Table of Contents

Backdrop for tumultuous crypto moves. A hot US CPI (inflation) print yesterday sent expectations of a 75 basis point rate hike to 60% in November and more dramatically perhaps the odds of 100 bps next week to 47%. Year-end rate hike expectations now represent the biggest jump in history. This served to push the dollar higher and smoked the markets, because the FED overdoing rate hikes to hit their 2% inflation target is seen as recessionary.

Bitcoin is down 11.1% since yesterday’s high, Ethereum down 8.5% and key correlated pairs Nasdaq down 6.5%, Gold supported down just 1.8%. Just to put the price shock into perspective Apple, the swing name in Nasdaq, had its best day since May followed by its worst day since May, in other words traders were not positioned for this.

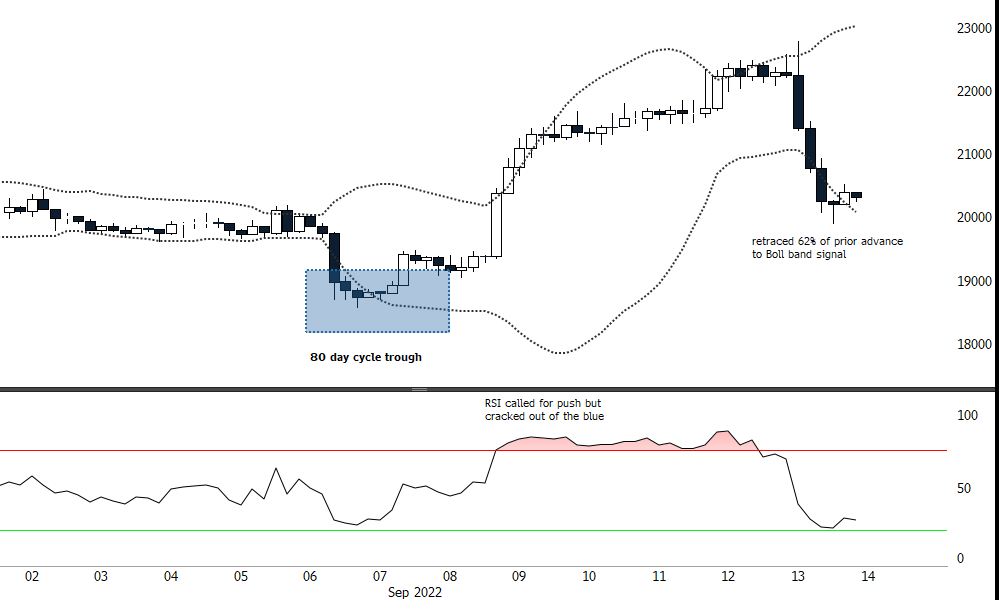

Looking at Bitcoin 240 minute chart here there are a few salient points. I am sticking to the thesis that the 7 September lows were that of the 80 day cycle. This means that the current 80 day cycle is young and bullish, in other words unless the new 80 day cycle literally just topped out (very bearish) then its upswing is still a tailwind. RSI was bullish right into the last top which re emphasises the shock (see Apple comments above as well).

Price has retraced hard but in fact has come in at a 62% Fibonacci level reference the prior impulsive advance – this is a recognised market balance point. Also we have seen a potentially bullish reversal at the lower Bollinger band (2 standard deviations below the 20 period moving average and over extended). There is an expression in the markets “don’t try to catch a falling knife”. So for now, we wait for stabilisation, but cognizant that the market may have already quickly priced in the worst case scenario.