Table of Contents

Derivatives of the Bored Ape Yacht Club (BAYC) project are nothing new. The list seems endless: Hola Mona, Desperate Apewives, Apocalyptic Apes… one could go on and on listing countless knock-offs of the famous Yuga Labs franchise. While some derivatives tout themselves as legitimate projects, their cheap association with BAYC comes across as nothing short of a cash grab, attempting to leech off the fame of another Intellectual Property (IP).

Ryder Ripps’ Bored Ape Yacht Club (RR/BAYC), however, is a derivative that goes beyond creating cheap knock-offs of the apes, opting to simply mint the images of the apes in their entirety, unaltered from the original.

The creator, conceptual artist Ryder Ripps, would disagree with the label of RR/BAYC being a derivative, instead labelling them “recontextualised” images of the original apes. According to rrbayc.com, Ripps believes the project demonstrates “the power of NFTs to change meaning, establish provenance and evade censorship” and sends the message that “you can’t copy an NFT.”

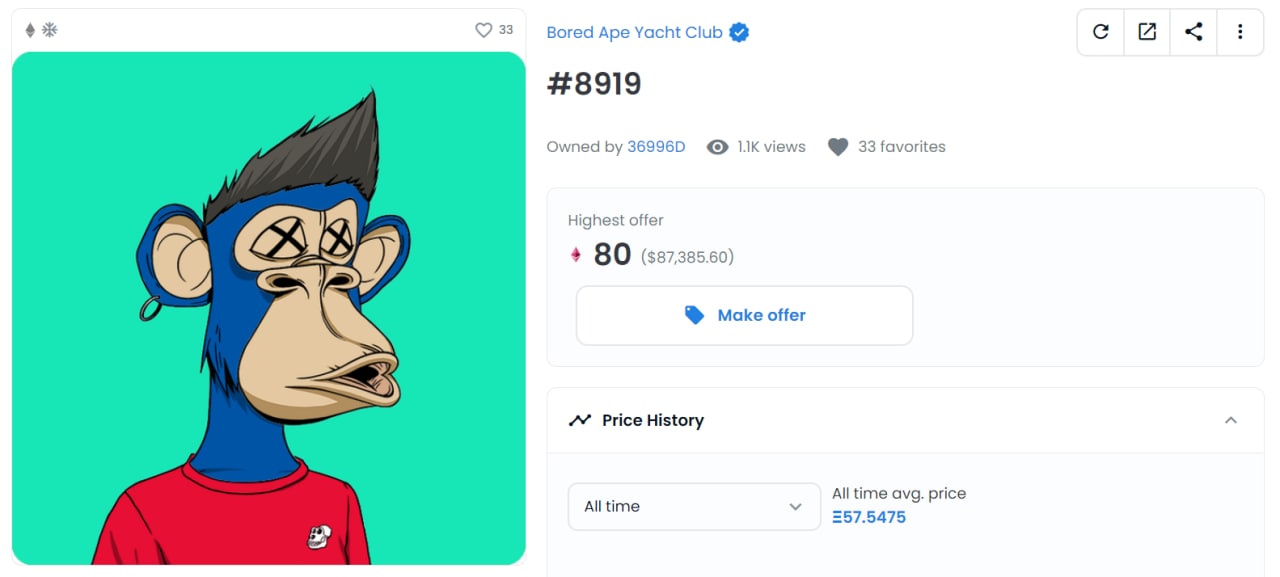

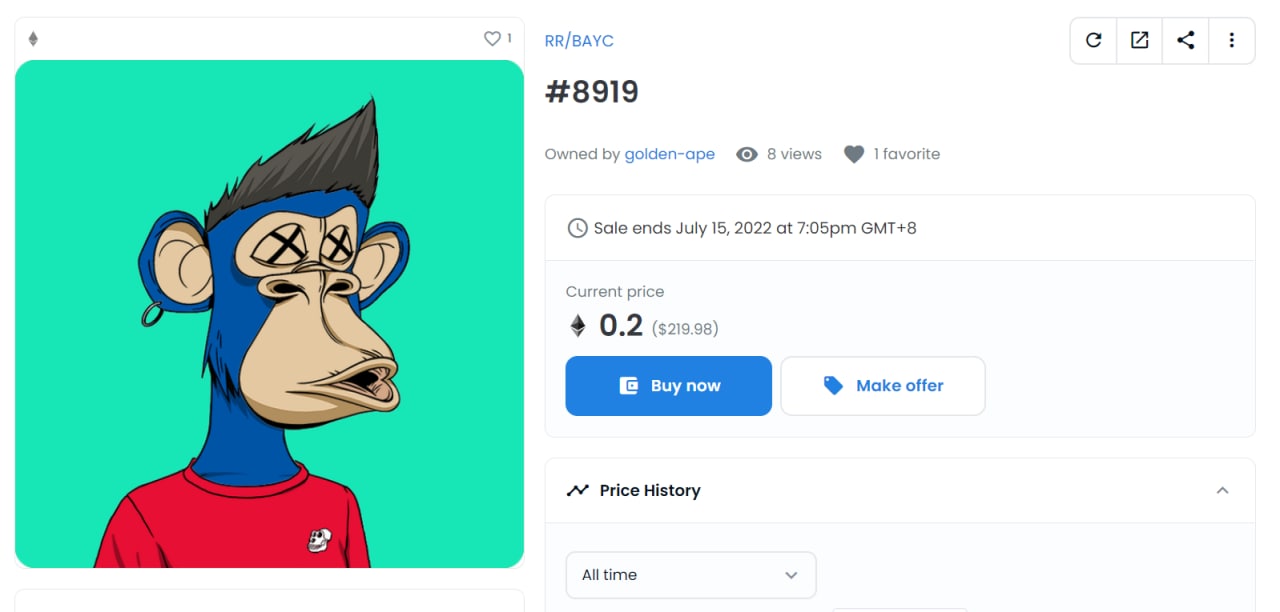

BAYC #8919 on the left vs RR/BAYC #8919 on the right. The JPEGs of each ape are completely identical, yet RR/BAYC remains up on Opensea.

Despite the controversy Ripps’ project has generated, particularly over his claims of BAYC being rife with Nazi symbolism, his project has remained standing so far, with marketplaces Foundation and Opensea taking down and subsequently relisting the RR/BAYC collection. The existence of RR/BAYC raises existential questions for NFTs, one which the space may not have the answers to.

An NFT is a unique token address, not a JPEG

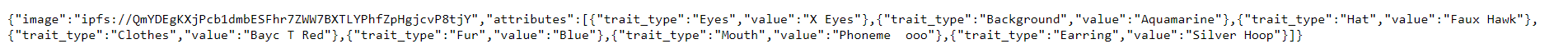

On rrbayc.com, Ripps states that his recent NFT work has been “centred around provocations and inquiries regarding the nature of NFT, provenance and digital ownership.” The provenance Ripps mentions can be inferred to refer to the unique token address of each NFT.

To clarify: while a common misconception about NFTs is that they are digital assets, a more accurate description of them would be that most of them are token addresses that point towards a corresponding digital asset, be it a JPEG, gif, or any other file types. This is something that may not be well understood by the less savvy in the space, with many selling the idea that buying an NFT is equivocal to owning the digital file associated with it.

Read more: Are You Really the Owner of Your NFTs?

Naturally, few people have attempted to try and prove this fact on a legal basis. Marketplaces may choose to delist collections that try a similar stunt on the basis that they are attempting to pass off as the original, deceiving potential buyers. Ripps, however, takes the bold approach of classifying his collection as “appropriation art” rather than a poor counterfeit attempt; he declares very openly that his collection is not the original despite the visual likeness they share. His approach worked, with Yuga Labs withdrawing a DMCA takedown request they previously filed against him.

This proves Ripps’ point, that you cannot copy an NFT. While that statement may appear to support the narrative that NFTs are unique digital on-chain assets that investors can own, a closer examination of this message suggests otherwise: that only the token addresses cannot be copied, and everything else around them, including the JPEGs, is free-game.

Are NFTs really “identity” as we know it?

The visual aspect of NFTs is certainly one that has been heavily sold by brands, with many selling the idea of JPEGs being a unique way to portray digital identity. Ripps’ project throws a wrench in that narrative, with his apes being completely identical to Yuga Labs’ apes.

If it is possible to copy the JPEG associated with NFT and re-upload it as a separate project (in the name of performance art), then can NFTs really claim to be unique forms of digital presentation?

The verdict on infringement of derivatives, for the most part, has also seemed to lie in the hands of centralised marketplaces. For instance, OpenSea delisted Not Okay Bears, a mirror of the Solana-based Okay Bears on Ethereum in which each PFP was flipped to face left instead of right, only to list it again two months later. If the ethos of Web3 is that it is decentralised, then who should get to decide which copies remain and which copies get delisted?

Is anything really guaranteed off-chain?

If we strip NFTs down to being their token addresses alone, one may argue that it is this token that gives holders access to various forms of “utility” that the creator may have to offer. In the case of BAYC, holders of each ape are entitled to benefits, such as varying amounts of $APE, priority in minting deed from Otherside, and other perks. Legally speaking, however, these benefits are not a given, and Yuga Labs is not beholden to its own word by anyone other than itself.

One of the tools the Web3 community boasts about are smart contracts, which are programs or lines of code that run when certain conditions are met (the terms of the contract). Smart contracts play an instrumental role in executing actions in Web3, such as buying or selling NFTs. They enable trustless transactions between wallets, bypassing the middle man in the transaction.

The term “smart contracts,” however, can be misleading. As LegalEagle, a US-based YouTuber who specialises in legal content, explained, smart contracts, while being effective programming tools, are not legally binding documents. Though they can be used to attest the ownership of the NFT to a particular wallet, many of the promises to holders of NFTs are typically made off-chain and not embedded in the code of the smart contract. If the main selling point of an NFT is its utility, then the current state of the blockchain is not enough to ensure a trustless guarantee of utility being delivered to holders, who have little choice but to put pray that their next purchase will not be the next rug pull.

So what really is an NFT then?

If NFTs are not an assertion of digital identity but just an expensive hyperlink with no binding guarantee of any of its advertised benefits, then what does the space even have left? While Ripps’ project asserts that the technology of NFTs “enables an immutable trace of origin in time to the publisher/creator of a digital work,” his own project undermines this narrative and raises more questions than answers as to whether it is possible for digital immutability to be upheld in a decentralised manner, at least in a way that is widely accessibly for mainstream commercial use.

Read more: Interview: PXN Controversy Raises Important Issues in IP Law

As crypto and NFTs enter their first recession, the existence of NFTs hangs in the balance of drying up liquidity. It remains to be seen what new innovations will emerge in the space that will widen the scope of smart contracts and other aspects of the code that Web3 runs on, and we can only hope that “the devs do something” and the bear market gives rise to a better system in time for the next bull run.