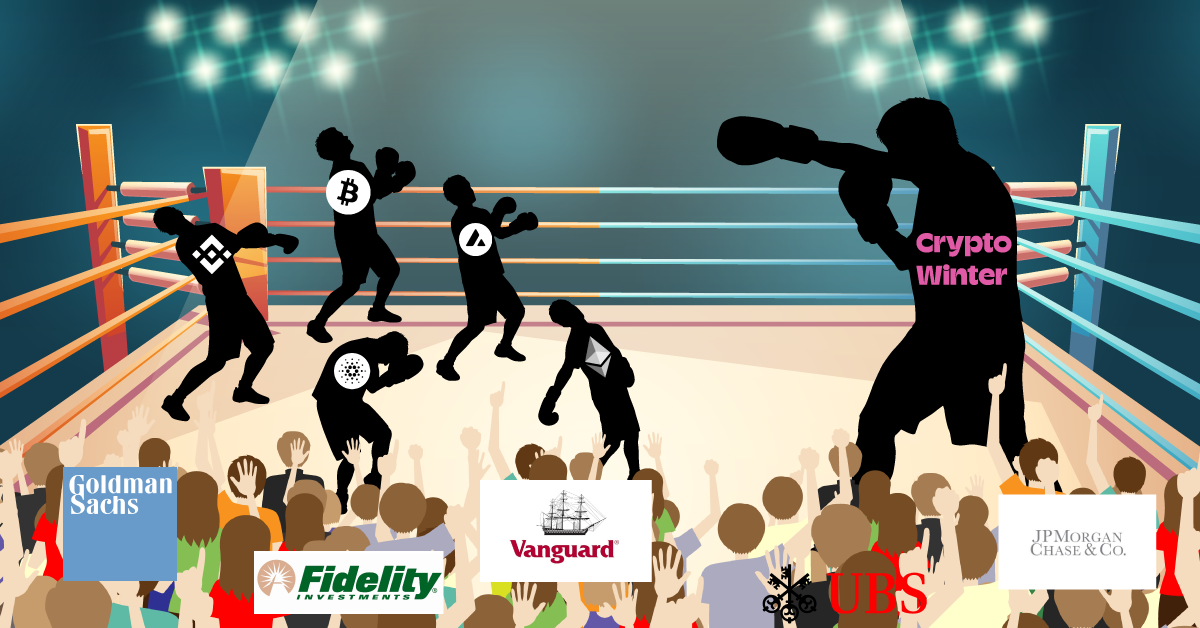

Funds Bet Big Even as Battered & Bruised Cryptocurrencies Face More Pain Ahead

For battered and bruised cryptocurrencies in the depths of crypto winter, there is more pain ahead before recovery, even as investment funds bet big on exchange-traded digital assets, a Blockhead survey showed.

The cold and hard crypto winter will continue this year, with any sharp recovery now predicted to come in the second half of next year compared to expectations for the worse to end by the turn of this year just a couple of months ago, according to a Blockhead survey of 20 analysts at research and investment management firms.

“Now that it is established cryptos are the new-age risk assets, the troubles are not yet in the rear-view mirror. If anything, they have more to fall before they rise like a phoenix,” said a chief investment officer at a large wealth management firm in Boston, with over $1.5 trillion in assets under management (AUM).

“We are not out of the woods, but at the same time, it is the best time to get into digital assets and add more to your portfolio, despite the risks of a global recession from higher borrowing costs around the world in an unprecedented fight against elevated but supply-driven inflation,” he added.

Outlook cut

Bitcoin is now forecast to end this year at US$20,000 and rise to US$26,500 by the end of 2023, from around $21,000 currently, according to a Blockhead survey of 20 analysts at research and investment management firms conducted in October and re-polled after the US Federal Reserve’s November meeting.

That is a sharp cut to the outlook for bitcoin from the previous survey of US$29,500 and US$45,000 for end-2022 and end-2023, respectively.

Forecasts in the latest survey ranged from a low of US$15,000 to a high of US$35,000 for bitcoin by the end of 2023, compared to the US$15,000 to US$60,000 range in the previous Blockhead poll.

The outlook for Ethereum was not very different.

Ethereum was predicted to weaken to US$1,400 by the end of 2022, then rise to US$1,650 by mid-2023, and climb further to US$2,000 by the end of December next year, from around US$1,590 currently. The range of forecasts was US$1,000 to US$3,500 by end-2023.

In the previous poll, Ethereum was predicted to end next year at US$3,200, and the range of forecasts was US$900 to US$5,500.

When asked what would be the primary driver of cryptos, a strong majority of analysts and funds said the Fed’s rate hike path and central banks’ rhetoric to fight inflation even at the cost of a recession.

In recent weeks the appetite for risk assets rose on hopes the Fed might pivot away from its aggressive rate hike policy after other major central banks signalled a move away from ultra-aggressive policy tightening.

But Fed chair Jerome Powell put a damper on the excitement by saying that it was “very early” to be thinking about a halt and that the rate peak would likely be higher than anticipated.

The fear higher interest rates were likely to grind the US economy into a recession was reflected in the Treasury yield curve last week, which was near its most inverted since the turn of the century.

“Global risk assets didn’t want to hear ‘higher for longer.’ That paved the way for a protracted Fed tightening campaign which depressed stocks and cryptos, boosted the dollar, and destroyed market expectations for a respite,” the head of alternative asset research at a prominent investment firm in Europe, with over $1 trillion in assets under management, told Blockhead.

A Rush of Money Bets Big on the Allure of Rusted Bitcoin

In the last three months, Bitcoin has fallen 17%, while the ProShares Bitcoin Strategy ETF, which tracks bitcoin futures, has fallen around 21%. The largest bitcoin fund in the world, Grayscale Bitcoin Trust, is down 34%.

Still, according to the Blockhead survey, an increasing number of asset management firms are betting on the long-term appeal of bitcoin and ether, the top cryptocurrencies in the world.

Indeed, investment firms have launched a rush of exchange-traded funds despite a decline in values during the previous 11 months, believing that elite cryptocurrencies and the technology that powers them will finally triumph.

Half of the more than 180 active crypto exchange-traded products (ETPs) and trust products worldwide have been introduced since the beginning of the bitcoin bear market, according to a note released this month by Morgan Stanley.

The proliferation occurred when the value of all market assets fell by 70% to US$24 billion as cryptocurrency values plummeted.

According to Morgan Stanley, the top two cryptocurrencies, bitcoin and ether, constitute the focus of almost 95% of those 180 funds.

“The intensity of the appetite naturally decreases when the market is slower, prices are lower, and people have lost money. However, in the long run, it is not true. I don’t think anyone is given up in general,” said a fund manager at a large investment firm in Edinburgh, with an AUM of about US$1 trillion.

“Asset allocation is shifting more in favour of baskets made up of the top crypto assets by market capitalisation. Compared to alternative assets in the crypto business, it’s a flight to quality,” added the fund manager.

According to research from digital asset manager Coinshares, cryptocurrency investment products have garnered around US$453 million in net inflows this year, with most of it flowing into bitcoin and investment vehicles that comprise the largest cryptocurrencies.

A deep-dive into regional breakdown showed that most active crypto ETP products are registered outside the US, with crypto offers leading the way among funds in Switzerland, Canada, Australia, and Brazil.

“One reason is that US regulators have rejected several applications for bitcoin funds, which tick-by-tick mirror the price movements of the cryptocurrency, citing many factors, including the absence of surveillance-sharing agreements with regulated markets regarding the underlying assets of the spot funds,” said a chief investment officer at a top investment firm in London, with about US$500 million in AUM.

But investors hope there will be an agreement and a reversal in the US’ policy as seen in other regions worldwide.