Table of Contents

Singapore’s state-owned investment fund Temasek is “engaging” with embattled crypto behemoth FTX in its capacity as a shareholder after the exchange experienced a liquidity crunch, which saw it turn to its rival, Binance, for a bail out.

The sovereign wealth fund told Reuters that it was “aware of the developments between FTX and Binance, and are engaging FTX in our capacity as shareholder,” but did not provide further details about how the developments would impact its portfolio.

Read more: Is Temasek’s Investment in Crypto Firm Amber Worth the Risk?

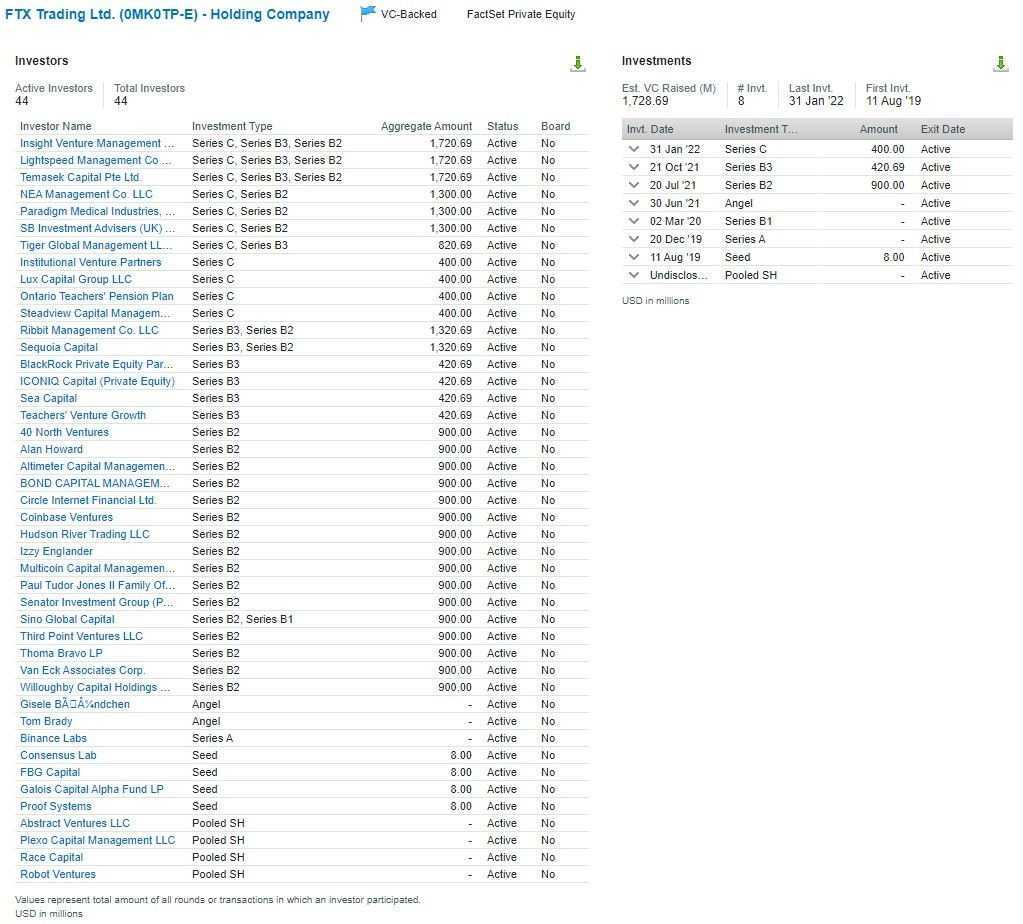

Temasek had invested in FTX in its Series B, Series B extension, and Series C funding rounds in October last year, when the exchanged raised US$1 billion, US$420 million, and US$400 million respectively. In January, FTX was valued at US$32 billion.

A leaked spreadsheet on Twitter shows that Temasek is the third-largest investor in FTX, but it’s unclear just how much Temasek has inveseted into FTX.

Earlier today, Binance called off the acquisition deal, citing “corporate due dilligance” as well as the latest reports of an SEC probe into FTX’s handling of user funds amid the liquidity crisis.

Read more: CZ Naughtily Pulls Out of FTX Deal, Leaves SBF Hanging

News of Temasek’s “engagement” with FTX were published before Binance decided to ditch the deal, and hence it remains unclear how Temasek and other FTX shareholders will be impacted. Temasek has also told media outlets that “given the ongoing discussions between both companies, it wouldn’t be appropriate for us to comment beyond that”.

Temasek did not respond to Blockhead’s request for comments.

Read more: Withdrawals Frozen Again, Markets in Freefall… Thanks FTX, SBF, CZ

Elswhere, venture capital Sequoia capital has told its investors that it is marking down its investment in FTX down to US$0.

In a letter to its limited partners (LP), Sequoia said that the full extent extent and nature of the risk is unknown, but its exposure to the company is limited.

Sequoia also revealed that its owns FTX.com and FTX US in one private fund, but FTX is not a top ten position in the fund and the US$150 million loss accounts for less than 3% of committed capital. Another fund had invested US$63.5 million in FTX.com and FTX US, representing less than 1% of the fund’s portfolio as at September 30, at fair value.