Table of Contents

Singapore is losing its prestige internationally on crypto rankings, whilst Malaysia is making leaps on the board.

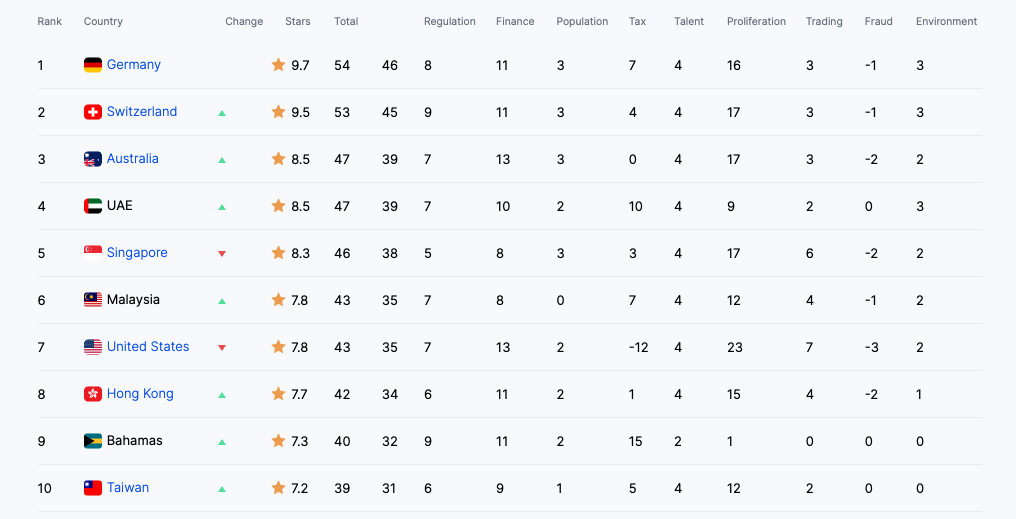

In Coincub’s Q3 Global Crypto Rankings, Singapore came in 5th, behind Germany, Switzerland, Australia and the UAE. The Little Red Dot had previously placed 3rd and 2nd in Q2 and Q1 respectively.

Across the causeway, Malaysia ranked just behind Singapore in 6th place – a significant jump from its Q2 position of 43rd. Malaysia wasn’t even featured in Q1’s top 45, but was commended for being 3rd in the top bitcoin mining countries per GDP.

Countries are scored based on nine categories: regulation, finance, population, tax, talent, proliferation, trading, fraud and environment.

Over the past two quarters, Singapore has dropped points in regulation, finance, population and proliferation. Regulation is scored from -4 to 9 points and looks at “positive government regulation, institutional outlook and negative government regulation.”

Finance is scored out of 16 points and considers “banks, Virtual Asset Providers (VASPS), crypto pensions, and business community and enterprise funding.”

Population is based on “Google search for bitcoin” and is marked out of 4 points. Proliferation has 24 points to offer for “crypto exchanges in the country, the number of BTC nodes, bitcoin ATMs, blockchain organizations, mining, and ICOs.”

In Q3, Singapore was overtaken by Switzerland, Australia and UAE. The United States, which took first place in Q2 has fallen behind Malaysia to 7th in the most recent quarter.

Singapore regulation points down

Coincub writes that “Singapore is a crypto powerhouse with a wide uptake of crypto investment among its population but has recently looked to constrain the third-party advertising of VASPS.” This could explain why the city-state dropped a point in the “regulation” category.

Although Blockchain.com and Coinbase recently earned crypto licenses in Singapore, MAS has retained a tight grip on the crypto space.

Read more: Blockchain.com Follows Coinbase in Getting Singapore License

The Monetary Authority of Singapore (MAS) recently warned that not all activities related to Digital Payment Tokens (DPT) are regulated in the city-state – i.e. do your own research and buyer beware, because the regulator isn’t always watching your back.

The financial watchdog has expressed reluctance for retail investors to be involved in crypto, and has banned crypto companies from directly advertising to retail customers. In August, MAS chairman Ravi Menon said that it is contemplating “adding friction” on retail access to cryptocurrencies, in a bid to protect retail investors from the speculative nature of the crypto market.

Tight regulation has caused leading firms in the space including Binance and Crypto.com to shift their focus to Dubai, which would explain how UAE is rising up the ranks on Coincub and why the region has overtaken Singapore in Q3.

Malaysia – bitcoin boleh

Malaysia scored on par with Singapore for finance and talent, which rates crypto education services, and placed better in terms of tax, regulation and fraud.

Meanwhile, as Malaysia becomes more crypto friendly, the country has been channeling its efforts on developing its web3 industry. In an interview with Blockhead, Ts. Mahadhir Aziz, CEO of Malaysia Digital Economy Corporation (MDEC) said “we see experiential digital content as important catalytic projects to drive more application for [blockchain] technology.”

Read more: Malaysia’s MDEC Goes on the Offensive, Announces Digital Facilitation Plans

“We’re seeing incredibly innovative economic models coming out from metaverse projects and seeing this innovation is exciting as Malaysia will get a chance to play a pivotal role in shaping the global landscape,” Low said.