Table of Contents

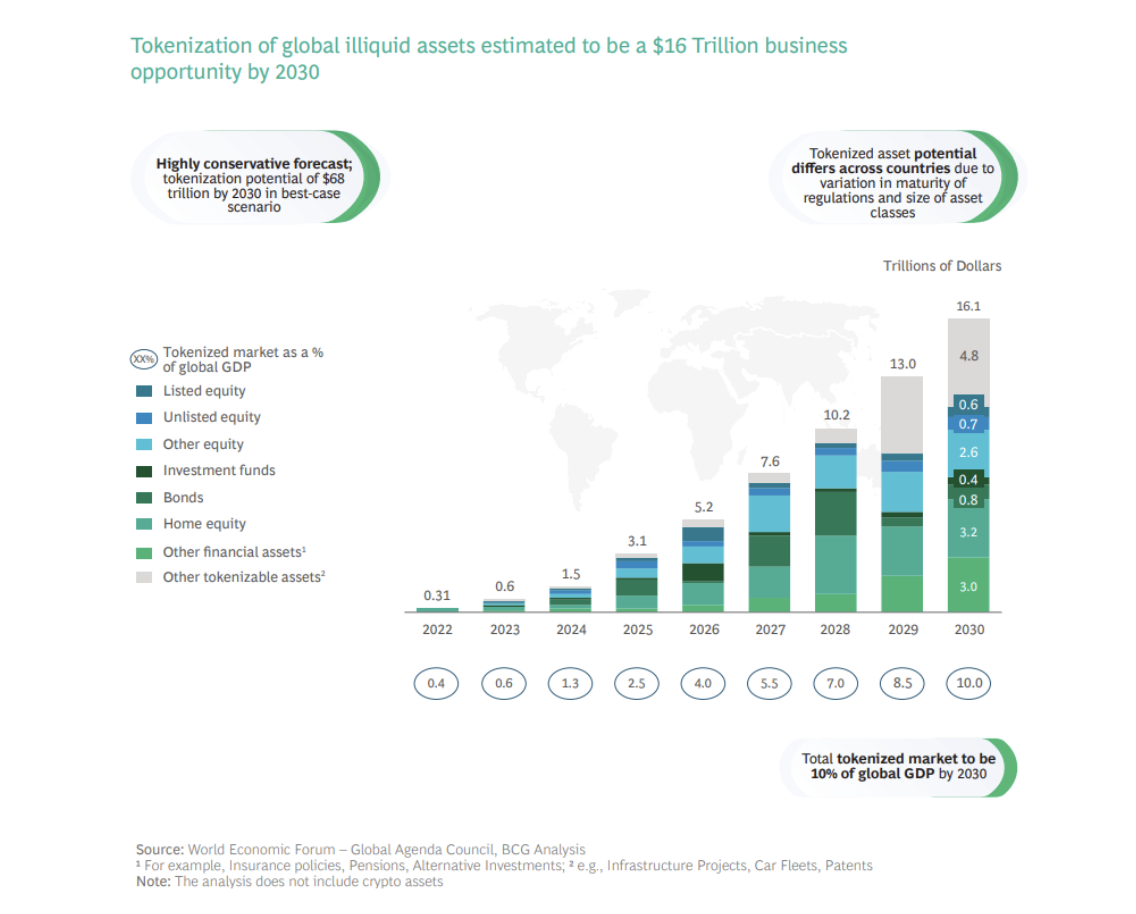

Investments in private markets is growing as more assets are tokenized and fractionalized, making them available to a larger pool of investors and allowing them to be more easily distributed and traded – and this market could be worth up to 10% of global GDP by the end of the decade, according to a new report by Addx and Boston Consulting Group (BCG).

Asset tokenization – the process by which an issuer creates digital tokens on a distributed ledger or blockchain to represent either digital or physical assets – will expand into a US$16.1 trillion business opportunity by 2030.

This growth comes as the crypto winter is prompting capital to focus on more viable blockchain use cases.

The projected growth in asset tokenization is driven by demand from a wide range of investors for greater access to private markets, as tokenization and fractionalization of assets lower barriers to investment in private markets by reducing minimum lot sizes.

According to the report, asset tokenization “may be on the cusp of wide global adoption” due to increased trading volume in tokenized assets, strengthening stakeholder sentiment across many countries, recognition among monetary authorities and regulators, more asset classes being tokenized, and a growing pool of active developer talent in the blockchain space.

In its best-case scenario, the market could be worth some US$68 trillion by 2030, the report said.

Read more: Crypto Deals to Focus on Financial Market Modernization as Investments Slow

“For years, the technology for overcoming those barriers was expensive and therefore available only on public exchanges. Blockchain changes the game because it can be applied cost effectively to private markets and alternative assets, where investors are fewer in number, albeit wealthier, and products are more bespoke,” Addx CEO Oi-Yee Choo said in a statement.

However, the report highlighted risks that exist in scaling up blockchain-based asset tokenization, including variance in regulation in key markets, managing market disintermediation caused by on-chain tokenization providers, lack of awareness and low adoption due to stickiness of users to existing incumbents and nascent distribution capabilities.

Founded in 2017, Singapore-based Addx is Asia’s largest private market exchange, using blockchain and smart contract technology to reduce manual interventions in the issuance, custody and distribution of

private market products.

The platform currently serves individual accredited investors from 39 countries spanning Asia Pacific,

Europe and the Americas (except the US), and has an institutional service for wealth managers and corporate investors.