Table of Contents

Three Arrows Capital (3AC) was one of the world’s largest venture capital firms in crypto. In the past year, the firm had made moves that left a significant impact in the industry. Some examples include Zhu Su, the co-founder of 3AC, claiming to have abandoned Ethereum in November 2021, which resulted in the price of Ether plunging and yet, 3AC had been acquiring Ether worth over US$660 million in less than a month.

More recently, 3AC was better known to have bought huge amounts of locked LUNA worth approximately US$560 million before the fall of Terra, suffering massive losses as it is only worth less than US$1,000 now. This led to 3AC throwing a Hail Mary by borrowing huge amounts of money from various parties and increasing its leverage in a bid to cut its losses. However, the markets turned for the worse, resulting in 3AC being unable to meet its lender’s margin calls. This resulted in Voyager Digital being severely implicated and filing for bankruptcy as 3AC was unable to pay back the US$665 million borrowed.

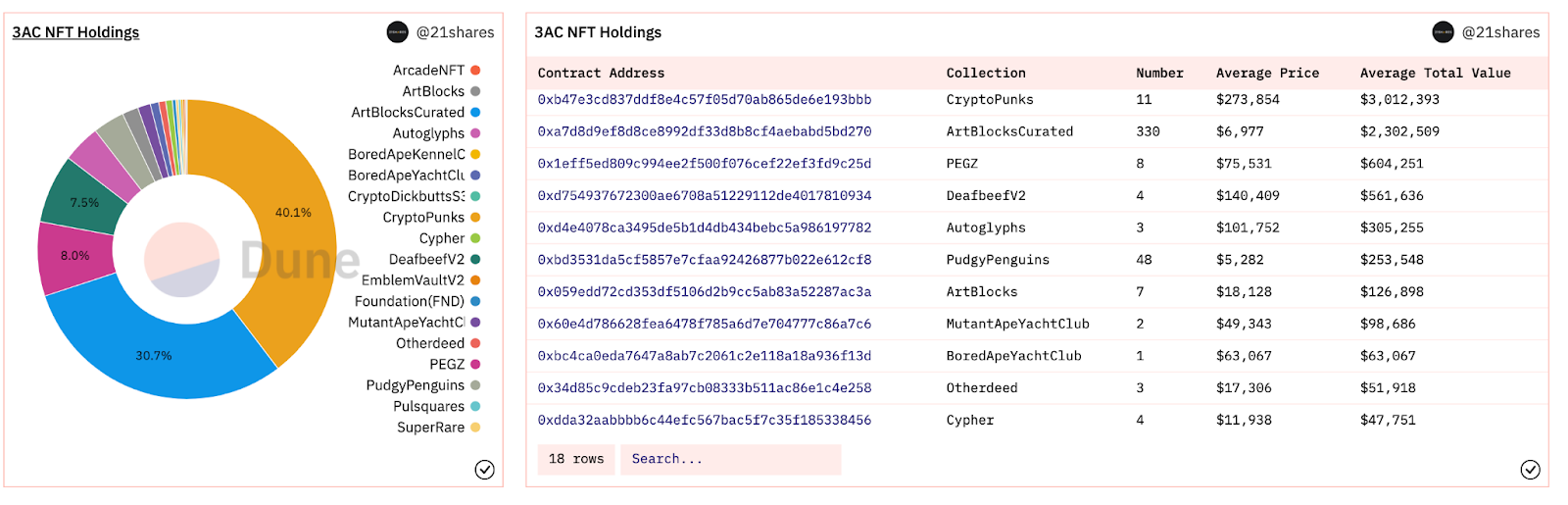

Over the years, 3AC also built up an impressive and extensive portfolio of NFTs – at least three wallet addresses associated with 3AC founder Zhu Su are known to hold NFTs collectively worth tens of millions of dollars, including CryptoPunks, Bored Apes, Squiggles and more.

Starry Night Capital: Curation or investment?

Established at the peak of the NFT era, Starry Night Capital aims to collect and invest in historically significant 1/1 works from well-known NFT artists around the world. These works are akin to high art in auction houses, browsed and collected by the rich.

Art pieces, especially generative art, are increasingly valued among this crowd. Previously, an artwork had to be created directly through an artist – pen to paper, paint to canvas. The growth of blockchain technology encouraged artists to pick up a new medium – code. Through coding, artists set the rules for their art to be created – parameters, shapes, colors, concept. They then leave the generation of their artwork up to the algorithm they have carefully crafted – physically separating artists and artwork – for even they would not know how their work would turn out. These higher forms of art empower both artists and consumers to more extensively study the possibilities of a concept, beautifully born from a human mind – that the artist may never be able to finish if he were to rely on his hands alone.

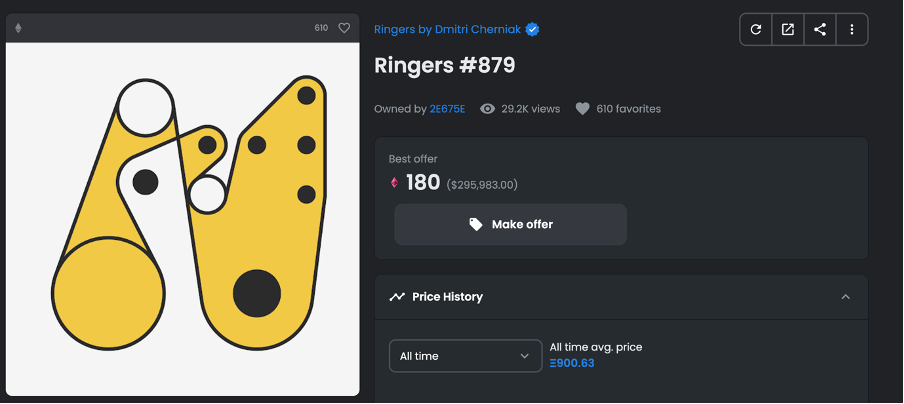

For example, Dmitri Cherniak explores the various possibilities a string can go through via pegs placed in different configurations in Ringers. Furthermore, prior to releasing his collection on OpenSea, Cherniak explored the vastness and security of the blockchain space by sending his dead ringers to a randomly generated address – once a day from January 1 to 31, 2022. In doing so, he observed the scarcity of his work as it is unlikely that any of these wallets will ever be activated – a possibility of 16 to the power of 40 (or more). Hence, Cherniak is not only an explorer of generative art, but also a true explorer of blockchain technology – producing work of another league, even in the world of generative art.

Generative art as high art? Unquestionable.

3AC saw the value of these NFTs and dedicated a portion of their funds to this promising and emerging digitalisation, automation and modernisation of art. While the price of their collections may have decreased (in terms of USD) amid the bear market, I am hopeful that these pieces will appreciate in price when mass adoption ensues. Perhaps in the future, these NFTs may be as precious as Van Gogh’s Starry Night – like what they have named its fund after.

Holdings

1,800 ETH – Starry Night’s highest expenditure

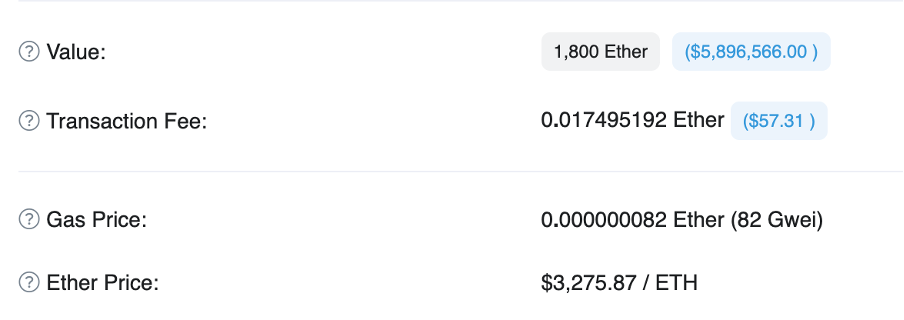

Was Ringers #879 a good investment by 3AC? Yes, if it weren’t for the ridiculous price they bought it for – 1,800 ETH, amounting to almost US$5.9 million on the day of trade.

With the all-time average price at approximately 32.6 ETH, this NFT was bought at 56,250% above average – making it far from a wise investment.

While the price of Cherniak’s Ringers did appreciate with time (it’s floor price stood at 60 ETH as of time of writing), I feel that it is unlikely to appreciate to such a degree where this purchase becomes profitable – maybe we’ll have to wait a century.

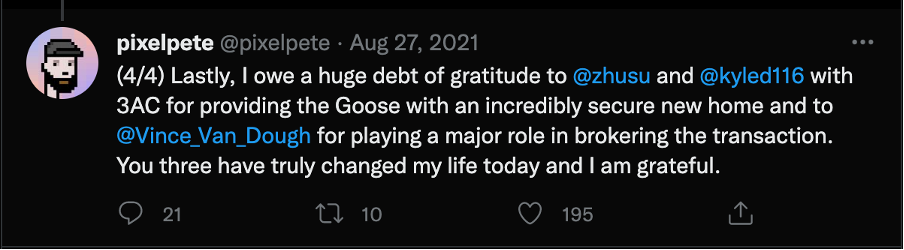

The seller in this transaction thanked the founders of 3AC and @Vince_Van_Dough (the broker, also SNC’s partner) after he profited approximately 1,798 ETH from the sale. It is truly unfathomable why 3AC would want to purchase this particular piece for such an unreasonably high price – especially if they could have stuck closer to floor prices or chosen others by the same artist. I am definitely intrigued why #879 stood out to them.

Other projects bought significantly above floor prices include Fidenza by Tyler Hobbs, Cryptopunks, Archetype by Kjetil Golid, Elevated Deconstructions by luxpris, Deafbeef and many more. This really leads me to ponder if there were any under table dealings with these transactions – beyond the traceable and transparent blockchain.

Weird/meme? Investments

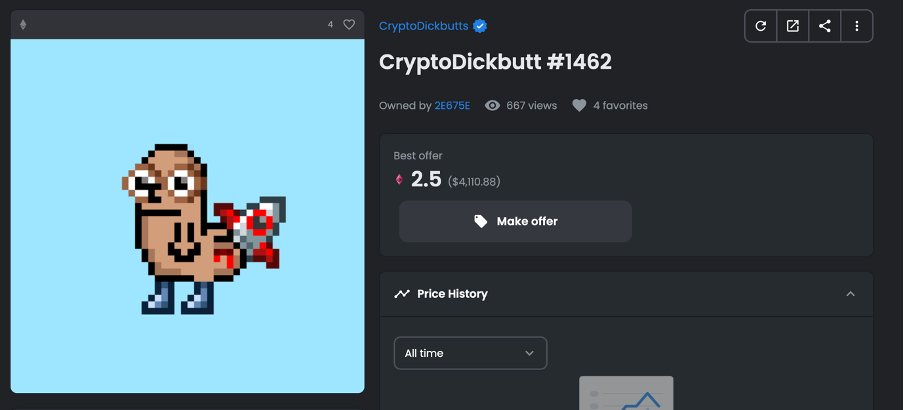

Weird. Meme. Unexpected – especially from a corporate firm.

The acquisition of a CryptoDickButt is such a powerful statement – seemingly dissociating themselves away from the politically correct way of web2. It is beyond me to imagine a traditional company taking pride in owning such a jpeg.

It strikes me as fascinating that 3AC was not just interested in fine arts, but also the very opposite of it – something readily and happily consumed by the masses – memes. However, many have speculated that this particular NFT was airdropped into the wallet.

While it may seem like a waste of money at first, memes have not only survived but also thrived in our fast-paced consumption of digital media. From the rise of Instagram to meme coins (e.g. Dogecoin) to overnight mooning of meme NFTs (e.g. Kevin from Pixelmon), this internet sensation is truly unstoppable.

Read more: Reflecting on the Nihilism of Free Mints

While some of these pieces have appreciated in value, many have done the reverse – as they are really just degen forays into the space. Some memes survive the test of time while some fall out of trend, often due to saturation.

Typical investments

According to the Dune Analytics report generated by 21shares, 3AC also holds community-based NFTs such as Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Pudgy Penguins. Evidently, they do have an interest in community, although it was to a much more limited extent than generative art as they have spent significantly less on these community NFTs than on Art Blocks Curated. This aligns well with the initial mission of Starry Night Capital, although I do find it a shame that many significant community NFTs are not represented in its collection – for example, Doodles and Azuki.

If I was in their position, I would have acquired more of what was deemed NFT “Blue Chips”. These are projects driven by teams that have proven themselves over time, which has led to the increase in floor price over time as well.

If Starry Night Capital intended to purchase NFTs as an investment, this would be the way to go. However, one can only make a guess at what their true intention was when starting this fund. Given their purchasing behavior, it would seem as though they intended more to be a collection, collecting “rare” or even monumental pieces of NFTs in the short NFT history.

Summary

While 3AC’s avid acquisition of historical and significant NFTs is commendable from an art curator’s point of view, I feel that it is not exactly financially sustainable. As for the current state of things, 3AC only has themselves to blame for spending ludicrous amounts to build up their collection. A little prudence would have gone a long way in helping with their current financial situation. The finest example would be for the purchase of Ringers #879, perhaps offering a value at double, or even 10 times the floor price instead of 500 times would be more than enough. I am sure any seller would be happy to let it go for such a huge amount of money.

As things are, it is hard to say if they would have to liquidate their NFT holdings in order to keep themselves afloat, though they might have little choice in the matter. Although the floor price of their NFT holdings have dropped substantially compared to the price at which they have purchased it at, it would still be better for them to liquidate their current holdings at a loss if it would mean that they can tide over this ordeal. Currently, this might already be ongoing. This can be seen from how Starry Night Capital’s website’s domain hasn’t been renewed.

Furthermore, according to the Dune Analytics report generated by 21shares, the last NFT transaction that 3AC or Starry Night Capital had taken was on 12 January 2022. This might indicate that NFTs haven’t been their focus – understandable, given they way things have panned out for the firm and their current financial situation. However, perhaps it has not reached a state where they would have to liquidate their NFT holdings yet as Starry Night Capital is seen as somewhat independent of 3AC.

At this point, without any additional insider information, we can only speculate at what would happen to one of the world’s largest venture capital firms as well as its NFT collection. It would be a pity to see this collections dismantled and sold for a huge loss.

Either way, Starry Night will go down in crypto history as one of the largest NFT collections and will be remembered both on chain and off chain for their contributions towards the NFT scene.