital deployment strategies to attract all sorts of developers to build on blockchain and push the envelope on blockchain possibilities.

In the hyper focused web3 space, the Fantom Foundation and Gitcoin launched a developer-focused grant program for “-Fi protocols” looking to build on web3. Their focus remains in an all encompassing Web3 thesis to support all verticals of NFTs, GameFi and metaverses.

In the APAC region, Tezos announced the first cohort for its APAC EGG web3 incubator, where the selection criteria on these companies tend to be traditional businesses models built with blockchain in mind. Some Zero-to-One models in here but yet to be tested.

What are the latest innovations set to elevate the #Web3 ecosystem?

— TZ APAC (@TzApac) November 15, 2022

Join us for a sneak preview on Twitter Spaces where Cohort 1 of the TZ APAC EGG Incubator will go live to share more.

📅 Wednesday, 23 November

⏰ 9pm, GMT+8

Set a reminder: https://t.co/ccmWVnF9ke pic.twitter.com/rH4dtFCSid

A new direction for DeFi adoption

While the funding for the other verticals in Web3 have not really changed its mandate, it seems that the crypto contagion at this point seems to be exclusive only to FTX and Alameda linked projects and investors who followed their fund thesis of going in big and fast into web3 protocols exclusive to DeFi.

Read more: BlockFi on the Brink

A comb through of the funds that announced their losses came exclusively from the FTX ecosystem of lending protocols that over-levered between each other. Which ironically, seems to be the final domino for a DeFi era of TradFi models pieced together with a blockchain layer.

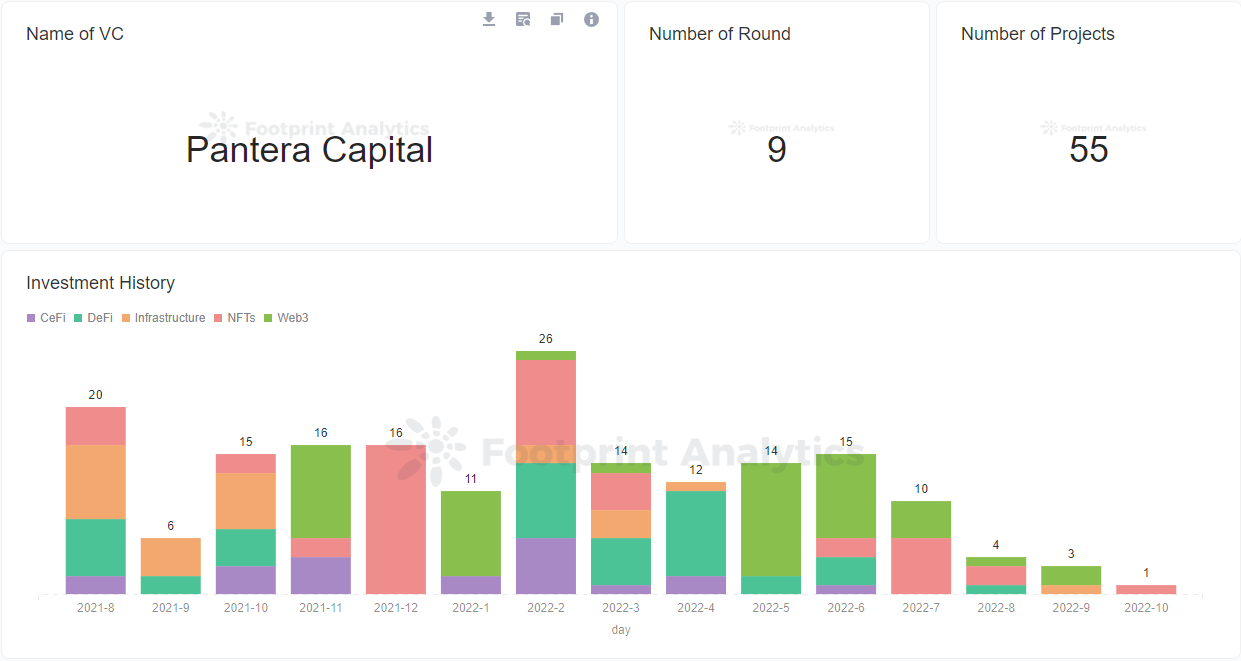

Pantera Capital announced that their lost investments came from the Blockfolio acquisition ,which made up for less than 3% of their AUM. In an open letter, the asset manger shared that the perverse nature of hidden dealings within FTX brought to light the problems that were exclusive to CeFi. They said that moving forward, they would desire regulations to move towards regulating centralised institutions over regulating DeFi, which serves as a more transparent, efficient and decentralised financial ecosystem.

In the same letter, they showed that their recently portfolio investments were into Braavos, a frictionless user acquisition wallet for DeFi, and Waterfall, a fractionalised NFT trading and future pricing protocol.

The takeaway from this letter revealed two things: web3 adoption remains the goal and there is significant fear in the markets over DeFi and regulation.

But when there is fear, there is opportunity, and it comes in the form of crypto custodian BitGo, looking to raise funds at an obnoxious $1.2 billion valuation. Crypto custodians will continue to lead the charge to onboard institutional funds as investors peering into DeFi crave deep level security solutions that remains lacking within digital asset classes.